Positive View

This week, the stock traded slightly above the levels seen at the beginning of the year. Going by the recent trend, the shares look poised to gain further and go beyond $2,400, which is up 20% from the long-term average. Interestingly, AZO is among the least affected by the recent selloff. For those who can afford the stock, it is time to buy.

Read management/analysts’ comments on quarterly reports

While operating conditions remain challenging – due to factors ranging from the resurgence of the pandemic and continuing supply chain issues to the high inflation and rising interest rates — the Memphis-based company maintained stable financial performance so far this year. Also, earnings and sales exceeded expectations in every quarter in the past three years.

Finances Intact

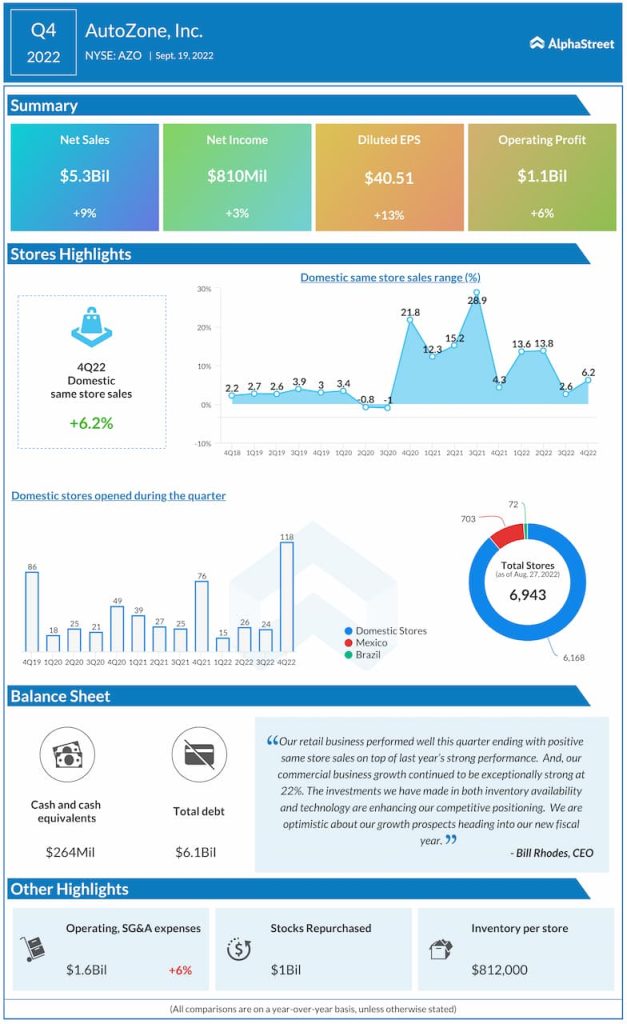

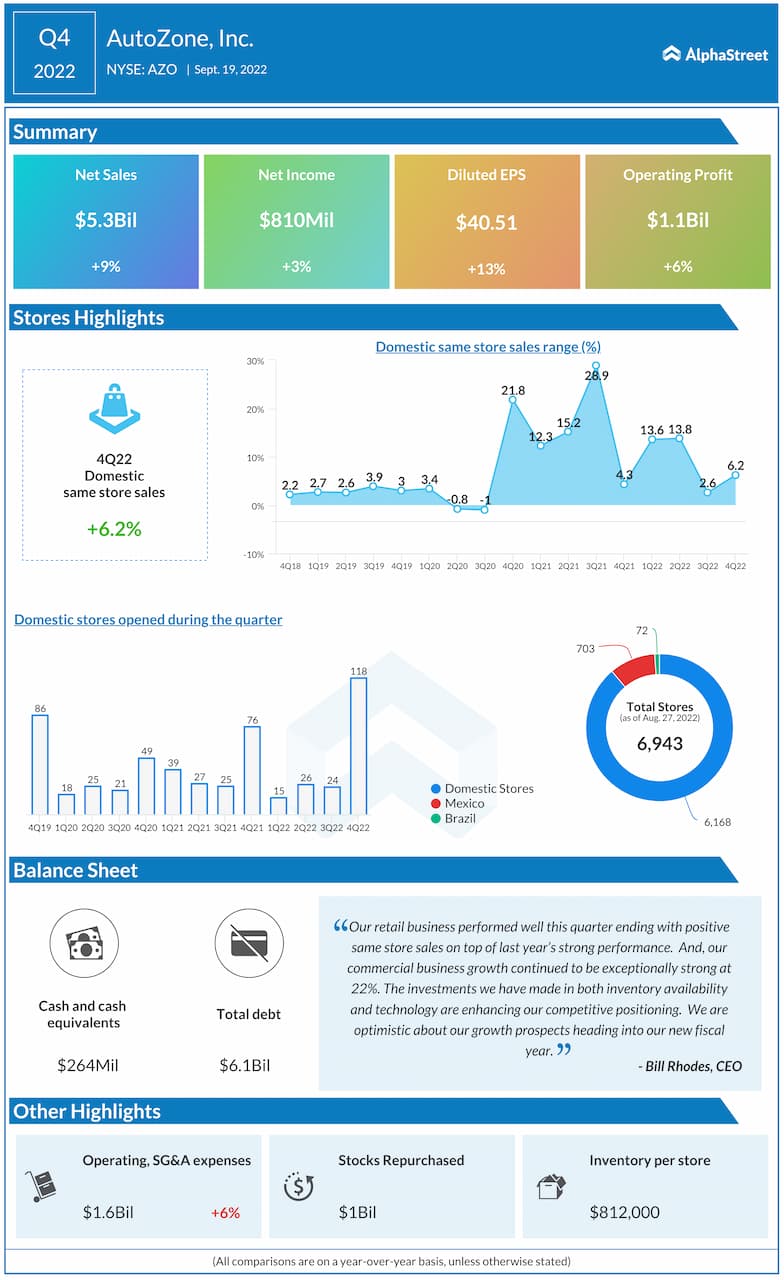

Though there is apprehension that the demand for do-itself-yourself auto parts is waning amid market reopening, AutoZone’s recent financial performance has dismissed those concerns. In the final three months of fiscal 2022, domestic same-store sales improved both year-over-year and sequentially, driving up net sales by 9% to $5.3 billion. That translated into a 13% increase in net earnings to $40.51 per share.

AutoZone’s CEO William Rhodes said in a recent statement, “our supply chain strategy is focused on carrying more product closer and closer to the customer, and we believe it has been a significant contributor to our recent success, especially in commercial. Additionally, we plan on continuing to grow our Mexico and Brazilian businesses. At almost 800 stores open internationally, these businesses had impressive performance this past fiscal year and should continue to grow in 2023 and beyond.”

On Track

The company bets on investments in technology and inventory optimization to boost its competitive position. Reflecting those initiatives and the high inflation, its inventory increased 21.5% from last year. AutoZone’s store network keeps expanding and it operated around 6,000 stores in the U.S at the end of the quarter. Meanwhile, sustaining the momentum would depend on the Federal Reserve’s monetary policy to a large extent, since interest rate hikes typically influence the auto finance market.

Advance Auto Parts gears up to beat inflation woes. Is the stock a buy?

AutoZone’s stock dropped following this week’s earnings release but soon regained strength, extending the volatility experienced in recent months. It traded higher throughout Tuesday’s session.