Transformation

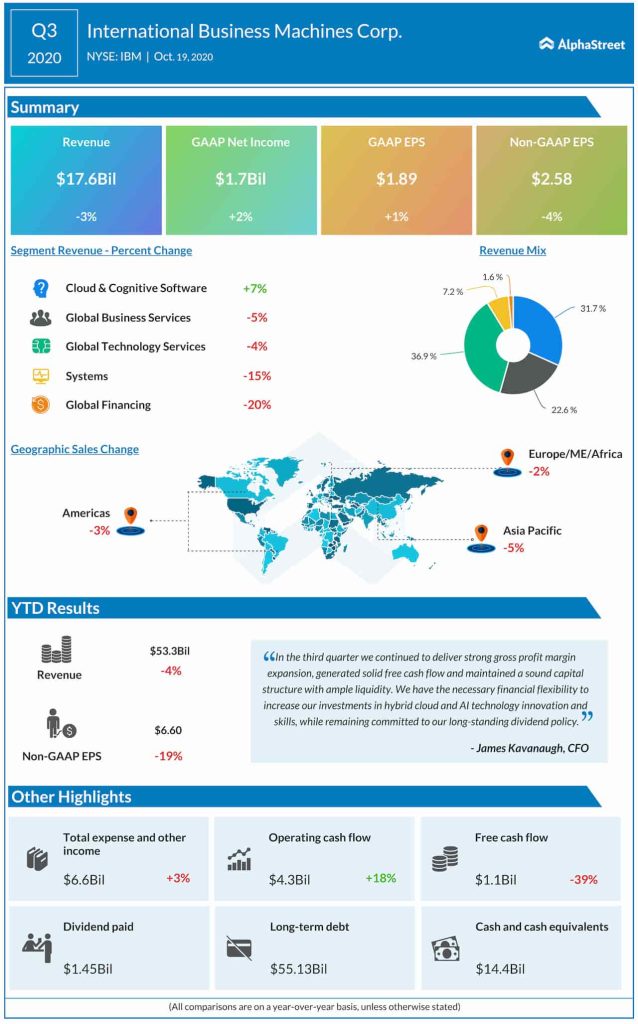

In a sign that the tech giant’s aggressive cloud push is on target, Cloud & Cognitive Services emerged as the only business segment to register revenue growth in the most recent quarter. The momentum justifies the management’s decision to focus more on that area by spinning off the Managed Infrastructure Services unit. The market will be closely following the company’s ongoing transformation into a hybrid cloud platform and AI company, against the backdrop of the pandemic-induced uncertainty.

IBM banks on its stable liquidity position and capital structure to take forward the growth plan, especially innovations in hybrid cloud and artificial intelligence. Currently, the management plans to build 1,000-qubit quantum computers by 2023, an ambitious goal that would complement the ongoing expansion of the Red Hat business, which joined the IBM fold last year.

“We feel very confident in the strength of our balance sheet, our cash, and the liquidity position to make sure that we can continue to invest in our business. We’re starting that immediately here in the fourth quarter around technology, around innovation, around skills, around capabilities and you’ll see that play out in addition to the $2.3 billion structural charges.”

ADVERTISEMENTJames Kavanaugh, chief financial officer of IBM

Long-term Goals

With more and more enterprises shifting their IT assets to the cloud and adopting the remote work model, the demand for new-generation digital solutions would grow further. Seeing significant opportunities in the changing customer needs, the company looks to create value for itself and clients through its platform-centric approach. Going forward, a slew of expansion initiatives are in the offing, mainly in hybrid cloud, for which savings from the cost-reduction efforts would be used.

Caution

At the same time, it goes without saying that enterprise spending might come under pressure due to budgetary constraints if the virus-related uncertainties persist. Such a scenario would not be in IBM’s favor.

“The last several months have made it very clear that companies need to modernize their businesses to succeed in this new normal. This is leading to an acceleration in digital transformations. Cloud and AI are at the center of these transformations and our open platform-centric model delivers greater innovation, higher productivity, and more strategic optionality to our clients,” IBM’s CFO James Kavanaugh said during his interaction with analysts this week.

Weak Q3

In the most recent quarter, revenues declined for the third time in a row, dragging down the bottom-line numbers. All the geographical segments and business units, except Cloud and Cognitive Software, recorded lower revenues. The top-line contracted 3% to about $18 billion but came in slightly above the estimate. Consequently, earnings slipped to $2.58 per share, in line with the forecast.

Read management/analysts’ comments on IBM’s Q3 2020 results

The lackluster performance did not go well with investors and the company’s stock lost about 7% this week, extending the downtrend that started several months ago. It also continued to underperform the market. In the past twelve months, the shares declined by about 13%.