Overview

Fundamentals

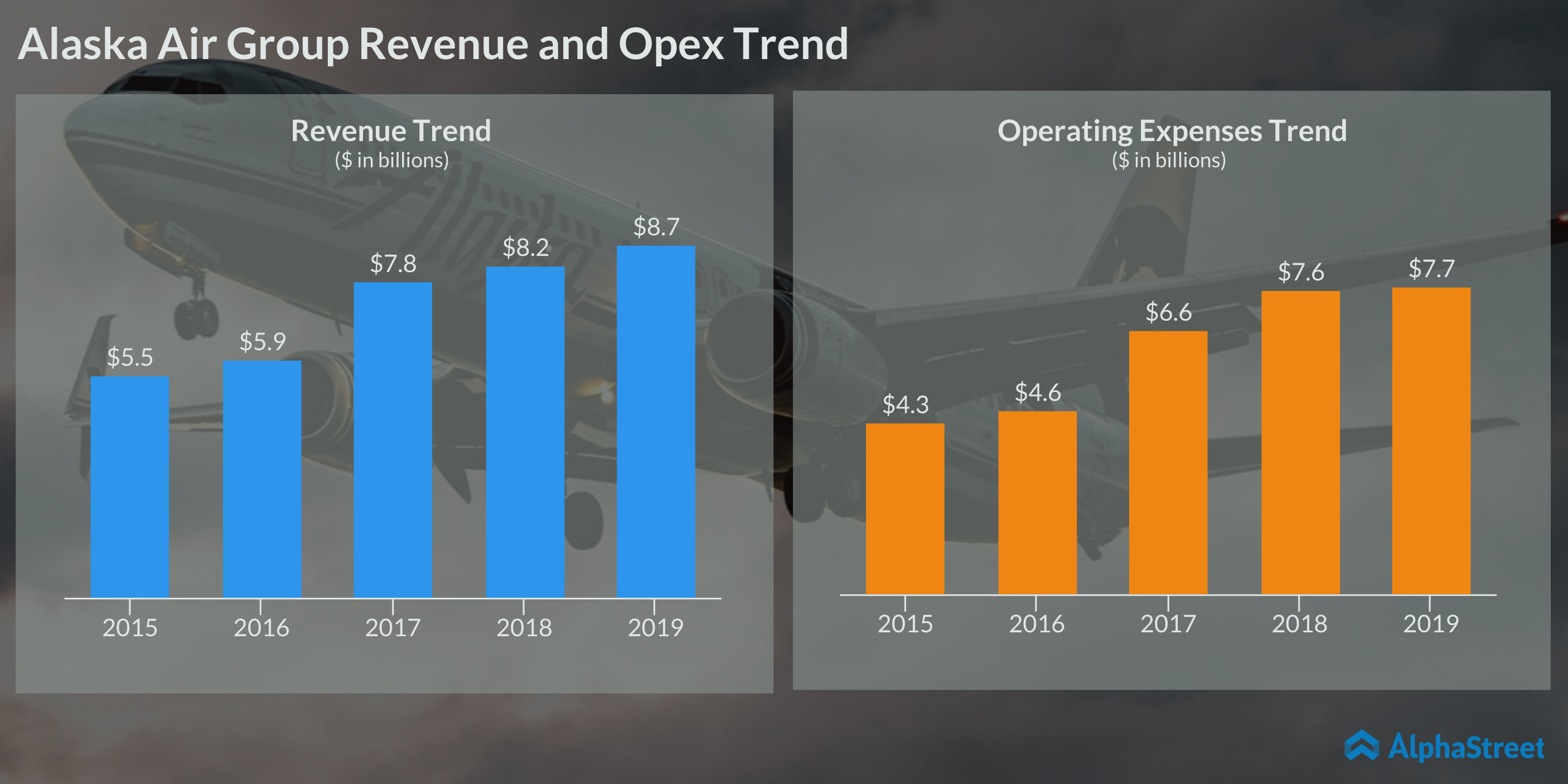

Looking at the five-year trend, Alaska has consistently increased its operating revenues with a 6% year-over-year increase in 2019 to $8.7 billion. This increase in revenue was fueled by continued network expansion and capacity growth. Passenger revenues, which make up the majority of the company’s operating revenues, rose 6% in 2019 versus 2018.

At the same time, Alaska also saw its operating expenses increase with a 1.3% increase in 2019 versus the previous year. This was driven by a 4.4% increase in non-fuel expenses during the year.

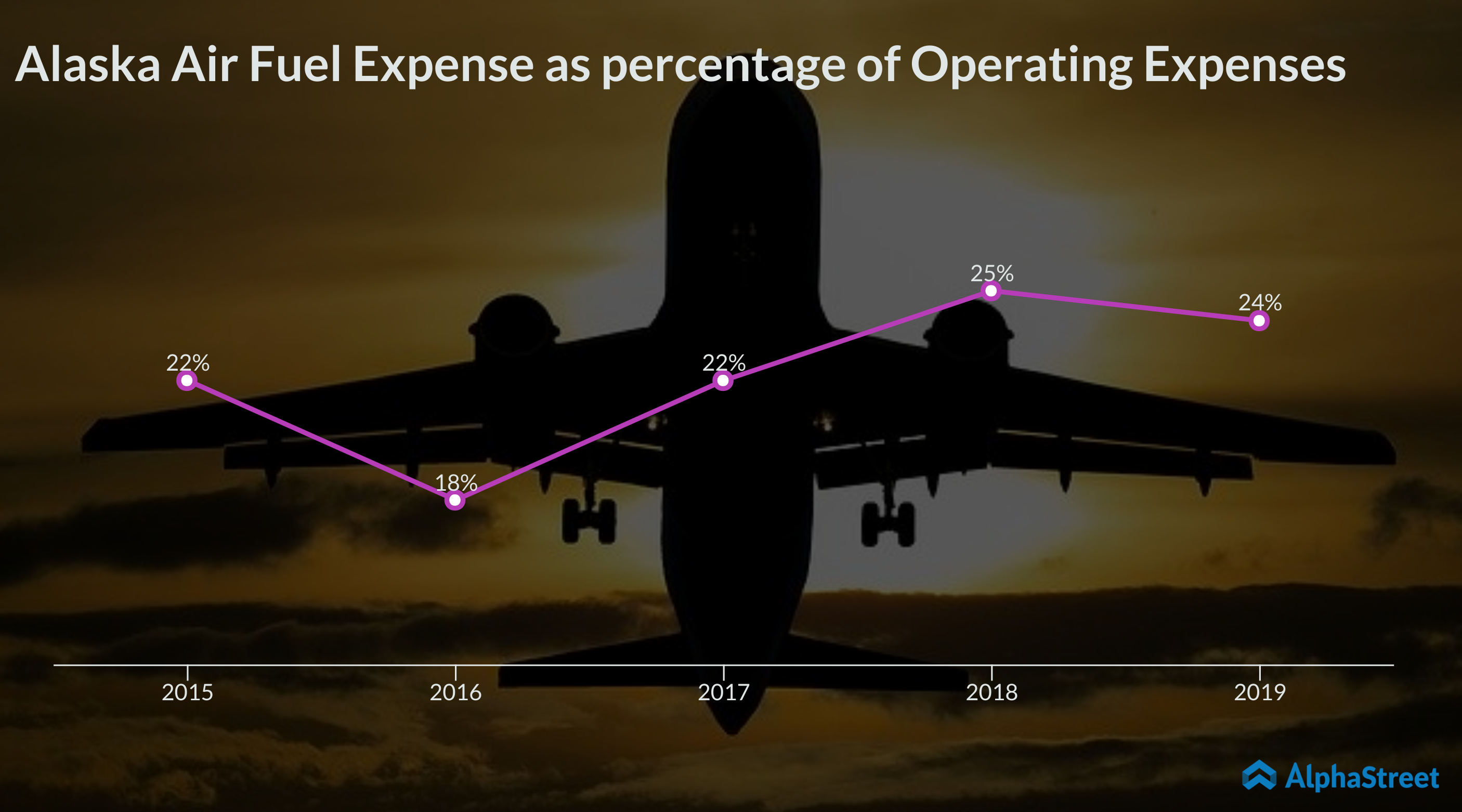

Aircraft fuel expense forms a key part of an airline’s operating costs. Fuel costs are volatile and can have significant impacts on operating results. Fuel prices are impacted by changes in crude oil prices and refining costs. In Alaska’s case, a change of $0.01 in the company’s fuel price per gallon can impact its expected annual fuel cost by approx. $9 million per year. In 2019, aircraft fuel expense comprised 24% of total operating expenses.

Capacity and traffic

During the five-year period, Alaska saw a steady growth in revenue passenger miles (RPMs), or traffic, as well as available seat miles (ASMs), or capacity. In 2019, traffic increased 2.5% year-over-year while capacity rose 2%. The growth in capacity was driven by network expansion and fleet growth.

COVID-19

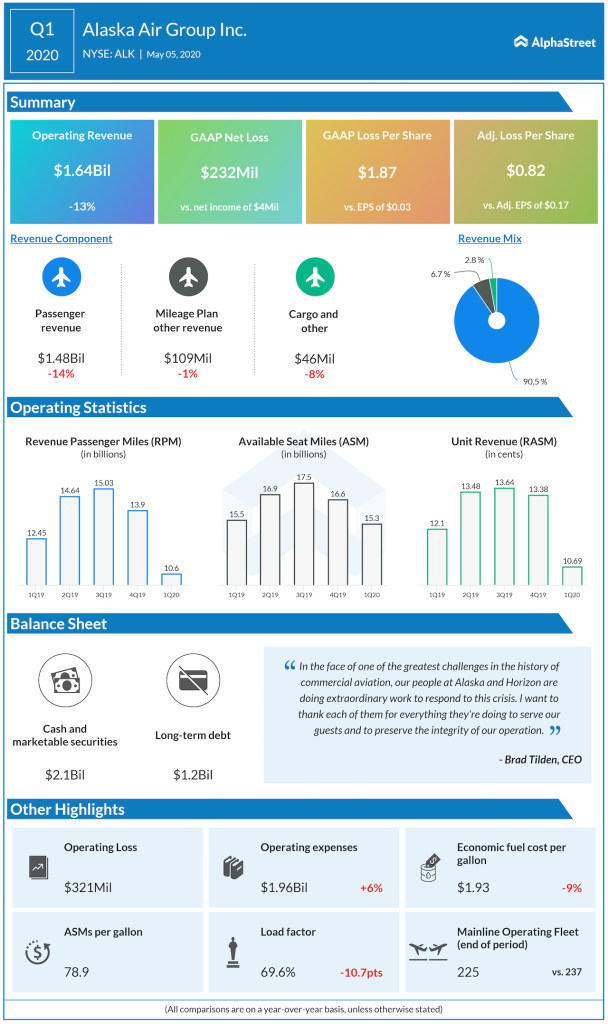

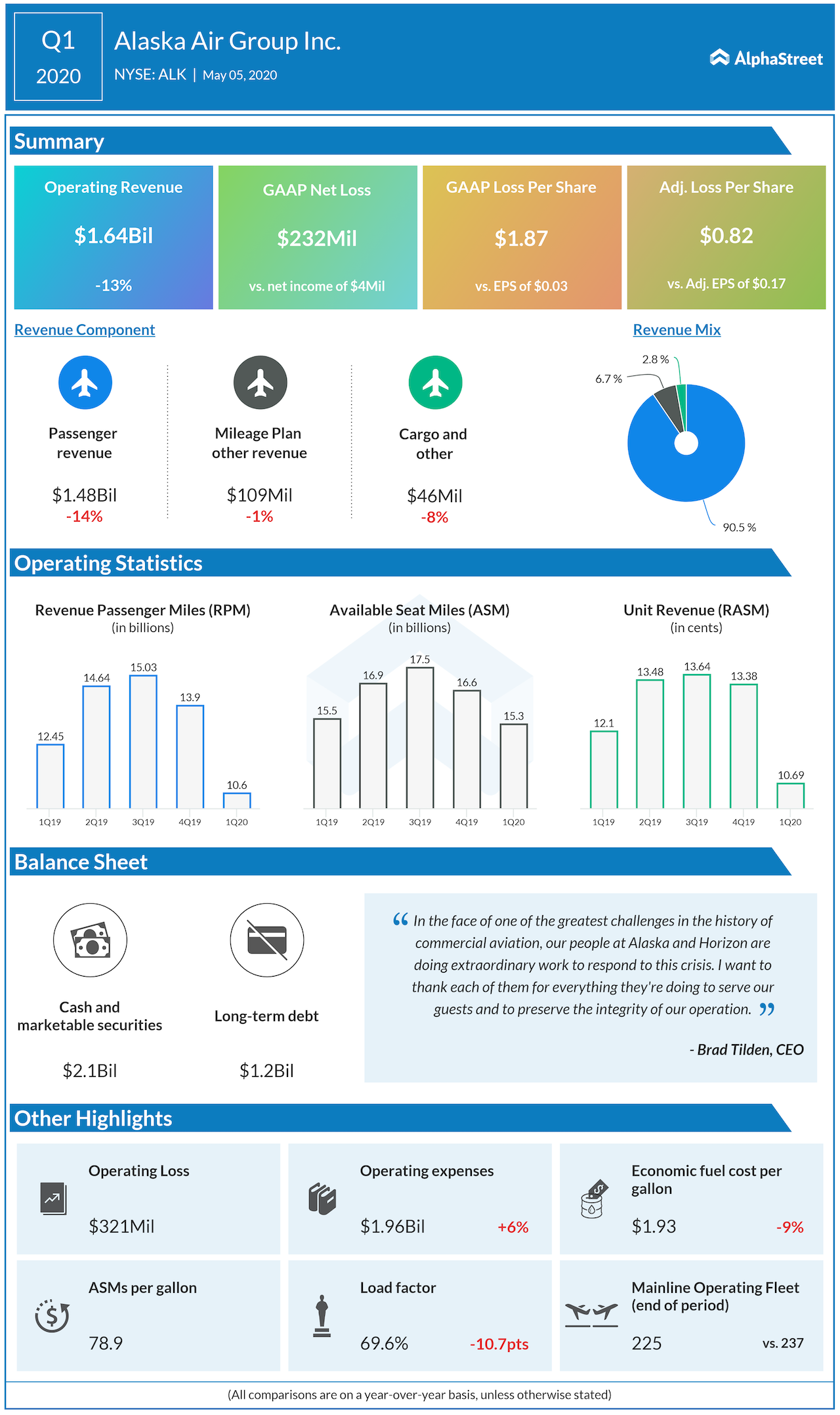

All this momentum went for a toss in 2020 as the coronavirus pandemic spread across the world. The outbreak led to a global lockdown with shelter-in-place orders and travel bans. As air travel came to a halt, Alaska saw its demand drop in February and by March, cancellations had buried new bookings. In May, demand had dropped over 90% below normal levels.

The company saw a 13% decline in operating revenues in the first quarter of 2020. Passenger revenues dropped 14% to $1.4 billion. Traffic fell by 14.4% while capacity decreased by 1.3% during the quarter. Operating expenses increased 6% during the period.

During its first quarter earnings announcement, the company

stated that flown capacity for April was down over 80% versus the previous year

and cuts for May will also exceed 80%. Alaska expects similar reductions for

June. The company believes its financial results will be impacted more

significantly in the second quarter than the first quarter as the uncertainty

around air travel continues.

Risks

Alaska continues to face risks that could affect its revenue

performance, one of them being changes in travel trends. The pandemic and the

resultant economic downturn could lead to postponements of leisure travel which

is a non-essential expense.

People traveling across short distances could replace air

travel with other modes of surface travel. In addition, the health crisis

brought about a massive shift to remote work which led to changes in the

business landscape as companies adopted new technological ways to work and communicate.

This reliance on video conferencing and other similar modes to communicate and hold meetings is likely to reduce the need for business travel as it proves to be more cost-effective. This in turn could affect Alaska and its peers as frequent business flyers contribute meaningfully to passenger revenue.

In summary, Alaska and its peers will continue to face challenges over the coming months and it is safe to say that the airline industry in general is likely to witness some significant changes in travel trends in the future.

Click here to read the full transcript of Alaska Air Group Q1 2020 earnings conference call