Revenue

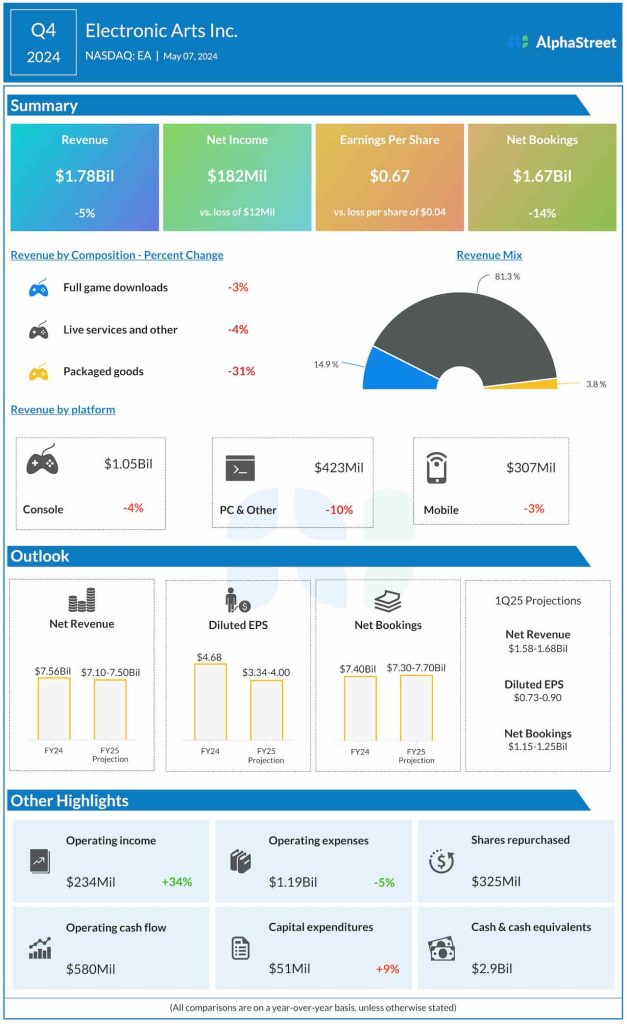

Electronic Arts’ revenue declined 5% year-over-year to $1.78 billion in Q4 2024. For the first quarter of 2025, the company expects net revenues to range between $1.57-1.67 billion. For fiscal year 2025, net revenues are expected to be approx. $7.1-7.5 billion.

Earnings

In the fourth quarter of 2024, EA delivered net income of $182 million, or $0.67 per share, compared to a loss of $12 million, or $0.04 per share, in the same period last year. In Q1 2025, net income is expected to be approx. $197-243 million and EPS is expected to be approx. $0.73-0.90. For FY2025, net income is expected to range between approx. $904 million to $1.08 billion while EPS is estimated to be $3.34-4.00.

Net bookings

In Q4 2024, net bookings fell 14% YoY to $1.67 billion. In Q1 2025, net bookings are expected to be approx. $1.15-1.25 billion. For the full year of 2025, net bookings are expected to range between $7.30-7.70 billion.