Shares of Tyson Foods, Inc. (NYSE: TSN) were up 1% on Friday. The stock has dropped 8% year-to-date. The company is slated to report its third quarter 2023 earnings results on Monday, August 7, before market open. Here’s a look at what to expect from the earnings report:

Revenue

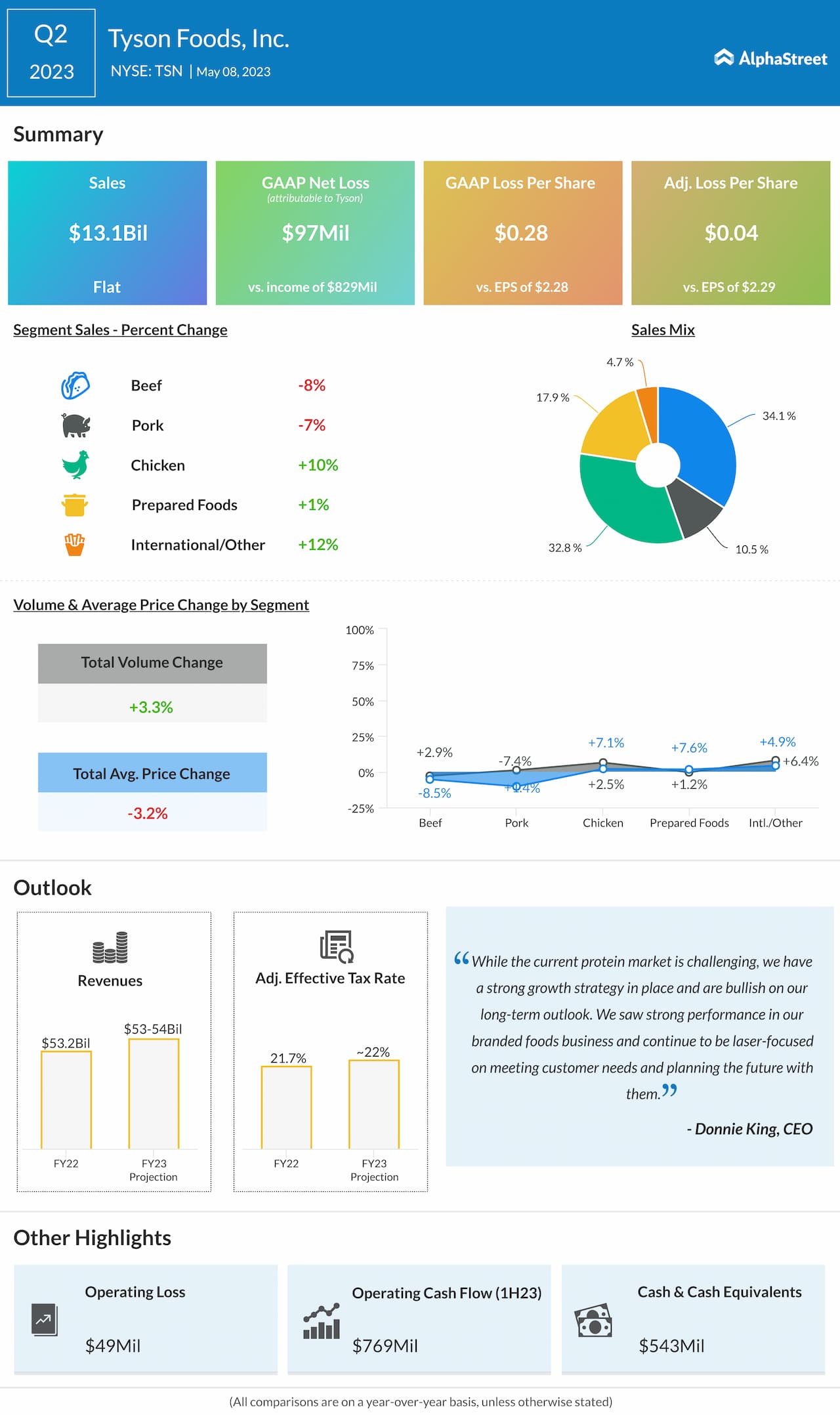

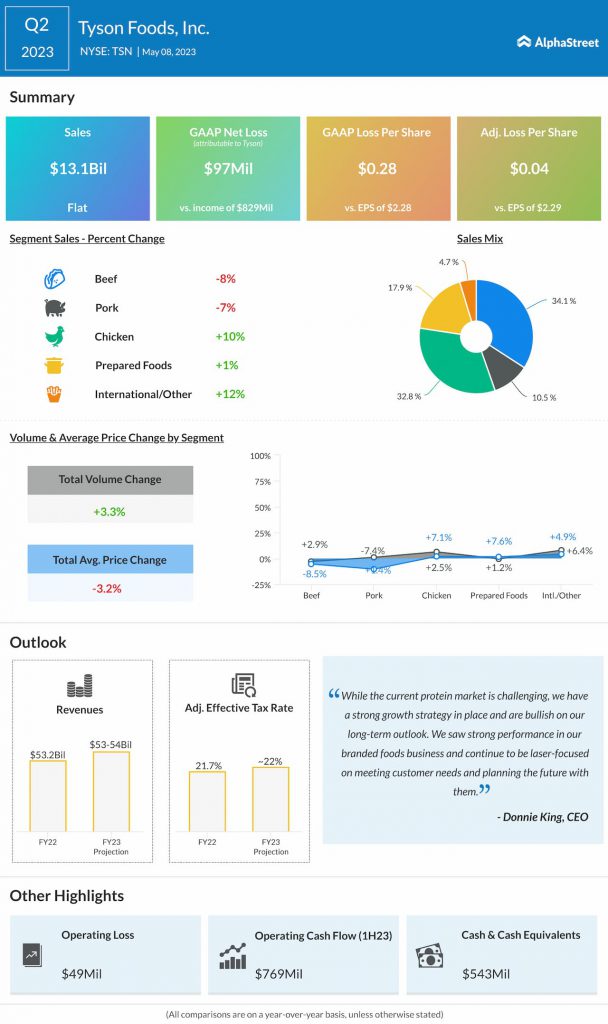

Analysts are projecting revenue of $13.6 billion for Q3 2023, which is up slightly from sales of $13.5 billion in the same period a year ago. In the second quarter of 2023, sales remained flat year-over-year at $13.1 billion.

Earnings

The consensus estimate for EPS is $0.26 in Q3 2023, which compares to EPS of $1.94 in the year-ago quarter. In Q2 2023, the company reported an adjusted loss of $0.04 per share.

Points to note

Tyson expects global demand for protein to continue to grow which is a positive. It plans to focus on driving growth in its core protein platform and remains well-positioned with the capacity to meet the protein demand.

The company could benefit from growth in its branded food portfolio aided by strength in brands such as Tyson, Jimmy Dean and Hillshire Farm. In Q2, branded foods saw volume growth of 7%. Branded foods presents meaningful opportunity to drive growth and improve margins.

In Q2, Tyson saw sales growth in chicken and prepared foods. Sales in chicken increased over 8% helped by volume growth of over 6% due to increased internal production. Sales also benefited from pricing actions. Sales in prepared foods rose 1.2% driven mainly by pricing gains.

Higher input costs are a concern. In Q2, higher input costs per pound in all segments, barring pork, led to an increase in cost of goods sold. Most of this increase was driven by the impacts of inflation on raw material and labor costs.