Shares of Target Corporation (NYSE: TGT) were down over 1% on Monday. The stock has dropped 13% year-to-date. The company is slated to report its second quarter 2023 earnings results on Wednesday, August 16, before market open. Here’s a look at what to expect from the earnings report:

Revenue

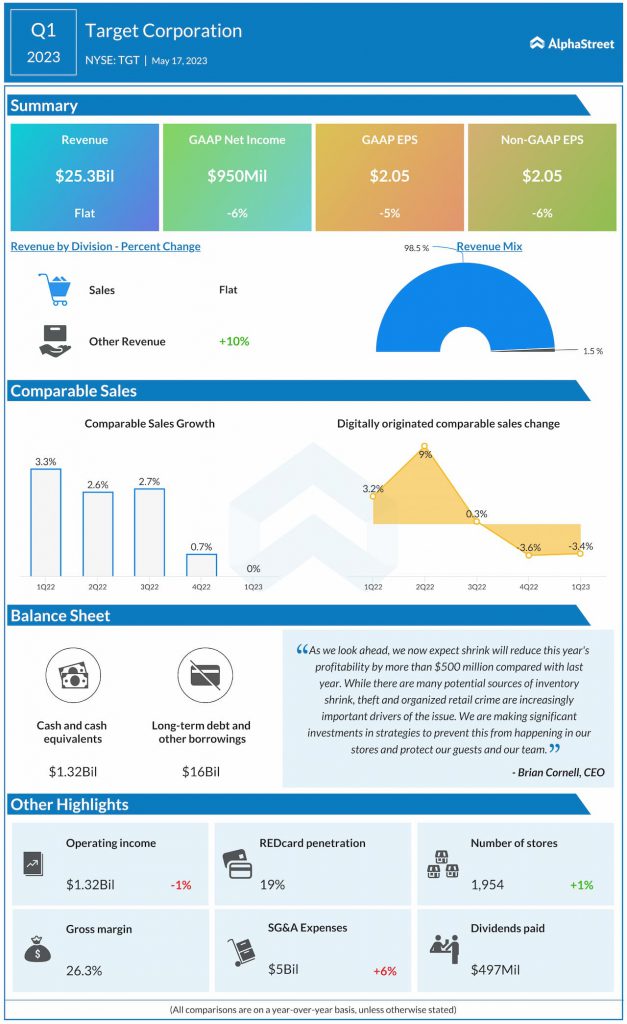

Analysts are projecting revenue of $25.2 billion for the second quarter of 2023, which would represent a decline of 3% from the same period a year ago. In the first quarter of 2023, total revenue of $25.3 billion remained relatively flat with the year-ago period.

Earnings

Target has guided for both GAAP and adjusted EPS to range from $1.30-1.70 in Q2 2023. Analysts are predicting EPS of $1.41 which compares to $0.39 in the year-ago period. In Q1 2023, GAAP EPS fell 4.8% to $2.05 while adjusted EPS dropped 6.2% to $2.05 versus the prior-year period.

Points to note

Inflationary pressures and cautious consumer spending have led to higher demand for essentials and a slowdown in discretionary categories. In Q1, comparable sales remained flat year-over-year. For Q2, Target expects a low single-digit decline in comparable sales.

The shift towards essentials over discretionary categories as well as the impacts from inventory shrink are likely to weigh on margins. Target expects a meaningful tailwind from freight and transportation costs and a significant headwind from inventory shrink to its gross margin in Q2. The company expects its operating margin rate to be higher on a year-over-year basis but lower on a sequential basis.

Target is expected to benefit from its multi-category portfolio as well as the efficiency of its same-day services. In Q1, same-day services expanded more than 5%, led by the Drive-Up service. Its continued investments in its stores and delivery services are likely to pay off.

Most Popular

Colgate-Palmolive (CL) Q3 2024 Earnings: Key financials and quarterly highlights

Colgate-Palmolive Company (NYSE: CL) reported its third quarter 2024 earnings results today. Net sales increased 2.4% year-over-year to $5 billion. Organic sales grew 6.8%. Net income attributable to Colgate-Palmolive Company was $737

Key takeaways from Southwest Airlines’ (LUV) Q3 2024 earnings report

Shares of Southwest Airlines Co. (NYSE: LUV) were down over 4% on Thursday. The stock has gained 4% over the past three months. The airline reported its earnings results for

HOG Earnings: A snapshot of Harley-Davidson’s Q3 2024 results

Motorcycle manufacturer Harley-Davidson (NYSE: HOG) Thursday reported a sharp fall in sales and net profit for the third quarter of 2024 amid weak demand. Consolidated net income declined to $119