Walmart Inc. (NYSE: WMT) has been focused on expanding its e-commerce capabilities lately, in order to better align the business with customers’ changing shopping patterns. The strategy has helped it tackle recent market challenges to a great extent. Taking the digital shift to the next level, the company is ramping up third-party advertising at its stores.

In a sign that the market is bullish on the Bentonville-headquartered grocery giant, the stock made steady gains in recent weeks and reached an all-time high a few days ago. The stock, which is among the least affected by the recent market selloff, is trading well above its 52-week average. Anticipating the uptrend to continue in the coming months, the majority of analysts following the stock recommend buying it.

Q2 Report on Tap

The department store chain is preparing to publish its second-quarter 2024 earnings on Thursday at 7:10 am ET. Going by experts’ projections, the company seems to have had another strong quarter. The consensus earnings estimate is $1.7 per share, which is broadly in line with the number for the year-ago quarter. The forecast for second-quarter revenue is $160.19 billion, which represents a 4.8% year-over-year increase.

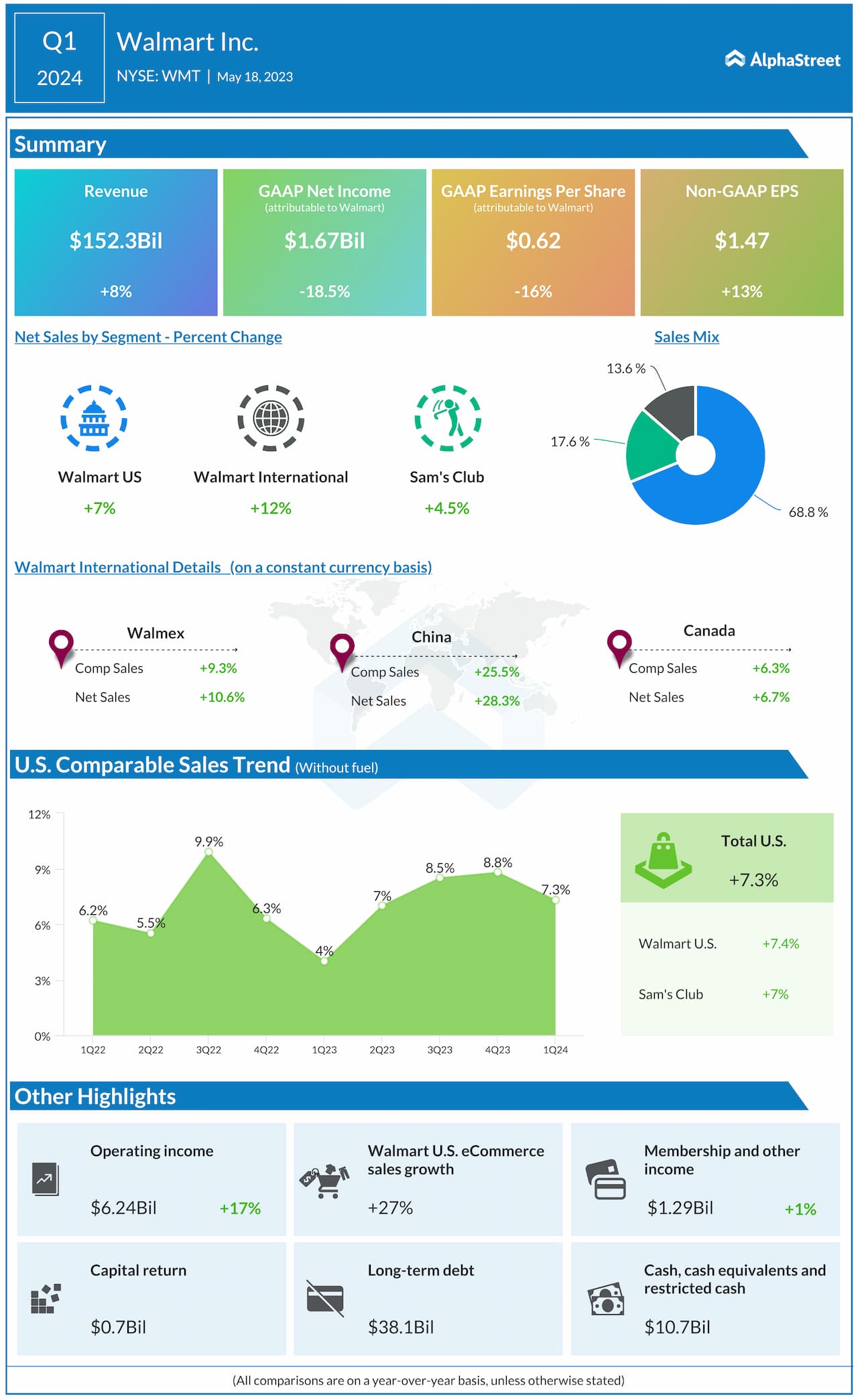

Walmart has a good track record of reporting earnings that beat estimates, a trend the company has maintained in each of the trailing four quarters. It had a positive start to fiscal year 2024, reporting a 13% growth in first-quarter adjusted earnings to $1.47 per share. Earnings benefitted from an 18% growth in revenues to $152.3 million — revenue also topped expectations, marking the thirteenth consecutive beat.

Strong Q1 Sales

The topline growth was broad-based across all operating segments – Walmart US, Walmart Intl., and Sam’s Club – and geographical regions, which also reflected in comparable store performance. US comparable sales were up 7.3% in Q1, while e-Commerce sales grew an impressive 27%.

While addressing analysts after reporting Q1 results in May, the management warned that the impact of inflation, especially in categories like dry grocery, would persist in the later part of the second quarter and third quarter. From the earnings conference call:

“At the headline level, consumer spending has proven resilient, but below the surface, we continue to see signs that customers remain choice-ful, particularly in discretionary categories. In Q1 we saw a nearly 360 basis point shift in U.S. sales mix from general merchandise to grocery and health and wellness. To benchmark the magnitude of this shift exceeds the 330 basis points of category mix shift we experienced in all of last year.“

In the past six months, Walmart’s shares gained about 9%. The stock opened Tuesday’s trading at around $160 and closed the session slightly lower.