Is KSS a Buy?

Analysts’ cautious outlook indicates that the current trend might continue at least until the next quarterly report, which is expected to be out on March 3 before the opening bell. Initial estimates indicate that earnings and revenues declined year-over-year in the January quarter. So, experts recommend holding the stock for the time being but hints at long-term recovery – the average 12-month price target on the stock represents a 12% upside.

For those looking for an entry point, the backdrop is conducive, given the encouraging outlook on Kohl’s long-term performance. It needs to be noted that the retailer is not planning to close any of its stores this year.

Growth Initiatives

While the general response to the expansion of Kohl’s Amazon (AMZN) returns partnership last year was positive, there is skepticism about the effectiveness of the program in terms of enhancing store traffic, especially in the wake of the weak sales performance.

Stakeholders are pinning hope on the management’s initiatives to ramp up the digital channel as it could boost sales at the footwear and children’s segments, which are performing well. It might also offset the negative impact on margins due to weakness in the women’s apparel business. However, the key to driving traffic would be innovation at the store level, without putting too much pressure on margins through promotions.

Q3 Outcome

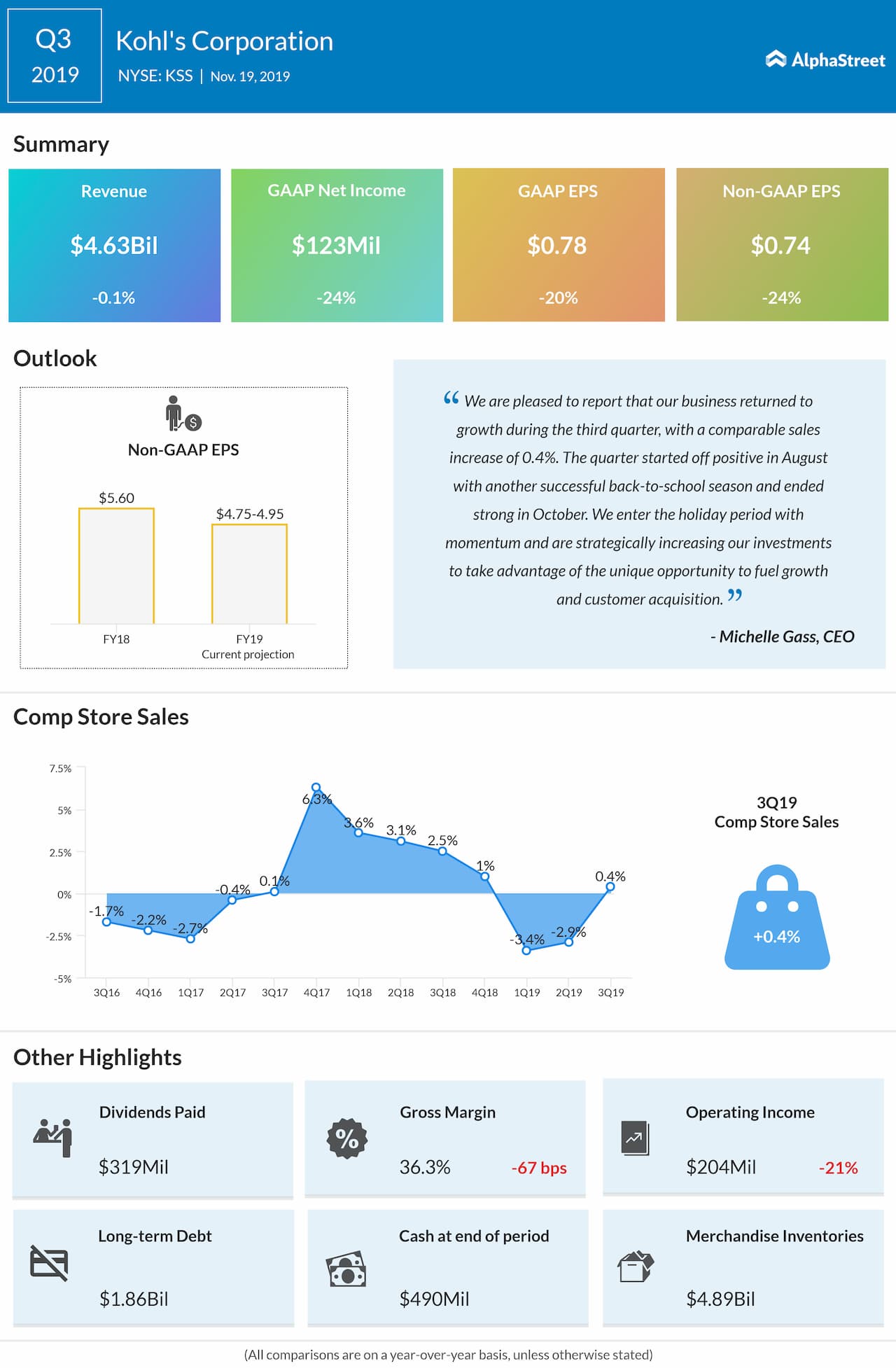

In the most recent quarter, earnings dropped sharply year-over-year to $0.74 per share on revenues of $4.63 billion, which remained unchanged from last year despite a modest increase in comparable sales. The bottom line, which was negatively impacted by an increase in expenses, also missed analysts’ forecast.

Reorganization

Last week, the company said it is planning to lay off around 250 employees as part of a business reorganization, in response to the unimpressive holiday sales. The performance of Kohl’s’ peers like Macy’s (M) and J.C. Penney (JPC) was no different this season, with both the store operators recording muted sales.

Shares of Kohl’s dropped 32% in the past twelve months and 13% since the beginning of the year. They traded below the $45-mark so far this week and closed the last session at $43.83.