Strength amid challenges

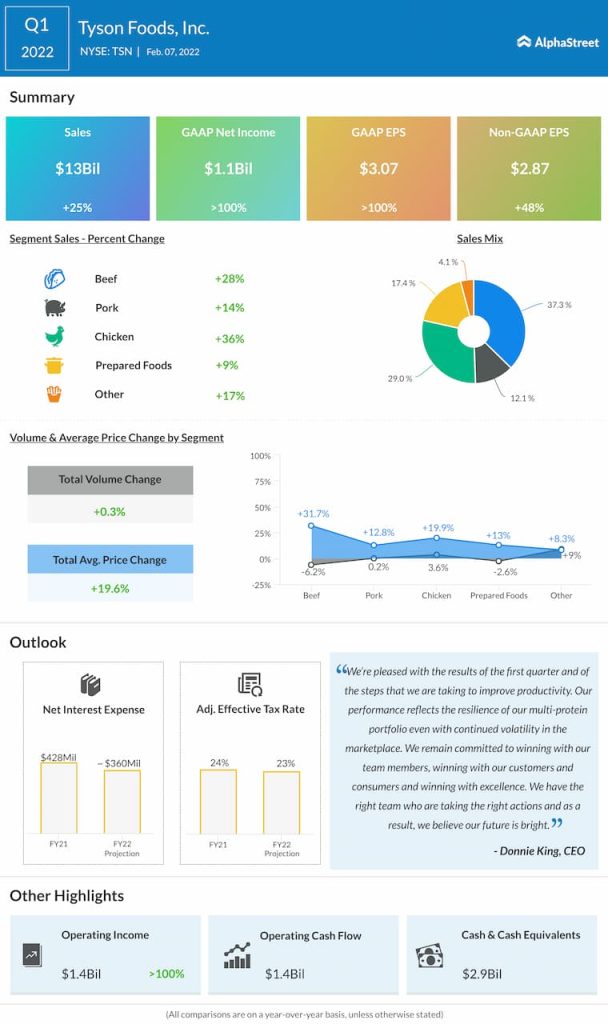

During the quarter, volumes saw a slight pickup despite being impacted by labor challenges. While volumes in chicken grew 3.6% helped by strong demand and improved live production, volumes in beef and prepared foods saw a decline. Beef volumes fell 6.2% due to labor shortages, and port congestion which hurt exports. Prepared foods volumes dropped 2.6%, half of which was caused by the divestiture of the pet treats business. Tyson expects these headwinds to ease out and results to improve as it moves through FY2022.

Tyson will work on improving its volumes during the year. The company is building 12 new plants to tackle its capacity constraints and meet the rising demand for protein globally. Tyson is dealing with higher input costs, as well as higher labor and transportation costs due to high demand and limited availability. An increase of 19.6% in average sales price in Q1 helped offset some of pressures caused by inflation.

Expectations

Looking into 2022, Tyson expects to grow total company volumes by 2-3%, outpacing protein consumption growth. Total sales are estimated to range between $49-51 billion. In terms of adjusted operating margin, the chicken and pork segments are expected to achieve margins in the range of 5-7% while prepared foods is expected to deliver margins of 7-9%. For the beef segment, margins are projected to be 9-11% while in international/other, margins are expected to be 2-3%.

Tyson has launched a new productivity program which aims to generate $1 billion in productivity savings by the end of fiscal year 2024 and $300-400 million in FY2022. The company is on track to achieve its savings target for this year.

Click here to read the full transcript of Tyson Foods’ Q1 2022 earnings conference call