Walgreens Boots Alliance, Inc. (NASDAQ: WBA), a leading retailer and wholesaler of health and wellness products, is scheduled to report third-quarter earnings next week. Over the years, the company has emerged as a one-stop destination for healthcare services, thanks to strategic acquisitions and diversification.

The Deerfield-headquartered pharmacy chain, which played a key role in the COVID-19 screening campaign by providing test kits, witnessed a slowdown in sales after the demand for tests declined. Meanwhile, the company’s aggressive push into primary care is bearing fruit, if the uptick in healthcare revenue is any indication.

In Recovery Mode

Ever since markets started reopening, hundreds of Walgreens stores have returned to full-time mode, driving up prescription volumes. With the store network almost back on track, it is expected that the company would regain the market share it lost to rivals following the widespread store closures during the pandemic.

After a prolonged losing streak, Walgreens’ stock is currently trading close to the ten-year low seen recently, which makes it one of the cheapest healthcare stocks. It has lost about 23% in the past twelve months, underperforming the broad market quite often. The company pays an attractive dividend yield of about 6% which is much higher than the S&P 500 average.

Rightsizing

Earlier this year, the leadership revealed plans to lay off about 10% of its workforce to focus more on the primary health business and also to streamline operations. To some extent, the job cut can be linked to the heavy investments in the new healthcare segment. It assumes significance considering the lackluster performance of the company’s core business.

Walgreens’ third-quarter report is slated for release on June 27 at 7:00 am ET, amid expectations for an increase in sales and earnings. Analysts, on average, are looking for an adjusted profit of $1.08 per share, which is up 12.5% year-over-year. The growth reflects an estimated 5% increase in sales to $34.21 billion.

From Walgreens’ Q2 2023 earnings call:

“Our retail pharmacy business provides a solid foundation for our leading healthcare assets to deliver value across the full care continuum, driving our long-term growth strategy. We are able to reach across both digital and physical channels to guide consumers through the complexities of healthcare. We are building the scale and resources to help health plans and patients improve outcomes and lower costs as only Walgreens can do.“

Q2 Outcome

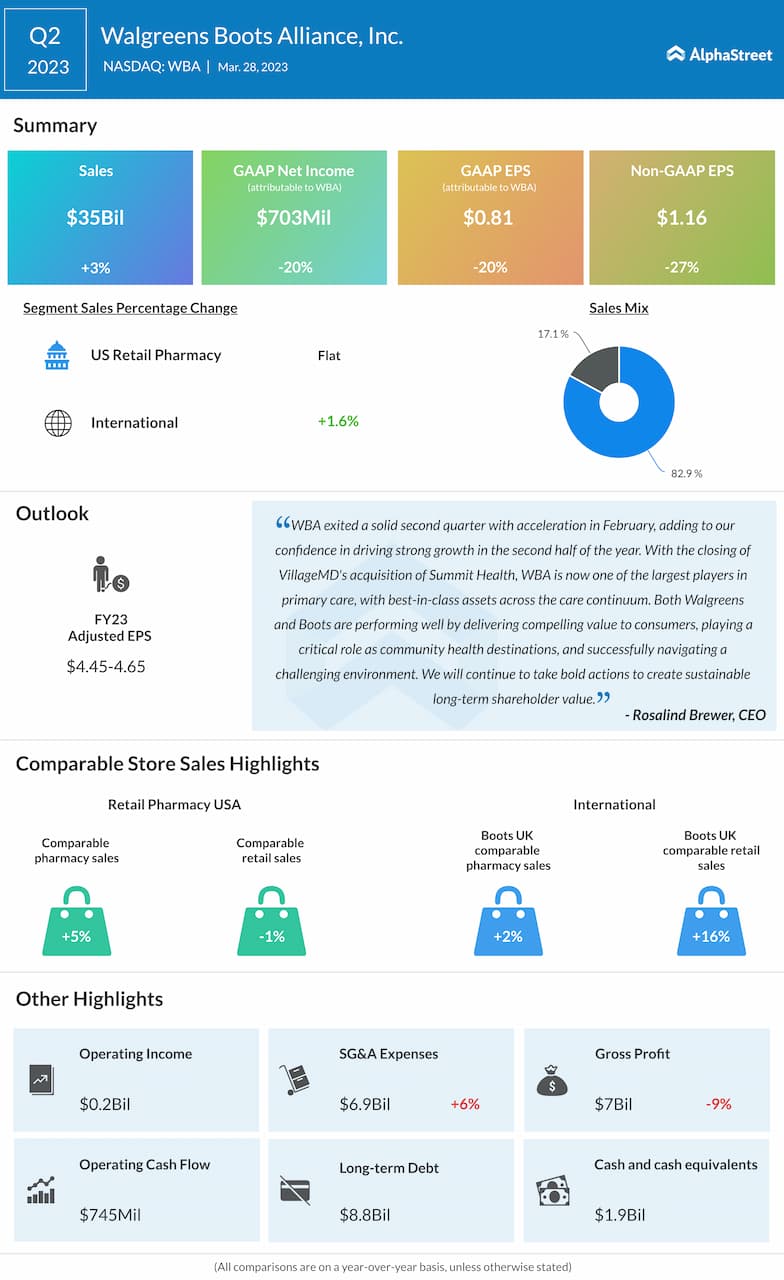

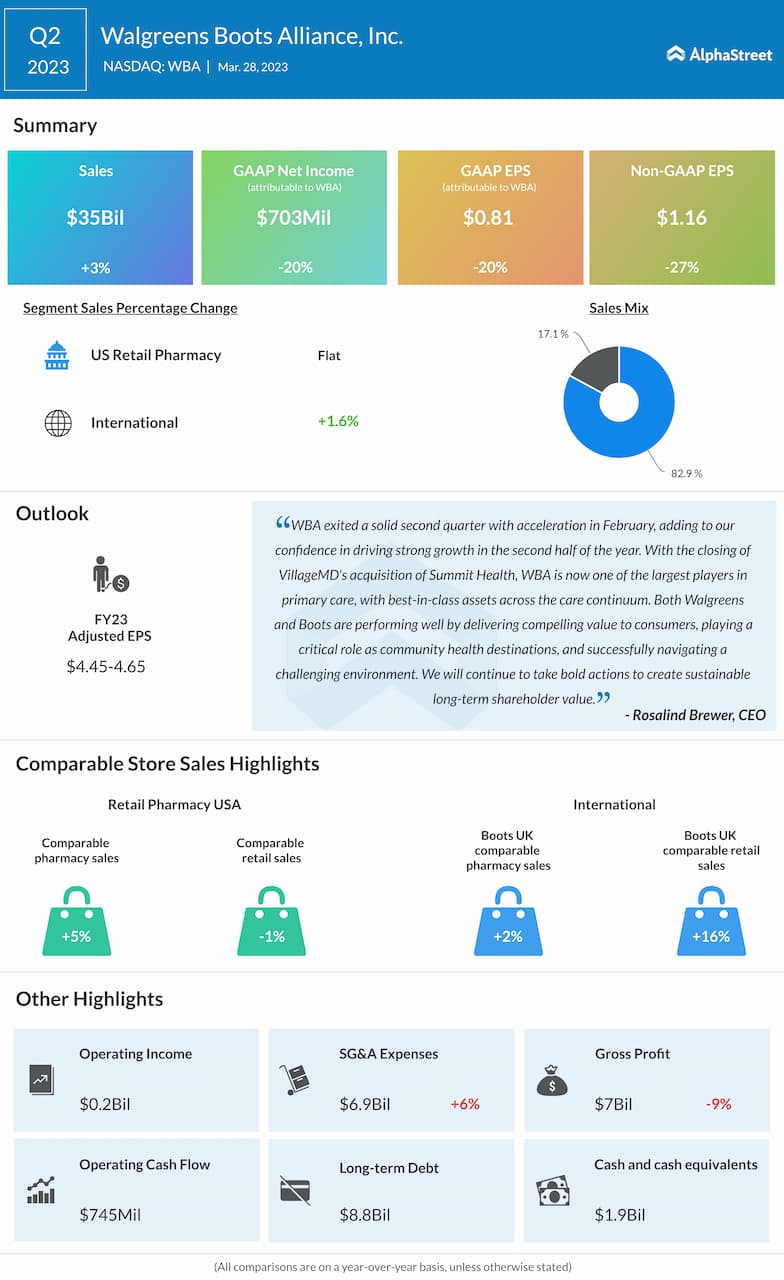

For the three months that ended in February 2023, Walgreens reported a 3% increase in sales to $35 billion. That was well above the market’s projection. A modest rise in international sales more than offset weakness in the core US Retail Pharmacy segment. Net earnings, adjusted for special items, plunged 27% from last year to $1.16 per share. In the past three years, quarterly earnings consistently beat estimates.

As part of the efforts to strengthen its foothold in the primary care market, the company recently acquired Summit Health through the VillageMD subsidiary.