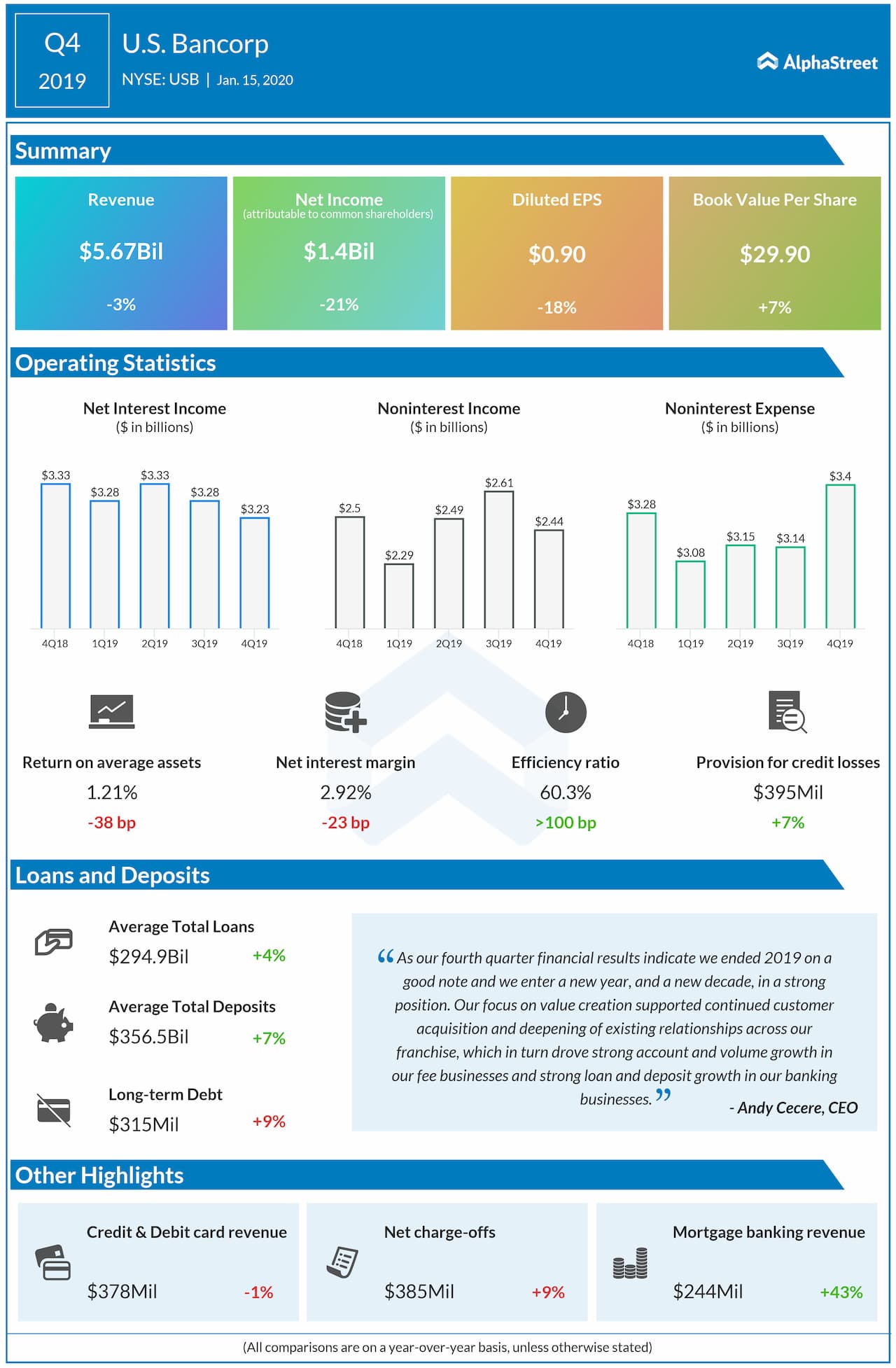

— Total net revenue declined by 2.8% to $5.67 billion versus $5.78 billion expected.

— Net interest income decreased by 2.9% mainly a result of the impact of the yield curve and deposit and funding mix, partially offset by higher yields on reinvestment of securities in addition to loan growth.

— Non-interest income declined by 2.5% due to lower commercial business sales volumes and a charge for increased derivative liability related to Visa shares previously sold by the company.

— Average total loans increased by 3.9% due to growth in residential mortgages, total commercial loans, credit card loans, and other retail loans.

— Average total deposits grew by 6.6% backed by wealth management and investment services, corporate and commercial banking and consumer and business banking.