Overview

Read management/analysts’ comments on Trxade’s Q3 2021 earnings

Product Portfolio

The portfolio is designed to make specialty healthcare services — which were inaccessible to many people until recently — available to all sections of society. The company’s key products and services are:

- Bonum Health (Telehealth/Telemedicine App)

- Community Specialty Rx (Pharmacy)

- DelivMeds (Rx Delivery App)

- Integra Pharma Solutions (Virtual Wholesaler)

- MedCheks (Health Passport App)

- Trxade Marketplace (Rx Marketplace)

- Trxade Medical (Rx Marketplace)

- Trxade HSO (Health Services Org)

- TRx Savings Card (Prescription Discount Card)

The Market

The North American e-pharmacy market is estimated to grow at a compounded annual rate of 14.8% through 2025, due to the growing prevalence of chronic diseases, the launch of generic drugs, and the sharp increase in clinical trials. Trxade is a leading player in the segment, serving nearly half of all the independent pharmacies in the country. The company leverages its technological prowess and disruptive business model to grow in a market that has become increasingly competitive. By collaborating with global distribution channels, it looks to scale internationally.

Trxade’s main competitors include Rite Aid Corporation (NYSE: RAD), Walgreens Boots Alliance (NASDAQ: WBA), and UnitedHealth Group (NYSE: UNH). Interestingly, the company competes with both large players like Amazon.com (NASDAQ: AMZN) and relatively smaller firms like Script Health and Petmed Express Inc. (NASDAQ: PETS).

Updates

Recently, the board of directors authorized the resumption of the company’s stalled stock repurchase program, with a modification that allows buyback of up to a maximum of 100,000 shares. However, there is no time frame for the repurchase program.

In November, the company launched what it calls Discount Card, which allows independent pharmacies to continue offering discounts while protecting margins. The program is made possible through a tie-up with pharmacy benefits manager Paramount Rx. Earlier, Bonum Health had launched pre-paid digital telemedicine passes that would allow uninsured consumers to avail healthcare services.

Key Numbers

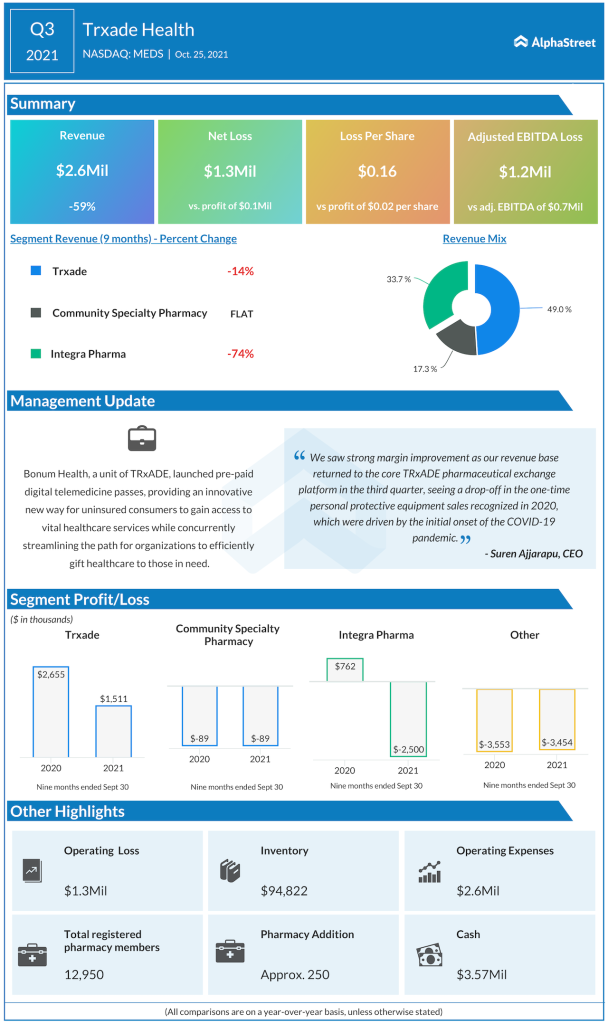

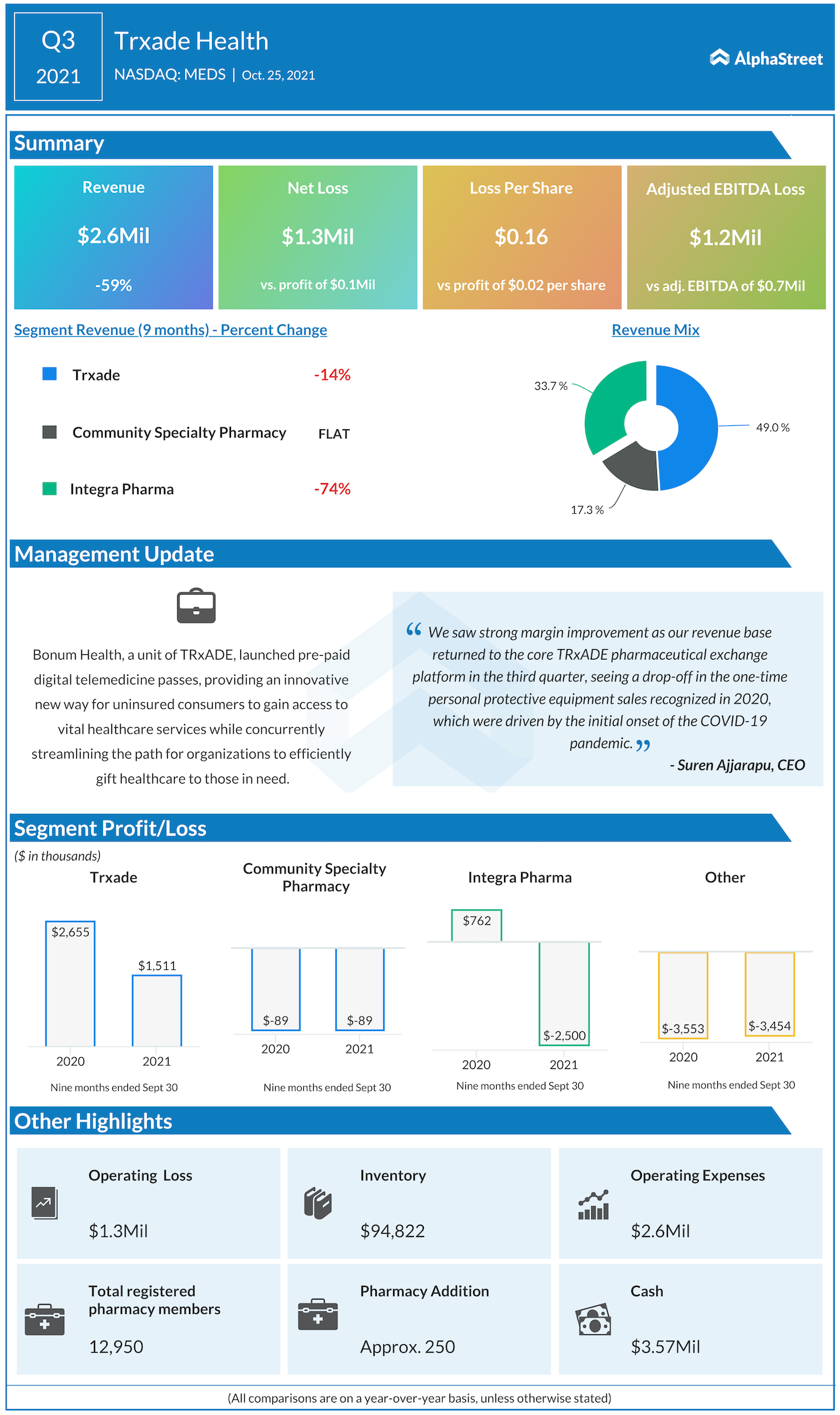

The company generated profit in five of the past 12 quarters and maintained healthy margins. With zero debt, the balance sheet is quite strong. It posted total revenues of $2.6 million for the three months ended September 2021, which represents a 59% decline from the year-ago period when the top-line was bolstered by one-time gains from a spike in the demand for personal protective equipment. While the Trxade and Integra Pharma segments witnessed double-digit declines, Community Specialty Pharmacy sales were almost flat. Consequently, net loss widened to $1.3 million or $0.16 per share from $0.1 million or $0.02 per share in the third quarter of 2020. Around 250 new members were added to the network during the quarter.

Outlook

In 2022, Trxade executives will focus on forging new partnerships to further expand the core business, adding new revenue streams by venturing into new areas, and better leveraging the Bonum Health business. Also, the management expects the company’s GPO programs to start contributing to revenues starting the second/third quarter of 2022. Meanwhile, the supply chain disruption caused by the pandemic remains a major concern as far as providing timely care to patients is concerned.

Pfizer stock research summary | Q3 2021

Risks

One of the main issues facing the prescription drug market is high costs, which make many drugs unaffordable to a large number of people. Lack of coordination among various segments of the healthcare delivery system and sluggish adoption of technology remains a hassle for efficient healthcare delivery. Also, new players face competition from cash-rich retailers like Walmart Inc. (NYSE: WMT) that enjoy an edge due to their financial strength. As far as pharmacy technology firms are concerned, monopolistic pharmacy benefit managers and retail chains also pose a challenge.

Stock Performance

The performance of Trxade’s stock was lackluster in 2021 when its value nearly halved amid volatility. The stock is yet to emerge from the single-digit territory. However, MEDS entered the new year on a bright note and traded slightly above $2 in the early sessions, valuing the company at $22 million. Market watchers are bullish on the stock’s growth prospects over the next twelve months and expect the value to more than double.

Conclusion

Trxade is a rapidly growing company that is well-positioned to tap into the positive changes in the prescription drug market. The company stands to benefit from the widespread adoption of technology and the growing need to digitalize healthcare services, thanks to its innovative products. The company’s quick response to the pandemic, by offering the required monitoring tools or telemedicine services, underscores its relevance in times of emergency.