Stock Slips

New Shopping Trend

But, the current trend shows that customers are getting used to contactless shopping facilities like curbside-pickup and home delivery, for the convenience and safety they offer. As the holiday shopping season progresses, it would be a whole new experience for the stakeholders. Walmart’s feature-rich e-commerce platform, in combination with the extensive store network, will allow it to effectively deal with a potential buying spree. Of late, customers have been consolidating their purchases, marked by bigger baskets, fewer trips, and lesser transactions.

From Walmart’s third-quarter 2021 earnings conference call:

“Changes in customer behavior have accelerated the shift to eCommerce and digital. We were well-positioned to catch and ride these waves given our previous work and investments. Our eCommerce and omnichannel penetration continue to rise, accelerating trends by two to three years in some cases. We’re convinced that most of the behavior change will persist beyond the pandemic and that our combination of strong stores and emerging digital capabilities will be a winning formula.”

Cautious Stance

At the same time, special care will be taken to avoid crowding in Walmart stores, considering the emergence of new COVID cases. Another virus outbreak could pose a big challenge to retailers, in terms of ensuring safety and keeping the supply chain moving. In the current quarter, Walmart expects to incur additional costs related to COVID preparedness.

Comps Surge

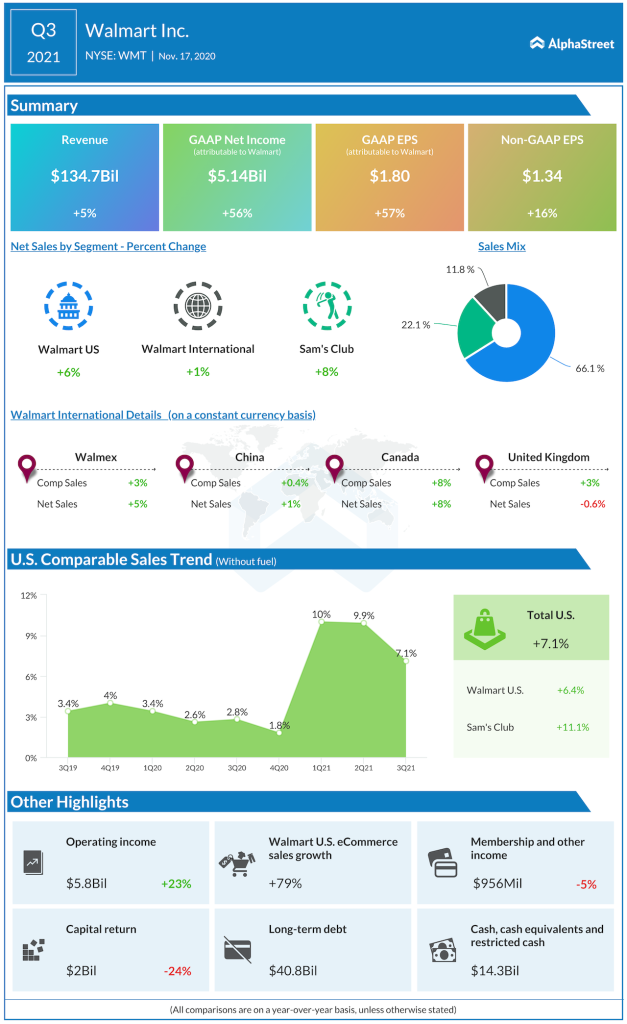

The highlight of Walmart’s third-quarter report is a 79% spike in e-commerce sales. Once again, comparable-store sales surged, but at a slower pace compared to the previous quarters, with Sam’s Club registering double-digit growth. Reflecting the strong performance across all business divisions and geographical segments, revenue moved up 5% to $135 billion. Consequently, adjusted earnings climbed 16% annually to $1.34 per share. The numbers also topped expectations.

Flipkart, Walmart’s Indian subsidiary that faced challenges initially, witnessed a sharp increase in the number of monthly active users in recent months.

I was in stores last week and I saw variance from one state to the other, one location to the other, just depends on how people are feeling at that moment. But what the action is the same as what we saw before. They’re just stocking up on paper goods, cleaning supplies, and dry grocery, should they need them. And so, I think we’re going to be able to respond in this instance better than we did in the first half of the year…

Doug McMillon, CEO of Walmart

ADVERTISEMENT

Stock Peaks

The current target price indicates Walmart’s stock has peaked but analysts recommend investing in the company, citing the strong fundamentals. Last week, the stock crossed the $150-mark for the first time and hit a record high prior to the earnings release, but pared those gains later. The shares have increased by 30% so far this year and 19% in the past six months.