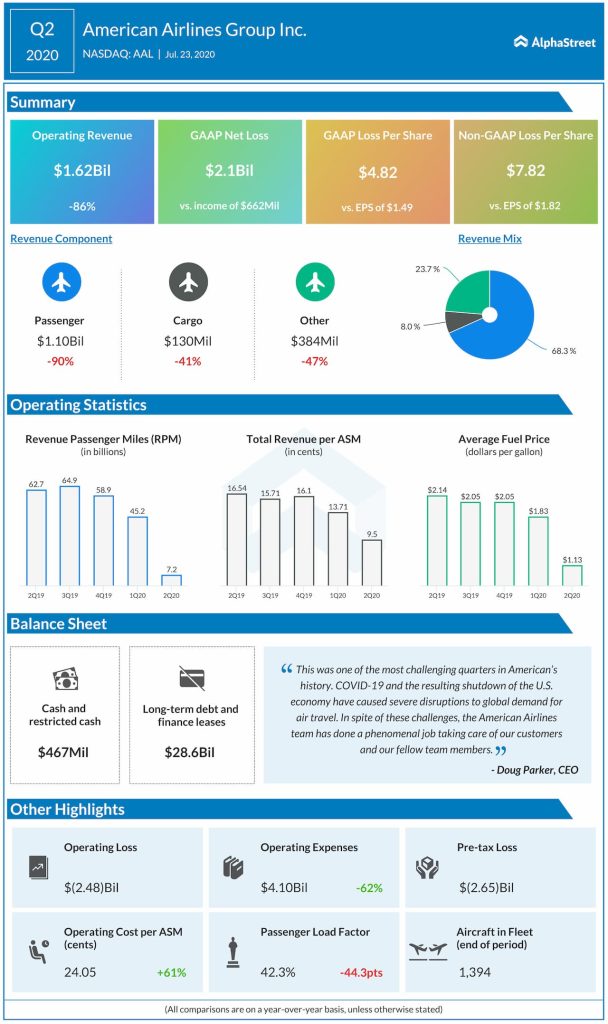

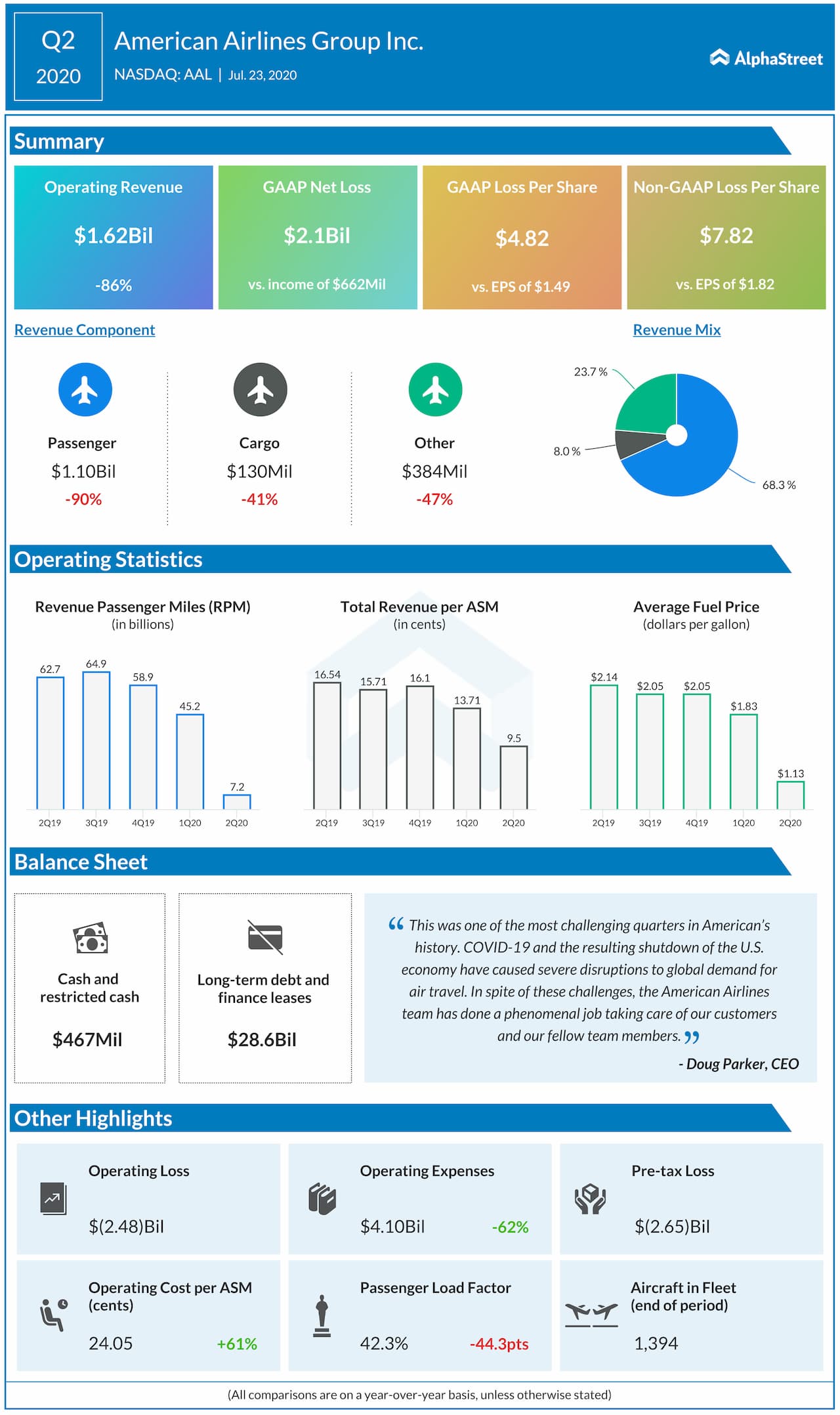

AAG Q2 results

Response to COVID-19

American Airlines took many actions to tone down the effects caused by COVID-19. These include strengthening liquidity, reducing capacity and fleet, cutting down costs and rightsizing the employees, American estimates to reduce 2020 operating and capital expenditures by more than $15 billion.

Capacity reductions

Heading into a seasonally softer travel season and due to the plateaued demand growth, the airline carrier modified its schedules accordingly. The company expects third quarter system capacity to be down 60% annually.

AAG also changed its international schedule for winter 2020 through summer 2021. The company now expects summer 2021 long-haul international capacity to be down 25% compared to 2019, and also plans to exit 19 international routes from six hubs.

[irp posts=”66887″]

Fleet

During Q2, American Airlines officially retired the Embraer 190s, Boeing 757s, Boeing 767s, and Airbus A330-300 aircraft, as well as a number of regional jets. In addition, AAG put the A330-200s and several of its older Boeing 737s into temporary storage programs. These changes reduced the company’s active fleet count by more than 150 aircraft.

Labor costs

In order to reduce the labor costs, American eliminated 5,100 management and support staff positions this summer in a manner consistent with the CARES Act. AAG put forward new voluntary leave and early out programs for its frontline team. More than 41,000 team members opted for early retirement, a reduced work schedule, or partially paid leave.

Liquidity

As of June 30, 2020, AAG had $10.2 billion in total available liquidity, consisting of $9.8 billion in unrestricted cash and short-term investments and $400 million in an undrawn short-term revolving facility.

Second quarter average cash burn rate was approximately $55 million per day, which was down from AAG’s original guidance of $70 million per day. The company ended June with cash burn at $30 million per day and expects to be cash flow positive in 2021, which requires certainly a demand growth.

The cost of the pandemic for #airlines becomes more visible in this chart ?

See here ➡️ https://t.co/7uCyvgRKH6#WeeklyChart #aviation pic.twitter.com/Y428a4kltt

— IATA (@IATA) July 26, 2020

What IATA says

Earlier this month, the International Air Transport Association (IATA) took a survey of recent travelers to find out about the impact of COVID-19 on passenger perceptions of the industry as well as expected traveling behaviors.

Fewer passengers said that they will travel again in the first months after the pandemic subsides. In early April, 61% of passengers said that they would travel again in the first months after the pandemic subsides. But in early June that fell to 45%. Also, about two-thirds of the passengers surveyed said that they will travel less in their future—be it for vacation, visiting friends/relatives, or business.

IATA chief Alexandre de Juniac stated,

“This crisis could have a very long shadow. Passengers are telling us that it will take time before they return to their old travel habits. Many airlines are not planning for demand to return to 2019 levels until 2023 or 2024.”

Prolonged recovery

Moving forward, American Airlines does not expect to get back to the kind of demand seen in 2019 until the people start moving again without concern about flying and not needing to quarantine.

During the Q2 earnings call, CEO Doug Parker said,

“As those things happen, more and more people will travel, but clearly in some cases, all that’s not going to happen until we get to a vaccine.”