Autodesk, Inc. (NASDAQ: ADSK) has faced several ups and downs in recent years but stayed on the growth path. Earlier, the COVID-driven digital shift boosted the tech firm’s revenues but the business is currently facing a slowdown due to weak economic activity amid high inflation and rate-hike fears.

The Mill Valley-based design software company’s stock rallied this week after it reported impressive first-quarter results and issued bullish guidance for the current quarter. The rise marked recovery from a two-year low and the trend points to sustained gains in the coming months, as estimated by the majority of analysts.

ADBE Earnings: Adobe Q1 revenue up 9%; profit beats estimates

The low valuation and encouraging long-term growth prospects make Autodesk a compelling buy. Moreover, the company is quite popular among income investors due to its regular dividend hikes and impressive yield.

Growth Drivers

Continued innovation and industry-leading products enabled the company to tap into the new opportunities created by the widespread adoption of digital technology during the pandemic. Autodesk’s flagship product AutoCAD, the design and drafting software widely used in engineering and construction, continues to be the main growth driver even four decades after its release. Building information modeling software Revit is also contributing strongly to revenues.

While AutoCAD has maintained its dominance over the years, there are several new players who are constantly trying to grab market share, which would be a key challenge for the company in the long term. Another concern is the current macroeconomic uncertainty and the related slowdown in construction and other engineering projects. On the positive side, the company has added several new products to the portfolio, including in areas like product lifecycle management, and media & entertainment.

Strong Earnings

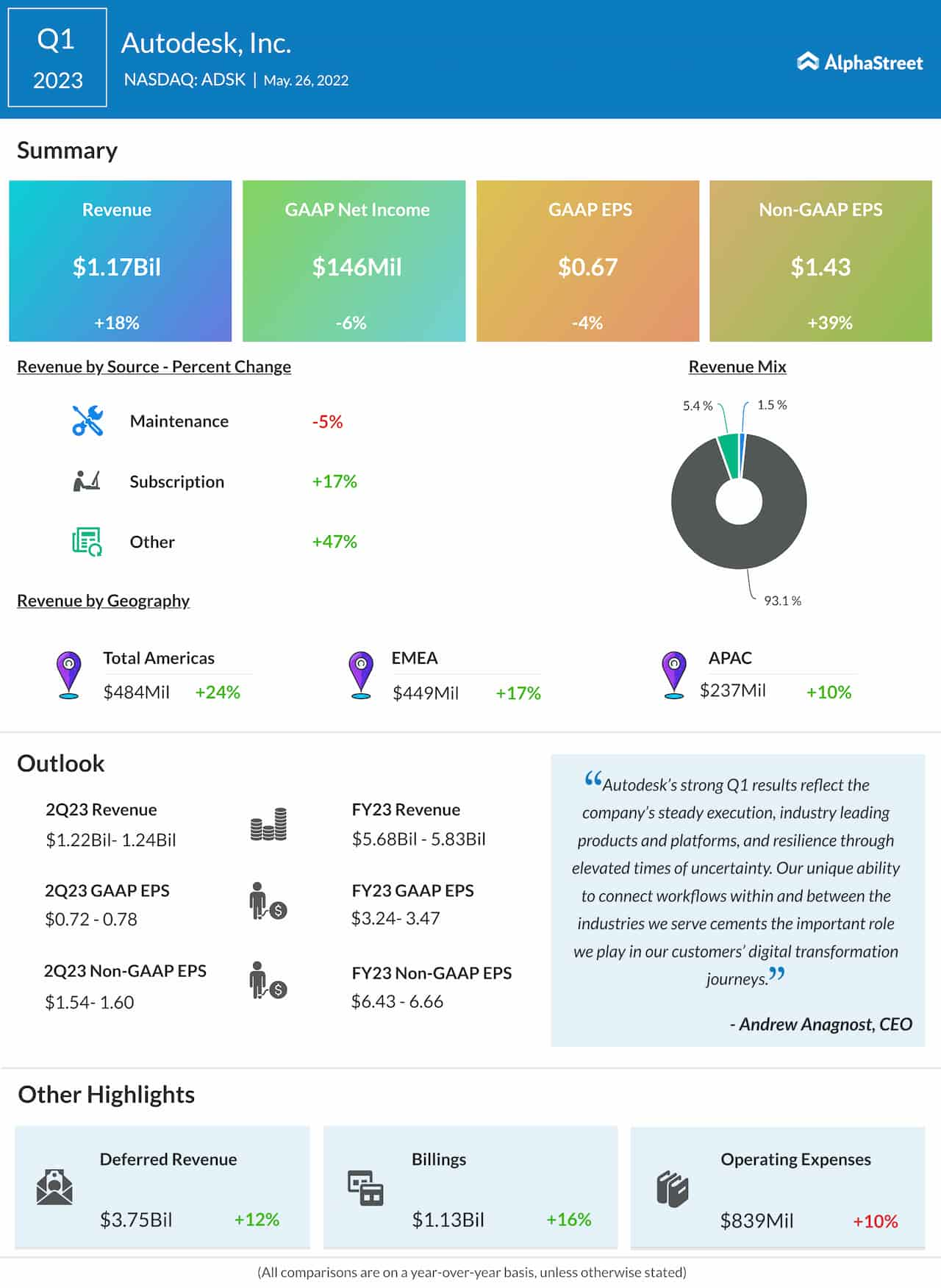

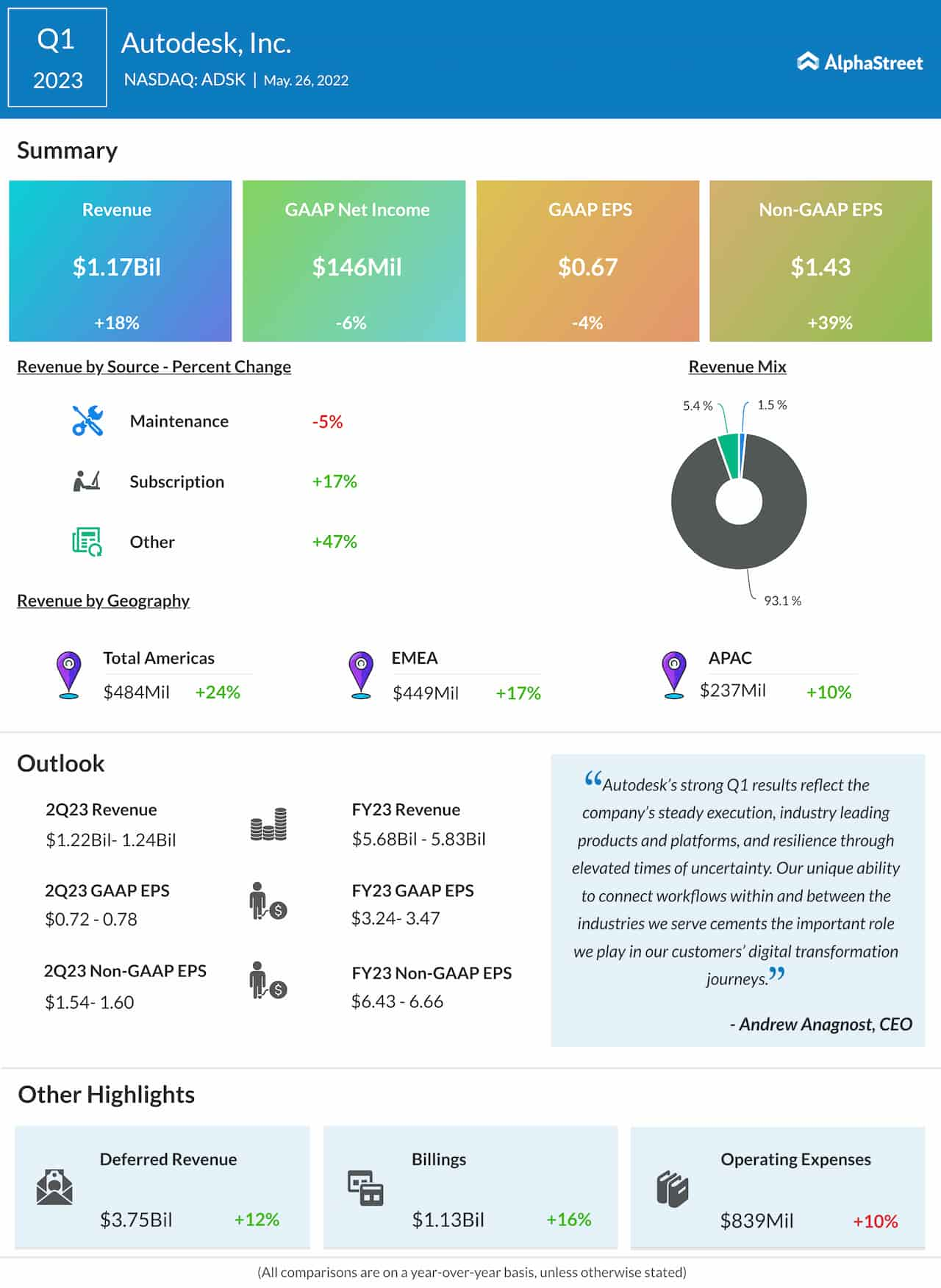

The company stands out among peers by delivering stronger-than-expected quarterly profits and revenues regularly for the past many years. Maintaining the uptrend seen so far this year, it reported a 39% growth in first-quarter profit to $1.43 per share. At $1.17 billion, revenues were up 18% year-over-year as the core subscription segment — which accounts for more than 90% of total sales — performed exceptionally well.

Autodesk, Q1 2023 Earnings Call Transcript

“Our steady strategy, industry-leading products, platform, and business model innovation, sustained and focused investment, and strong execution are creating additional opportunities for Autodesk. By accelerating the convergence of workflows within and between the industries we serve, we create broader and deeper partnerships with existing customers, and bring new customers into our ecosystem,” said Autodesk’s CEO Andrew Anagnost during his post-earnings interaction with analysts.

ADSK has been on a downward spiral since the beginning of the year, extending the weakness experienced in the final weeks of 2021. The stock, which has gained 19% since last week, ended the last session higher.