The Company

Read management/analysts’ comments on 360 DigiTech’s Q1 earnings

The fintech firm owes its success to the innovative capital-light model to a large extent. Recovering from last year’s slump, loan demand has once again reached the pre-COVID levels, indicating that buy days are ahead for the consumer finance market. 360 DigiTech looks to tap into the unfolding opportunities by incorporating new technology. Currently, AI-assisted procedures play a key role in its post- lending management services.

The company, which was founded in July 2016, is led by chairman Hongyi ZHOU and chief executive officer Haisheng WU. It has dominated the market consistently, supported by effective risk management, stable revenue growth, and sustained profitability. Borrowers often use the company’s affordable line of credit as a supplement to credit card debt. The key operating divisions are:

- Shanghai Qiyu Information & Technology Co.

- Fuzhou 360 Online Microcredit Co.

- Fuzhou 360 Financing Guarantee Co.

- HK Qirui International Technology Company

- Shanghai Qiyue Information & Technology Co.

- Shanghai 360 Financing Guarantee Co.

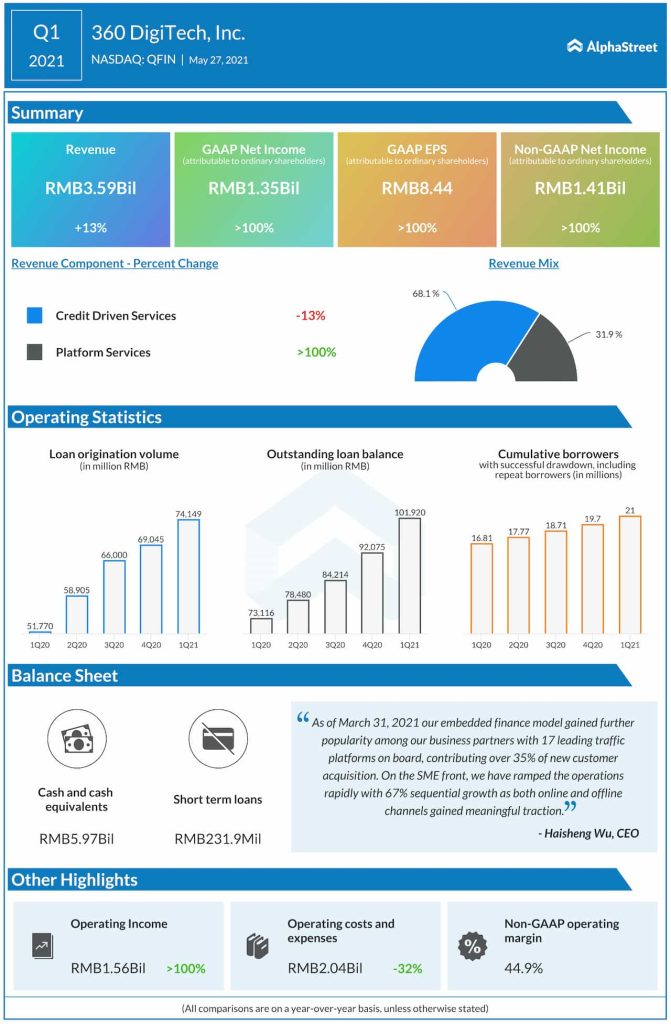

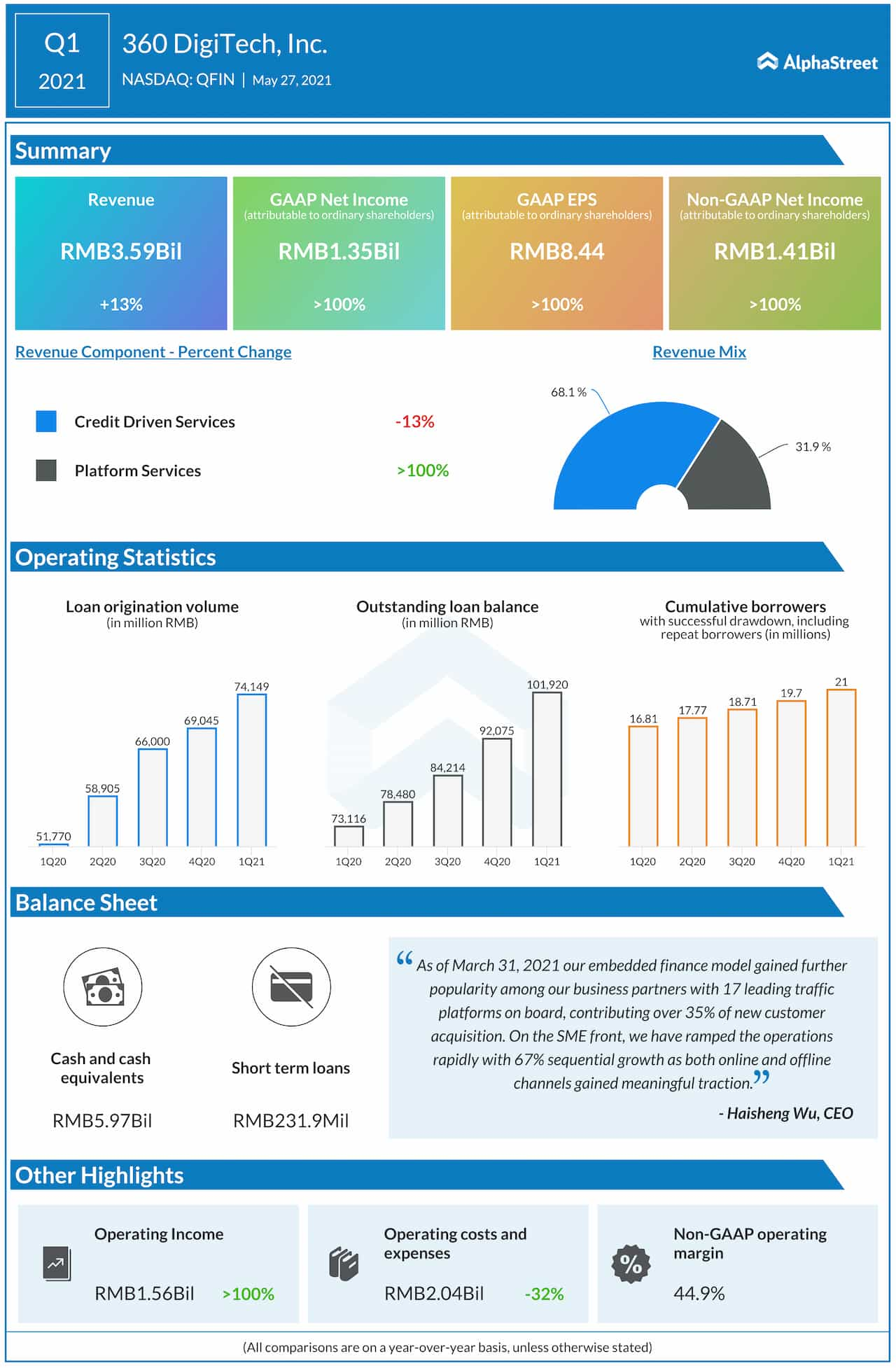

Financial Metrics

360 DigiTech has entered fiscal 2021 on an upbeat note, with adjusted earnings more than doubling to RMB1.41 billion in the first three months of the year. The strong bottom-line performance reflects double-digit growth in revenues to RMB3.6 billion. In a significant shift, the rapidly-growing Platform Services segment grew sharply and raised its revenue share to more than a third of the total, while the core Credit Driven Services contracted. Both loan volumes and outstanding balance rose at a faster pace even as the company broadened its client base further. Of late, loan-loss provisions have remained elevated due to the looming market uncertainty, though the latest numbers indicate an improvement amid the broad-based economic recovery. As of December 2020, the share loans delinquent for more than 90 days was just 1.5%.

Competition

The tech-enabled risk management capabilities give 360 DigiTech an edge over rivals. The capital-light model continues to attract borrowers to the platform, thanks to competitive pricing and continued innovation such as the incorporation of advanced technologies like artificial intelligence. The main competitors include Yirendai (NYSE: YRD), which thrives on a diversified product portfolio that includes education and home remodeling loans, and customer credit technology firm Qudian Inc. (NYSE: QD) that operates in the domestic market through its Instalment Credit Services and Transaction Services divisions.

Risks

When it comes to the sustainability of the business, the primary concern is the volatile regulatory environment as the rules for online consumer lending are still evolving in China. The industry remains at the nascent stage, which makes 360 DigiTech vulnerable to potential changes in the regulatory framework in the future. For that reason, ensuring low delinquency rates while also expanding the borrower base and partner network becomes a major challenge. It is crucial to maintain security on the platform, considering the involvement of highly sensitive information and the complexity of the technology that supports it. Besides, China’s non-traditional financial services market is susceptible to macroeconomic fluctuations and credit cycles.

Recent Developments

Last year, the management gave the company a new identity by changing its name to 360 DigiTech from 360 Finance, which it believes would represent the brand in a better way. Last month, the company completed the issuance of RMB300 million asset-backed securities listed on the Shenzhen Stock Exchange. Earlier, investment bank Morgan Stanley (NYSE: MS) initiated coverage of QFIN stock with an overweight rating.

Looking Ahead

While it is likely to repeat last year’s stronger-than-expected performance, the company is cautious in its outlook for fiscal 2021. Loan volumes are expected to be in the range of RMB310 billion to RMB330 billion this year – up 26-34% year-over-year. Buoyed by a strong loan balance of RMB100 billion in the first three months, with the capital-light model contributing more than half of it, the management sees continued growth in 2021 and beyond, catalyzed by better regulatory clarity on the conduct of fintech business.

At the Bourses

Shares of 360 DigiTech have been on an upward trajectory for quite some time and climbed to a record high this week, hovering near the $40-mark and well above their 52-week average. The value more than tripled in the past six months, all along outperforming the broad market. After slipping to the negative territory briefly, the stock entered 2021 on a high note and maintained the momentum since then.

Conclusion

360 DigiTech’s business strategy has remained intact despite the COVID-related disruption, thanks to stable demand for finance during the pandemic through elevated sales and marketing costs weighed on margins. The impressive performance of various products, supported by advanced technologies like intelligence credit engine and embedded finance, gives a sense of where the consumer lending market is headed. Being a market leader, the company stands to benefit from the emerging trend and the favorable regulatory environment.