Diversified Model

UnitedHealth, which is a component of the Dow 30 index, has a better annual average revenue growth than some of the large Wall Street companies, and the trend is expected to continue in the coming years. There has been a steady increase in medical enrolments. The Optum Health business, which brings together different parts of the health care system like technology and pharmacy to create an integrated and personalized experience for the stakeholders, continues to be a key growth driver.

Meanwhile, the company’s margins have come under pressure lately due to higher medical costs as patients choose to undergo elective procedures that were either canceled or postponed during the pandemic when healthcare facilities were focused on providing COVID care.

Key Numbers

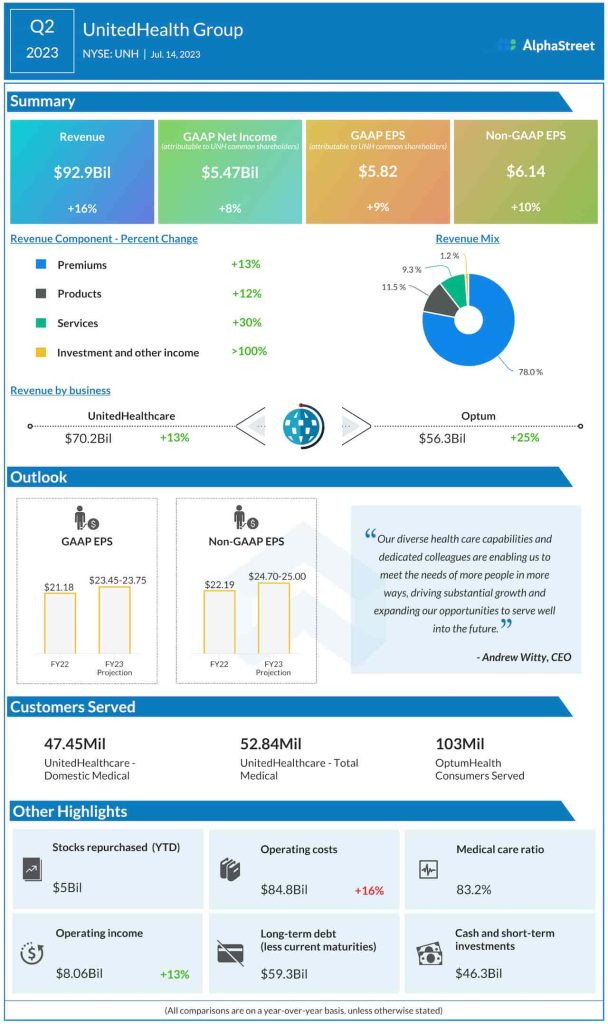

Revenues from the Premiums segment, which accounts for nearly 80% of the top line, grew 13% annually in the second quarter. Total revenues climbed 16% to $92.9 billion and exceeded the consensus forecast. Optum revenue climbed 25%. As a result, adjusted net income moved up 10% to $6.14 per share, which is above estimates. Interestingly, the company’s quarterly profit has never missed estimates for over a decade.

From UnitedHealth’s Q2 2023 earnings conference call:

“Even in this challenging funding environment, we continue to prioritize the stability and affordability our members have come to rely on from UnitedHealthcare. We’re confident that next year, we will once again grow at a pace exceeding that of the broader market. While of a much lesser impact than senior outpatient care, we also are seeing increased care activity in behavioral. Over the past few years, behavioral care patterns have been accelerating as people increasingly feel comfortable seeking services.”

Outlook

Anticipating the momentum seen in the first half to continue in the remainder of the year, UnitedHealth executives predict that adjusted earnings would grow in double digits to $24.70 per share -25.00 per share in the whole of fiscal year 2023. The guidance for full-year unadjusted profit is between $23.45 per share and $23.75 per share.

The stock closed the last session up 2% and continued to gain in early trading on Friday. The shares have mostly traded sideways since the beginning of the year.