Shares of Tyson Foods, Inc. (NYSE: TSN) were up slightly on Tuesday, recovering from the plunge it took a day ago after delivering disappointing results for its third quarter of 2023. The stock has dropped 12% year-to-date. The company continues to operate in a challenging environment which may persist through the remainder of the year. Here’s a look at some of the headwinds it is facing at present:

Decline in sales and profits

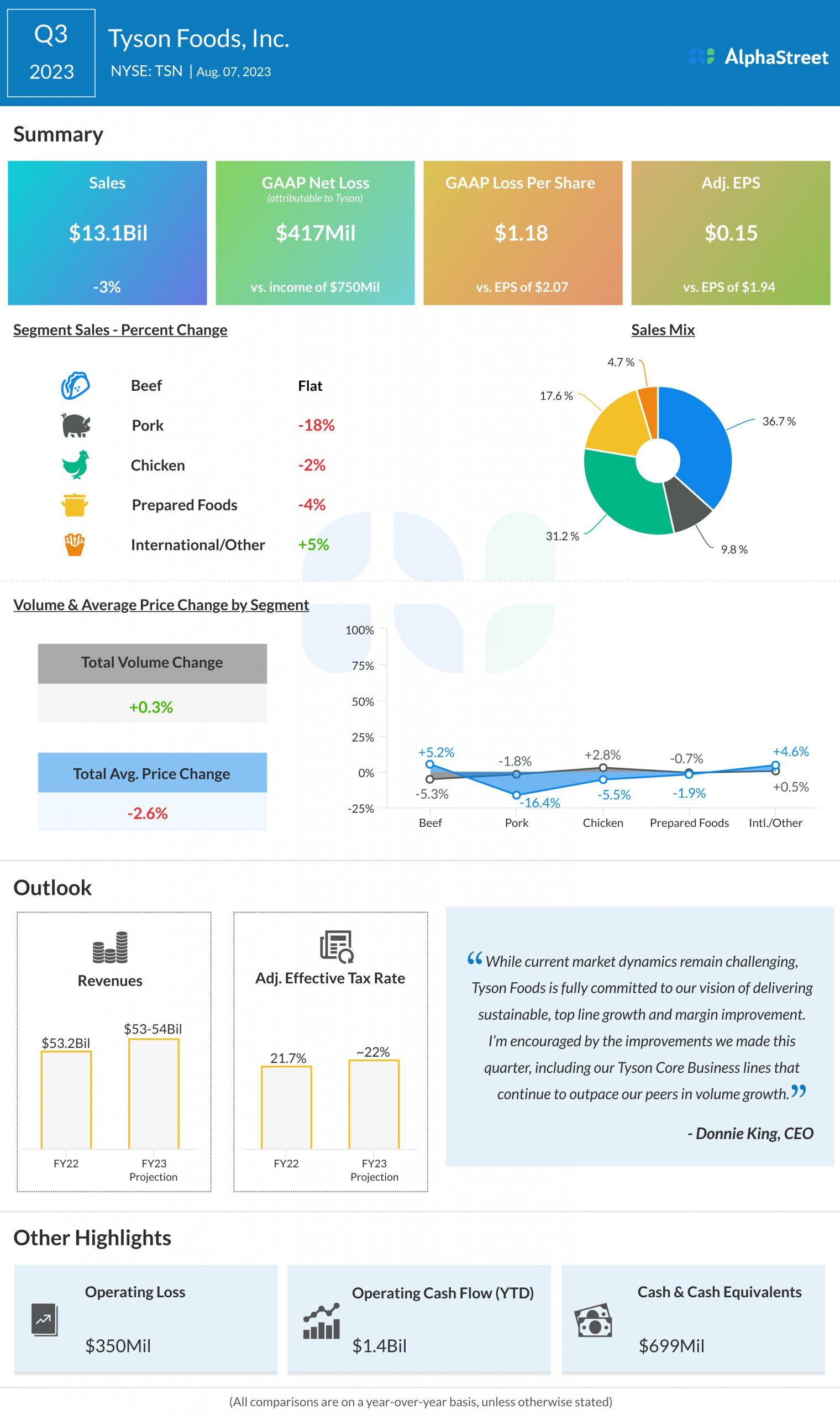

In Q3 2023, Tyson’s sales decreased 3% year-over-year to $13.1 billion, mainly due to declines in pork and chicken caused by a reduction in price per pound. The company reported a loss of $1.18 per share on a GAAP basis while adjusted EPS fell 92% to $0.15. Both the top and bottom line numbers fell below market estimates as well.

Category headwinds

Tyson recorded the biggest revenue drop of 18% in its pork segment in Q3, which was driven by lower pricing due to softer demand. Price was down 16% while volumes fell 1.8%. As stated on the quarterly conference call, this segment continues to be impacted by market pressures in live operations, lower exports and the impact of a fire at one of its manufacturing facilities.

Sales in chicken fell 2% year-over-year in Q3. Price was down 5.5% but volume increased 2.8%. Commodity prices across most cuts remained significantly lower versus last year. The company also plans to close four additional chicken facilities this year.

In the beef segment, sales remained flat YoY. Price grew 5.2% while volume fell 5.3%. On its call, Tyson said it expects the beef industry to face headwinds as herd liquidation continues to tighten supply, leading to higher cattle cost, narrowing spreads and difficult export market conditions.

Outlook

For the full year of 2023, total sales are expected to be $53-54 billion. Tyson expects to come at the lower end of this guidance range with roughly flat sales growth for the year. Within the beef segment, the company expects adjusted operating margin to be down 1% to up 1% in FY2023.

Adjusted operating margin in the pork segment is expected to be down 2-4% while in the chicken segment, it is expected to be down 1% to up 1% for the year. For prepared foods, the company expects adjusted operating margin of 8-10%.