The airline also saw a 2% increase in unit costs, ex fuel

and special items, during 2019. This increase is expected to continue in 2020

due to wage inflation, higher engine maintenance on some of its fleets, and

higher lease return costs associated with its Airbus fleet.

Alaska is focused on reducing its overhead, improving its

productivity and managing its vendor costs. The company is also taking steps to

manage its fuel costs by flying bigger, more fuel-efficient aircraft thereby

improving its fuel efficiency.

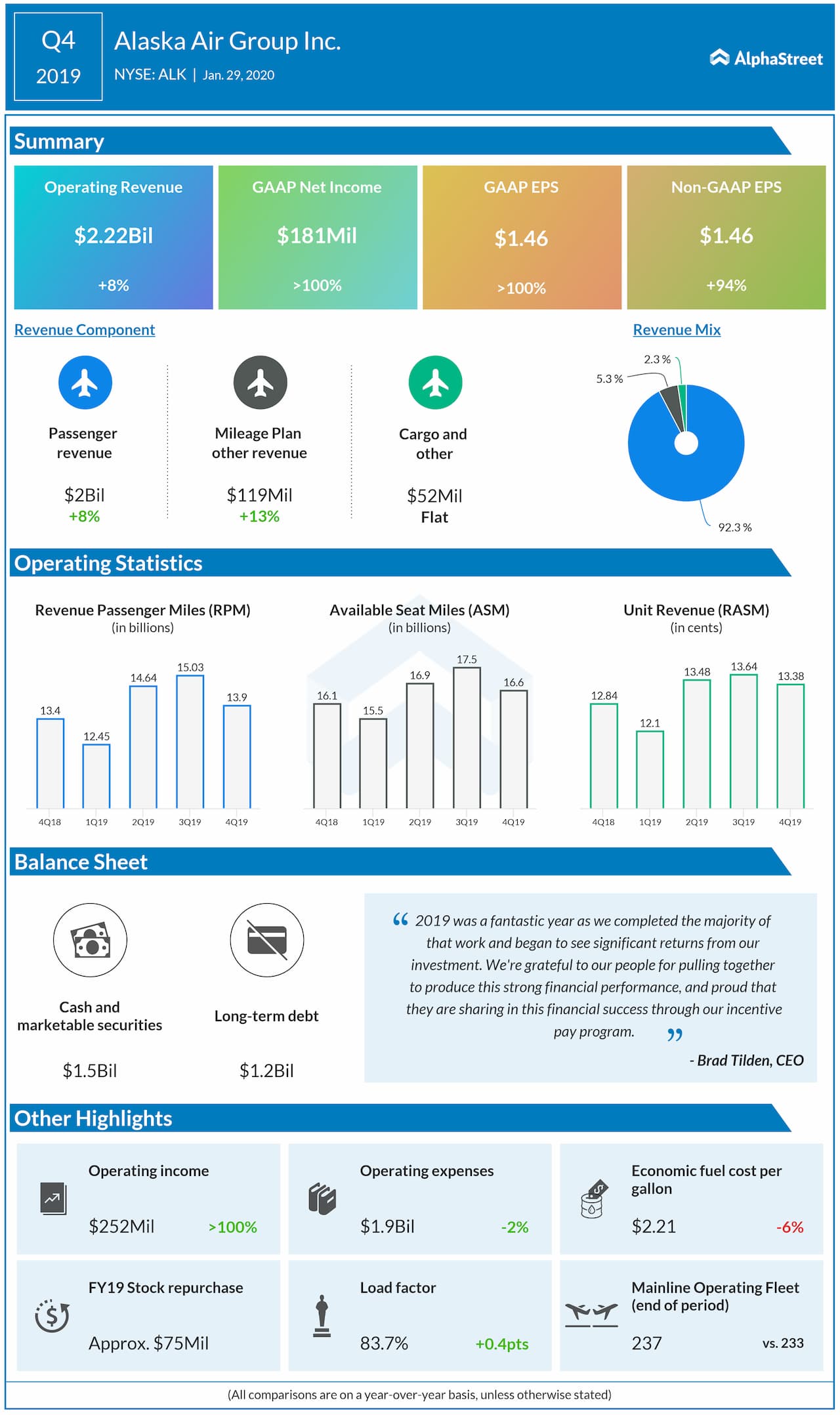

In 2019, Alaska saw a 6% growth in total revenues with a 4.2% increase in unit revenues. Capacity increased 2%, fueled by network expansion and fleet growth. The aforementioned revenue initiatives are expected to drive incremental revenue in 2020 as well.

Alaska expects to increase its network capacity by approx. 3-4%

in 2020, but this guidance is heavily dependent on the return to service of the

Boeing 737 Max aircraft. The company currently expects 10 737 Max aircraft to

be delivered in 2020 but if the grounding delays these deliveries, the capacity

growth might be negatively impacted.

Analysts are forecasting earnings of $7.04 per share on revenue of $9.18 billion for 2020. The majority of analysts have rated the stock as Buy and it has an average price target of $76.60, representing an upside of 15% from the current level.