The streaming business is an important part of the Walt Disney Company’s (NYSE: DIS) growth strategy. The division has seen strong growth since its launch and despite some near-term churn, the company remains confident in its long-term opportunity. Here’s a look at some of the plans it has in place for this segment:

Subscribers and revenue

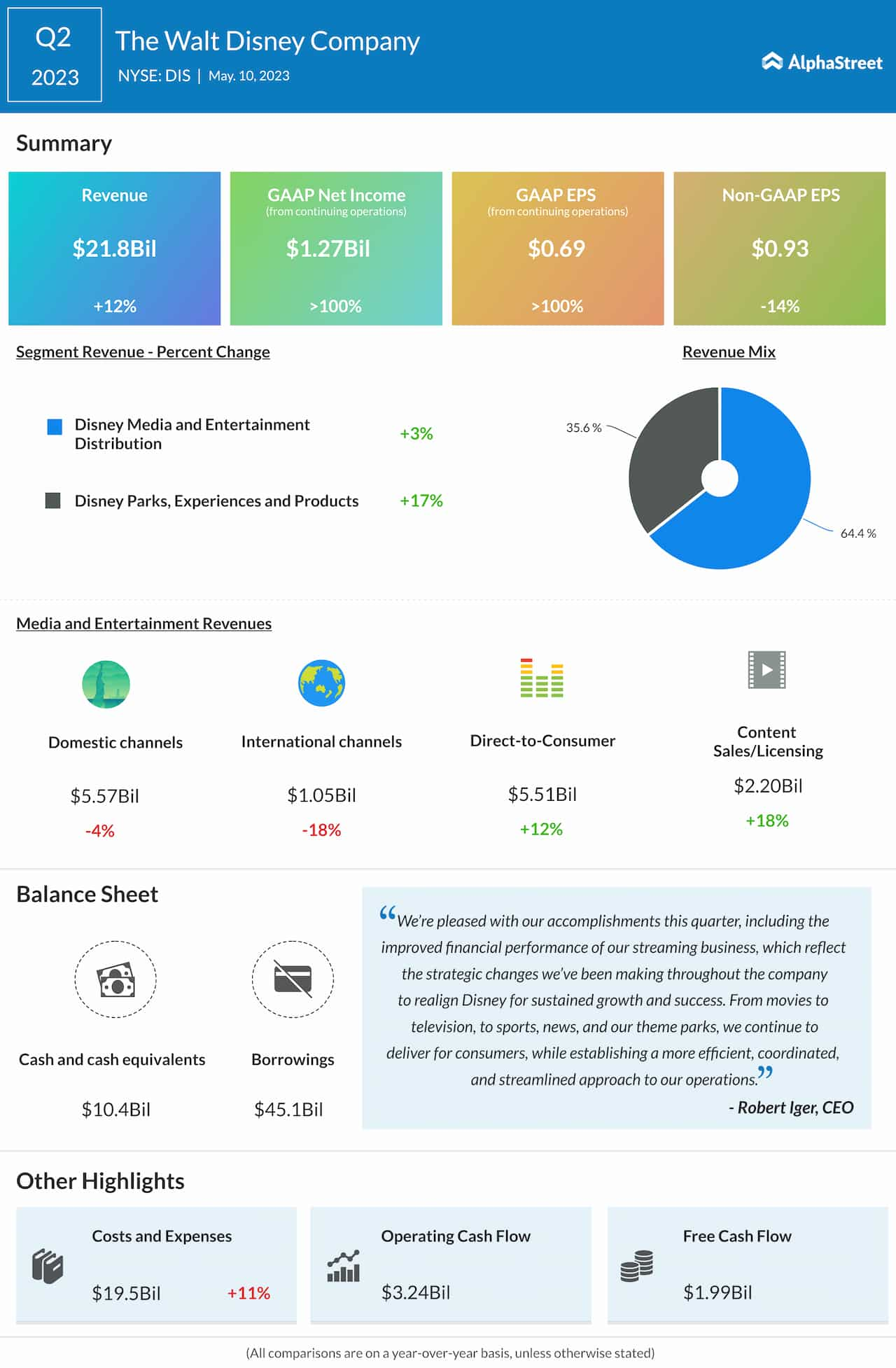

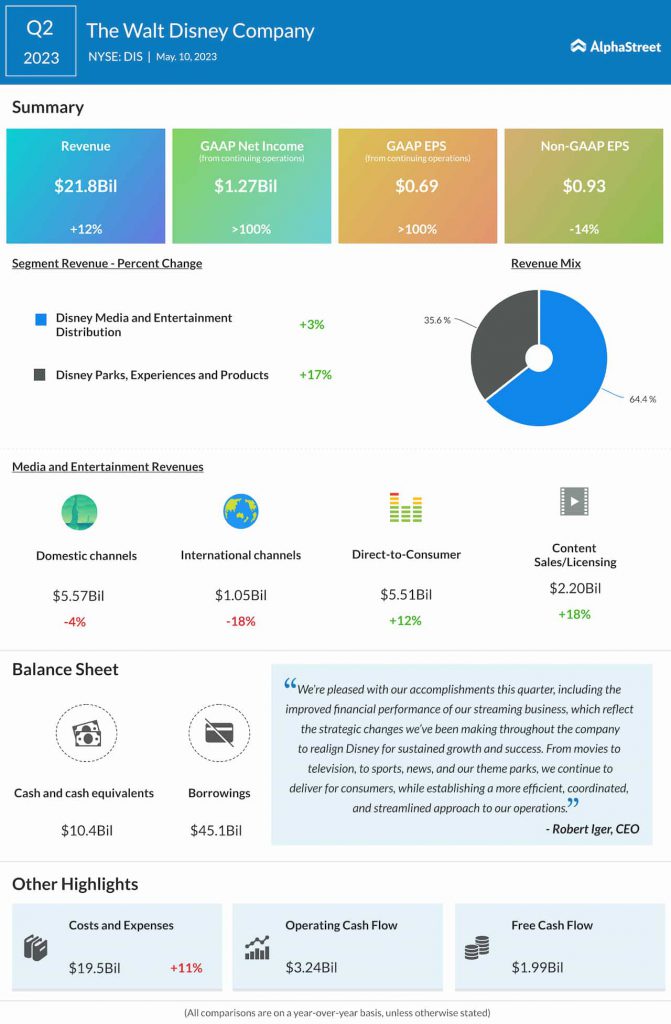

In the second quarter of 2023, revenues in the direct-to-consumer (DTC) segment increased 12% to $5.5 billion while operating loss decreased to $0.7 billion. The drop in operating loss was due to improved results at Disney+ and ESPN+, which were driven by growth in subscription revenue. The growth in subscription revenue was fueled by subscriber growth and price increases.

During the quarter, total Disney+ subscribers were down 2%. Disney+ Core subscribers rose 1%, with a 2% growth in international subscribers and a 1% decline in domestic subscribers. Although domestic subscribers declined due to price increases, domestic average revenue per user (ARPU) rose sequentially.

While the company anticipates the softness in domestic Disney+ net adds might continue into the third quarter of 2023, it expects growth in Core subscribers to bounce back in the fourth quarter. Disney+ Hotstar saw an 8% drop in subscribers.

One-app offering

Disney plans to offer a one-app experience for its domestic customers that incorporates its Hulu content via Disney+. These combined offerings are expected to provide greater opportunities for advertisers while also providing bundle subscribers with more streamlined content, which will help drive engagement. The company plans to roll out this offering by the end of calendar year 2023.

Advertising

Disney sees considerable opportunity for advertising within the aforementioned combined platform. The company believes that over 40% of its domestic advertising portfolio is currently addressable and it expects this portion to keep growing over time. It also sees potential for growth in programmatic advertising and it believes it can expand further as the market improves and the size of audiences increase.

Disney currently has 5,000 advertisers across its streaming platforms, with over 1,000 added over the past year, and over a third buying advertising programmatically at present. It also plans to launch its ad tier on Disney+ in Europe by the end of 2023. This is expected to drive increased inventory and revenue over the long term.