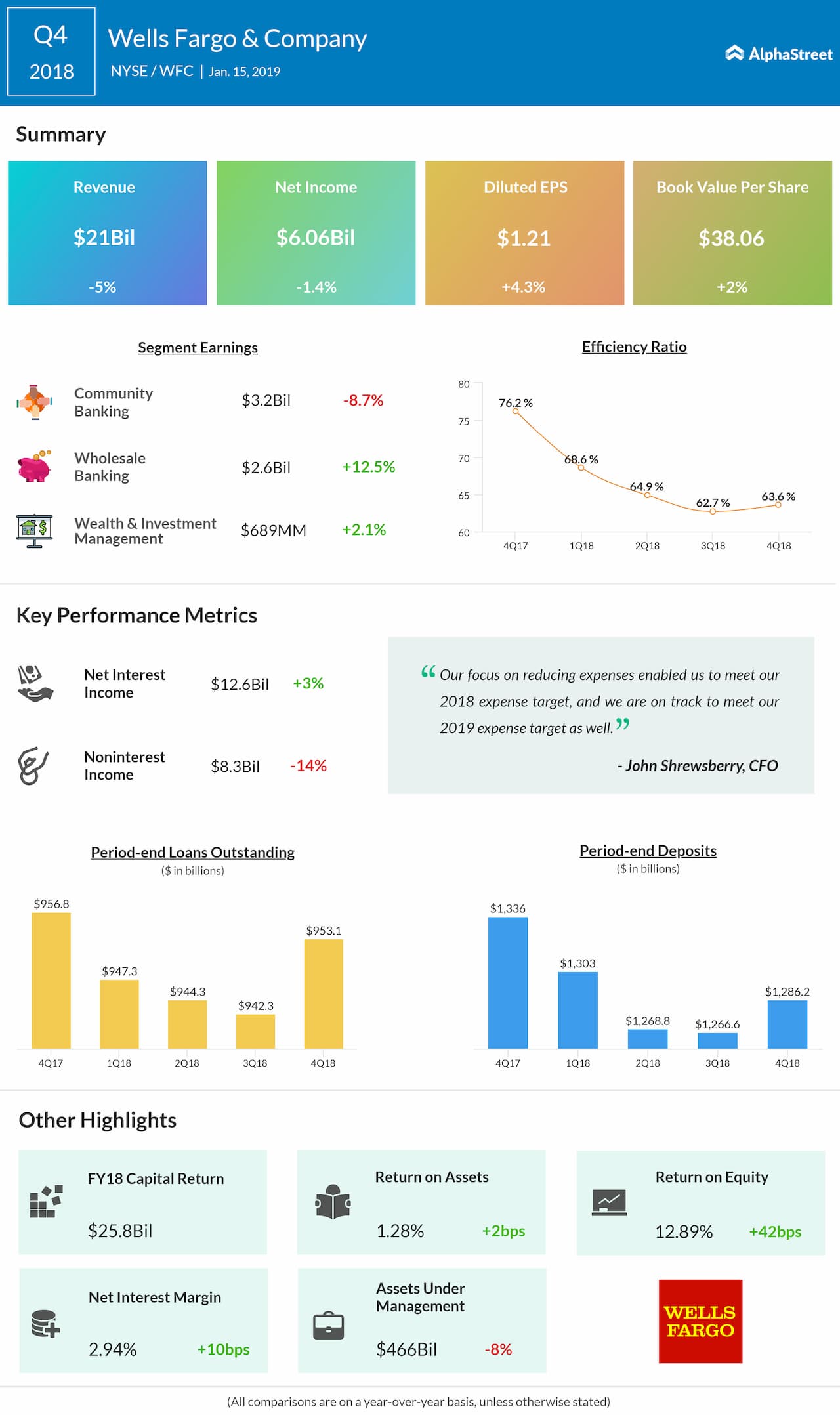

Net interest income was $12.6 billion, up $331 million from last year. Non-interest income was $8.3 billion, down $1.4 billion from fourth quarter 2017.

Revenue from Community Banking declined 2% predominantly due to lower market-sensitive revenue and mortgage banking income. Primary consumer checking customers was 23.9 million, up 1.2% from last year. Debit card point-of-sale purchase volume increased 8% to $89.8 billion and general purpose credit card point-of-sale purchase volume rose 5% to $20.2 billion.

There were 29.2 million digital (online and mobile) active customers, including 22.8 million mobile active users. The company has 5,518 retail bank branches as of the end of fourth quarter 2018, reflecting 93 branch consolidations in the quarter and 300 in 2018.

Wholesale Banking revenue fell 7% largely due to the impact of the sales of Wells Fargo Insurance Services USA (WFIS) in fourth quarter 2017 and Wells Fargo Shareowner Services in first quarter 2018, as well as lower market sensitive revenue, operating lease income and treasury management fees.

Commercial card spends volume grew 11% to $8.6 billion on increased transaction volumes primarily reflecting customer growth. US investment banking market share of 3.2% in 2018, compared with 3.6% in 2017.

Revenue from Wealth and Investment Management inched down 9% on lower deferred compensation plan investment results, asset-based fees, brokerage transaction revenue, and net interest income. Total client assets of $1.7 trillion, down 10% from a year ago, driven primarily by lower market valuations, as well as net outflows.

The company continued to have positive business trends in the fourth quarter with primary consumer checking customers, consumer credit card active accounts, debit, and credit card usage, commercial loan balances, and loan originations in auto, small business, home equity and student lending all growing compared with a year ago.

Wells Fargo’s focus on reducing expenses enabled the company’s to meet 2018 expense target, and it is on track to meet 2019 expense target as well. The company currently expects the effective income tax rate for the full year 2019 to be about 18%, excluding the impact of any unanticipated discrete items.

Also read: Wells Fargo Q4 2018 earnings call transcript

Meanwhile, peers JPMorgan (JPM) and Citigroup (C) announced their results and the banking companies surpassed street’s estimates. Wells Fargo, JPM and Citi were trading in a downward trajectory before the bell.

Shares of Wells Fargo ended Monday’s regular session up 1.15% at $48.42 on the NYSE. The stock has fallen over 22% in the past year and over 7% in the past three months.