Stock Dips

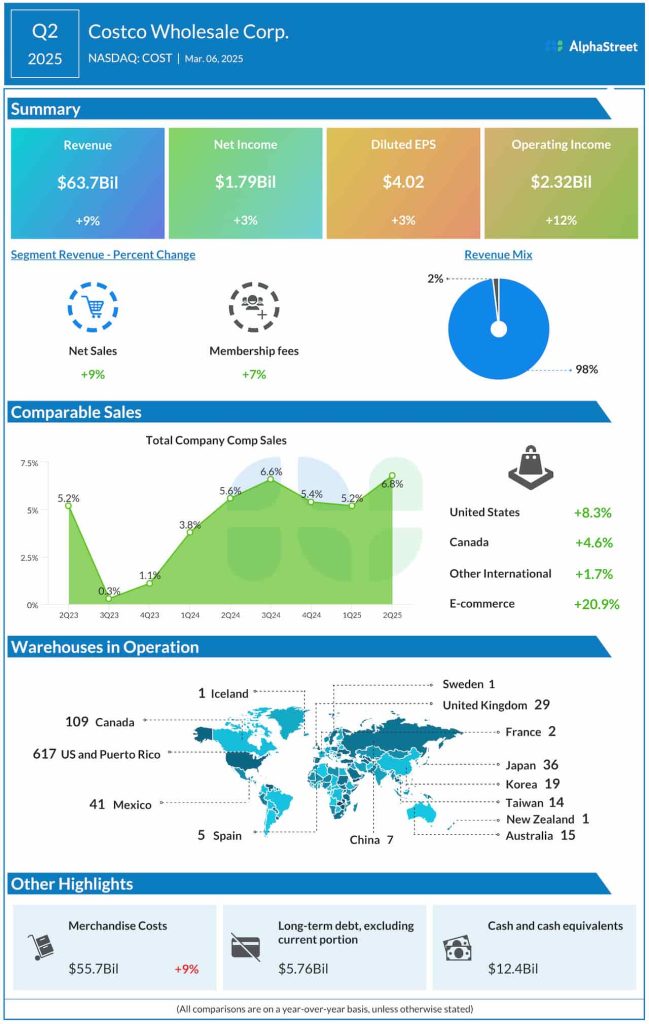

In the second quarter, consolidated comparable store sales increased by 6.8%, and e-commerce sales advanced by 20.9%. Total revenues rose to $63.7 billion from $58.4 billion last year. Sales exceeded estimates, after missing in the past two quarters. There was a 7% increase in membership fee income in Q2, reflecting the recent fee hike. Second-quarter net income was $1.79 billion or $4.02 per share, compared to $1.74 billion or $3.92 per share in the corresponding period of 2024. Merchandise costs increased at a higher rate than in the previous quarters, resulting in a weaker-than-expected bottom-line growth.

Trade War

The management expects customers to remain price-conscious in the coming months, focusing on value and quality, though they are showing a willingness to spend. It also warned of a potential impact from government-imposed import tariffs and return of inflation. It is worth noting that about one-third of Costco’s US sales consist of products brought from other countries, mainly Canada, Mexico, and China. However, the company’s pricing power remains solid, especially in discretionary categories where inflation is easing. Also, its membership renewal rates have remained very high over the years.

“As we look ahead to the remainder of this fiscal year, headwinds from foreign exchange look likely to continue. Given events over the last week, it is difficult to predict the impact of tariffs, but our team remains agile and our goal will be to minimize the impact of related cost increases to our members. About a third of our sales in the US are imported from other countries, and less than half of those are items coming from China, Mexico, and Canada. In uncertain times, our members have historically placed even greater importance on the value of high-quality items at great prices,” said Costco’s CEO Ron Vachris at the Q2 earnings call.

Focus on Value

The cautious outlook comes on the heels of other major store operators, including Walmart and Target, raising concerns about the new tariffs and shift in spending patterns. Meanwhile, the company is working with its suppliers to keep prices low and provide maximum value to customers, at a time when they have become increasingly choosy.

COST has been trading above its 12-month average price for about six months. On Monday, the shares maintained their post-earnings downturn, trading lower throughout the session.