Abbvie (NYSE: ABBV) is one of the worse performing pharma stocks in the trailing 12-month period. The stock has declined almost 19% during this period, underperforming the S&P 500 index, which is up about 4%. The decline was primarily driven by the stagnation and subsequent decline in sales in its immunology segment.

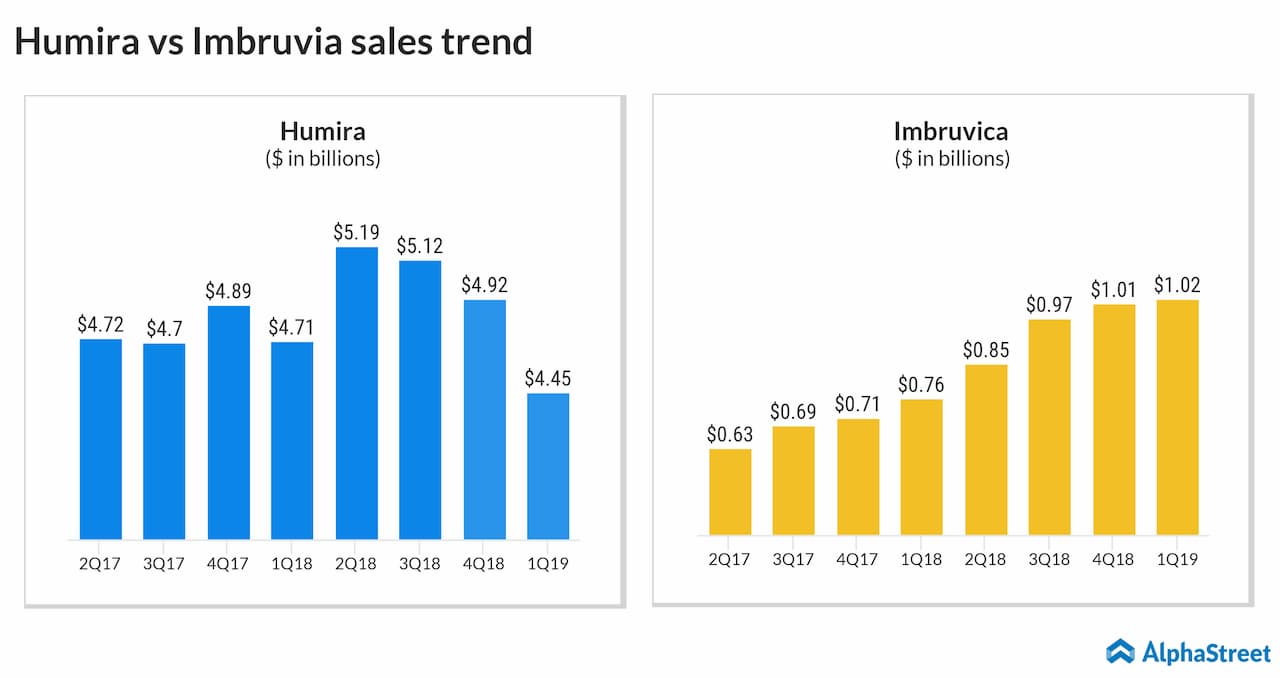

The segment, which accounts for more than half of Abbvie’s total revenue, is driven by the sales of its flagship product Humira. However, this drug lost its exclusivity in Europe last year with the launch of numerous biosimilars, which in turn, started denting its sales. Sales have been relatively unaffected back in the US, but it could be only a matter of time.

Shift of focus to oncology

However, the company is currently going through a transition, though not a self-proclaimed one. The oncology segment, despite being smaller in size, has been doing significantly well over the last few quarters. As of the last-reported quarter, the oncology segment accounted for only 15% of the total revenue, but it recorded a 43% year-over-year growth.

The oncology segment is driven by two drugs – Imbruvica and a newer addition Venclexta, both used in the treatment of lymphocytic leukemia, a kind cancer that affects the bone marrow and blood. Imbruvica sales jumped almost 40% in 2018 to 3.6 billion and the company estimates the drug has the potential to reach peak annual sales of $7 billion.

Meanwhile, Venclexta

has also been showing steady quarter-over-quarter progress and has the

potential to become a blockbuster drug.

Despite the steady growth, these two drugs might take some time to offset the weakness showed by Humira. But when taking into account a strong pipeline with as many as 16 late-stage candidates, it makes Abbvie quite an attractive prospect.

Most promising in its pipeline is upadacitinib, a rheumatoid arthritis drug that could drive the immunology segment even if Humira fails in the future. This drug has the potential to bring in annual revenues of $6.5 billion.

The oncology market

Recent studies indicate that cancer drug sales could reach $200 billion in the next 10 years. Worldwide oncology drug sales are expected to increase at a compound annual growth rate of 12%, which presents great growth opportunities to biotech firms.

READ: What is NASH and which biotech companies are vying for its first-mover status

Abbvie has a forward PE ratio of 8.33, which is much better than most of its rivals. Hence, it may be said the dip has presented a buying opportunity for a stock that is looking bright in the oncology side. Add to that the fact that the North Chicago, Illinois-based biopharmaceutical company offers one of the best dividend stocks with a yield of 5.46%.

Maybe its time to rejig your portfolio.

DISCLAIMER: The article does not necessarily imply the views of AlphaStreet, and contains opinions of the author alone.

Get access to timely and accurate verbatim transcripts that are published within hours of the event.