Spotify Technology SA (NYSE: SPOT) is slated to report fourth quarter 2019 earnings results on Wednesday, February 5, before the market opens. Analysts have projected a loss of $0.25 per share compared to earnings of $2.60 per share reported a year earlier. Revenue is expected to grow around 24% to $2.09 billion.

Spotify’s topline results are expected to benefit from growth in users and premium subscribers, both of which saw double-digit increases on a year-over-year basis last quarter. The company appears to be benefiting from its podcast strategy which has helped in increasing engagement levels and aiding the conversion of free users to paid ones.

The streaming service has also seen growth in developing regions which has led to an increase in its monthly active users. Spotify faces tough competition from the streaming services of giants like Apple (NYSE: AAPL) and Amazon (NYSE: AMZN). However, its investments in podcasts bodes well and is anticipated to help the company achieve profitability.

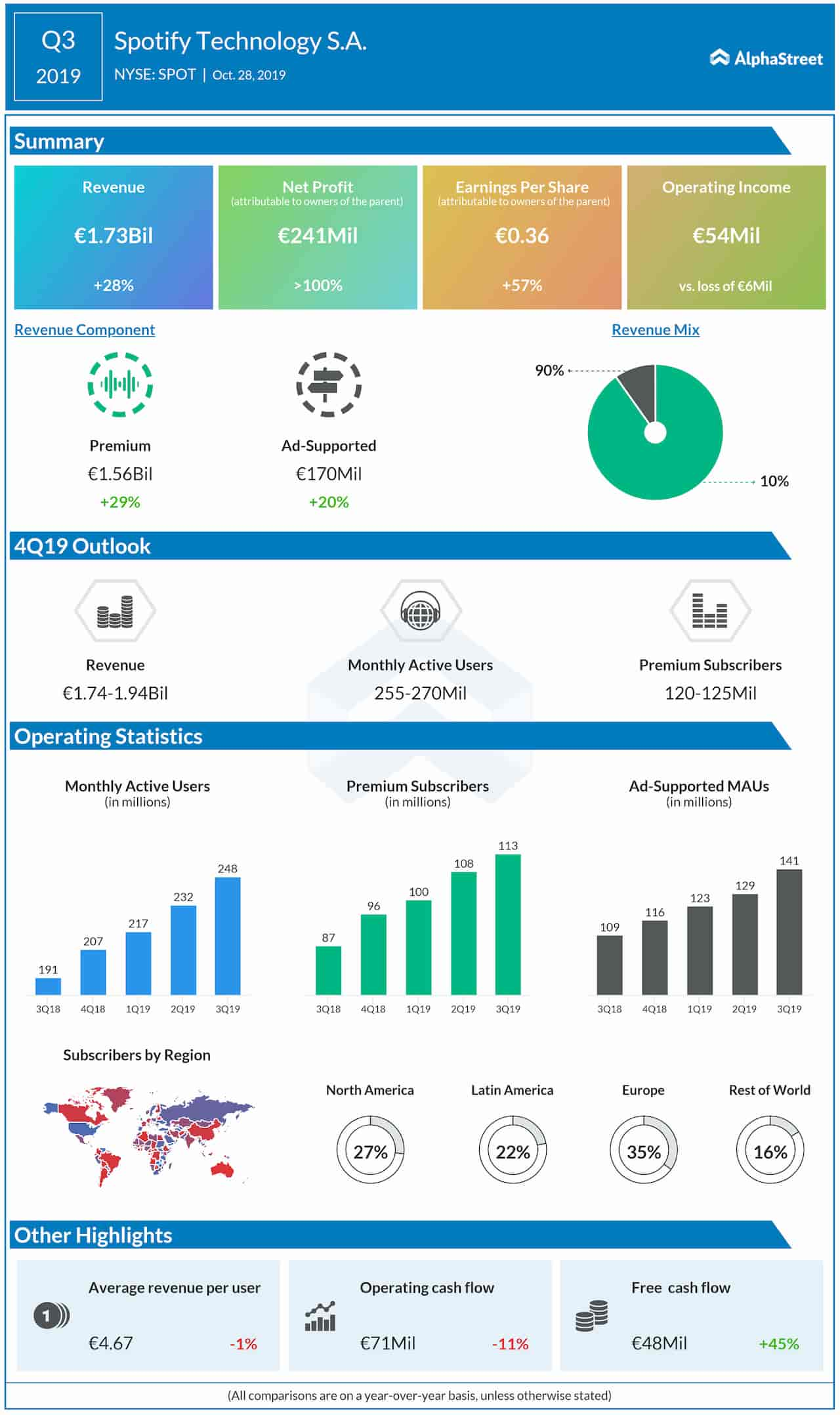

In the third quarter of 2019, Spotify reported higher revenues and profits. Revenues grew 28% to EUR1.73 billion. EPS rose 57% to EUR0.36, beating estimates. Total monthly active users (MAUs) grew by 30% year-over-year to 248 million while global premium subscribers increased 31% to 113 million.

For the fourth

quarter, the company has guided for total revenues of EUR1.74 billion to EUR1.94

billion. The number of monthly active users is expected to come in the range of

255 million to 270 million. The number of premium subscribers are expected to

be between 120 million and 125 million.

Spotify’s shares have gained 6% in the past one year. The stock has an average price target of $169.57, which represents an upside of 16% from the current price.