Affordability

The stock which traded above $3,000 before the split has become accessible to a broader range of investors now. Considering Chipotle’s ability to create shareholder value, the stock split is good news for prospective buyers who were held back due to the high price. The company’s successful business model, marked by its well-thought-out menu and efficient digital platform, should continue to drive investor confidence.

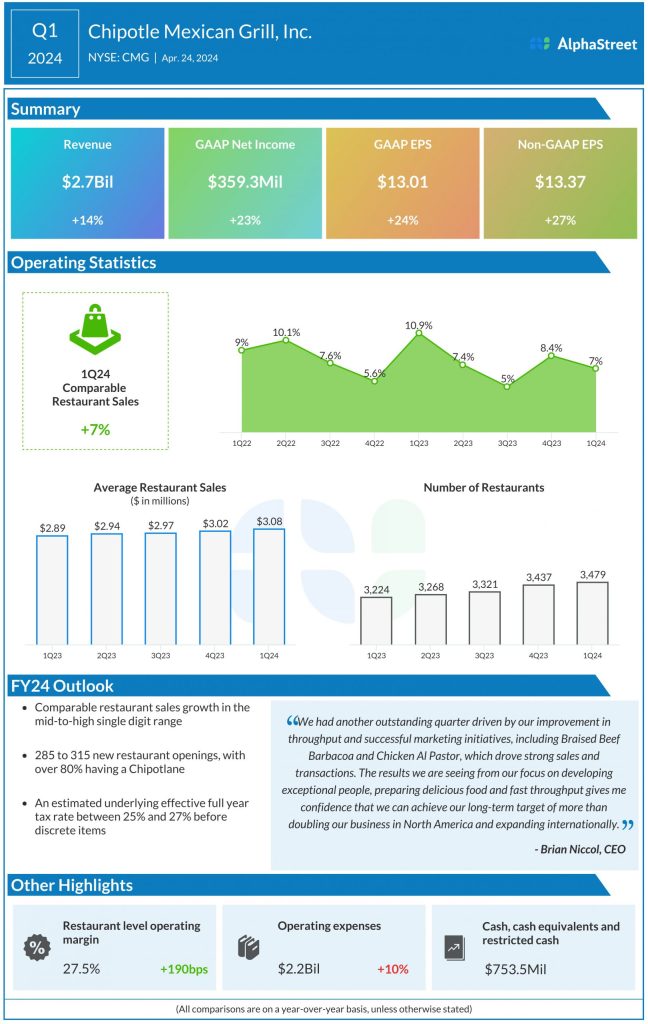

Last year, Chipotle delivered stable comparable restaurant sales growth, despite inflationary pressures and economic uncertainties, while expanding its restaurant network. It sees mid-to-high-single-digit comparable sales growth in fiscal 2024, and targets 285-315 new restaurant openings. The long-term target is to more than double the business in North America. Of late, the company has also been expanding its footprint in overseas markets. The addition of new restaurants will accelerate revenue growth and boost profitability.

Q2 Report

The company is expected to report its second-quarter results on July 24, after the bell, amid expectations for an increase in sales and adjusted profit. Analysts forecast a 25% increase in Q2 earnings to $0.31 per share on revenues of $2.93 billion, representing a 16% year-over-year increase.

From Chipotle’s Q1 2024 earnings call:

“It is exciting that we now have a digital reach of about 40 million rewards members that we can leverage to increase engagement. Through our marketing initiatives, we continue to find successful ways to drive enrollments, and we are leveraging our digital team to create a seamless app experience and deliver more relevant journeys for our rewards members. The goal is to drive higher engagement in the program, which results in higher frequency and spend over time. In our restaurants, we continue to explore technology tools that could drive higher productivity and improve the overall experience for our teams.”

Key Numbers

In the first three months of fiscal 2024, Chipotle’s adjusted profit rose 27% from last year to $13.37 per share. Net income was $359.3 million, or $13.01 per share, compared to $291.6 million, or $10.50 per share a year earlier. The positive bottom-line performance reflected a 14% increase in revenues to $2.7 billion. Earnings beat estimates for the fifth consecutive quarter.

Shares of Chipotle closed the last trading session slightly higher, after experiencing weakness in the preceding sessions. They have gained an impressive 37% so far this year.