Walgreens Boots Alliance, Inc. (NASDAQ: WBA) is scheduled to report first-quarter earnings on Thursday, amid expectations for a mixed outcome. The retail pharmacy giant, which is entering the new fiscal year after a lackluster 2023, is looking to regain strength by leveraging its initiatives to reduce costs and streamline operations.

The performance of Walgreens’ stock has been quite unimpressive for some time. The value has more than halved in the past two years and recently WBA fell to the lowest level in more than two decades. It recovered since then but continues to trade below the 12-month average.

Cautious Outlook

The company has been paying dividends for several decades and currently offers an impressive yield of 9.5%, which is well above the industry average. Going by the recent trend, the stock is unlikely to regain its lost ground in the near future as the company continues to struggle with performance and profitability. It will take a while before the ongoing cost-reduction program and working capital optimization initiatives bear fruit.

Tim Wentworth, who took the helm as CEO recently, has a difficult task – developing effective strategies and equipping the business for sustainable growth. While the company is expanding primary health services, by launching clinics at its locations, there is still a great deal of uncertainty as far as its long-term prospects are concerned. The management is likely to go for an organizational restructuring with focus on spinning off underperforming business segments.

A Rough Patch

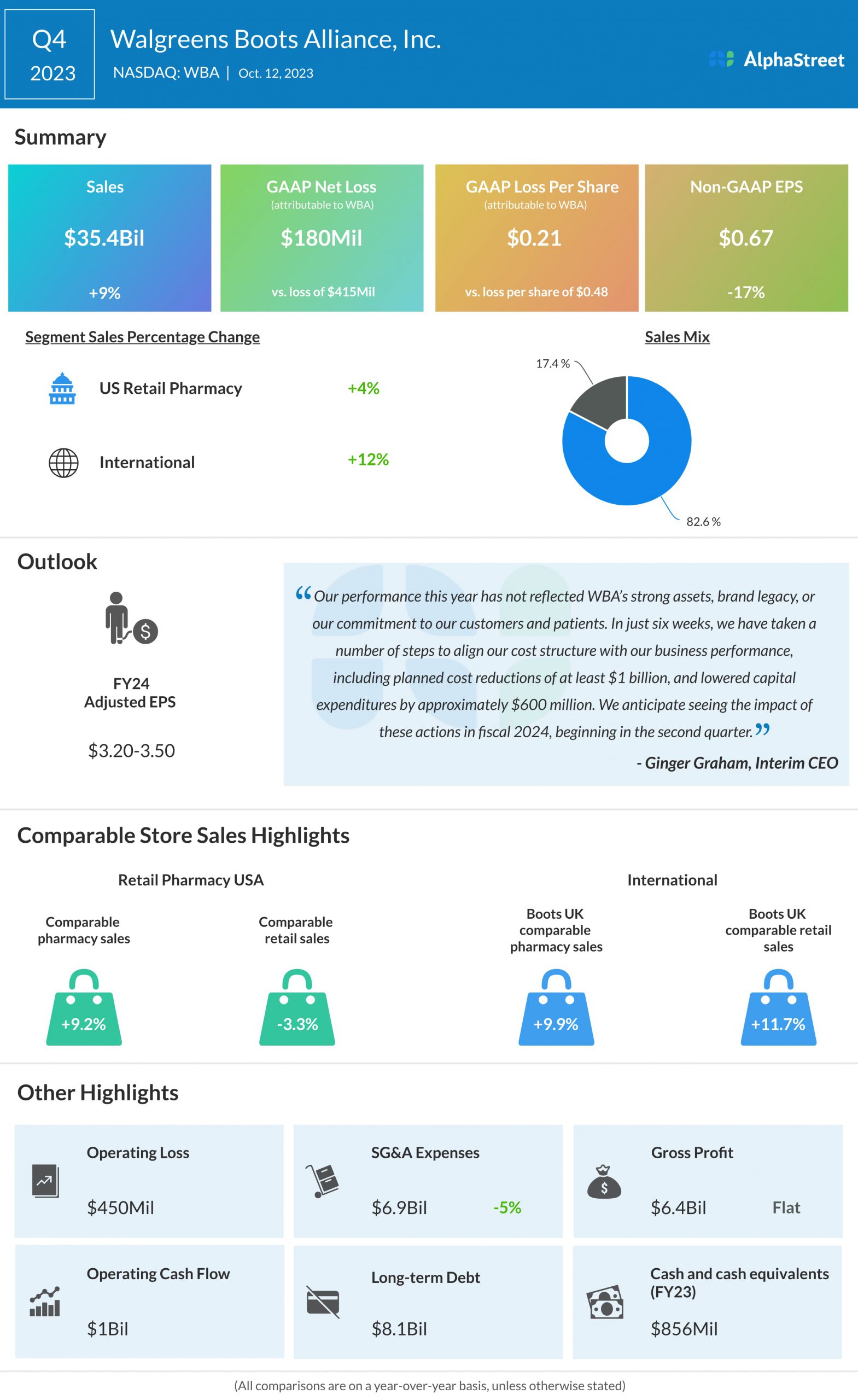

Walgreens is yet to recover from the impact of the sharp fall in COVID-19 vaccine and testing volumes. The company witnessed a spike in sales during the pandemic when it channeled its resources into providing COVID-19 care, but the momentum waned as the pandemic subsided. The management is looking for adjusted earnings between $3.20 per share and $3.50 per share for fiscal 2024, which is lower than the profit reported last fiscal year.

From Walgreens’ Q4 2023 earnings call:

“We do expect reimbursement pressure to be less of a headwind in fiscal ’24 than in fiscal ’23. We’re projecting approximately 5 million COVID vaccinations in 2024. Quarter to date, we’re well on track and have already administered over 3 million COVID vaccinations. In retail, we expect margins to benefit from our category performance improvement program and a roughly 1 percentage point increase in own brand penetration.“

Q1 Report Due

Walgreens is expected to report results for the first quarter of 2024 on January 4, at 7:00 a.m. ET. The market will be keeping a tab on the outcome since earnings fell short of expectations in the previous two quarters, after beating regularly in the past few years. Analysts are looking for earnings of $0.63 per share for the November quarter, which is down 46% from the corresponding quarter of fiscal 2023. Meanwhile, first-quarter sales are expected to rise modestly to $34.85 billion.

In the August quarter, adjusted profit decreased 17% annually to $0.67 per share and missed the Street view. Meanwhile, reflecting the continued strong performance of the US Retail Pharmacy segment, total sales rose 9% to $35.4 billion in Q4.

After closing the previous session sharply lower, Walgreen’s stock traded higher Tuesday afternoon. It has gained about 30% in the past 30 days.