Shares of Beyond Meat Inc. (NASDAQ: BYND) gained 20% on Friday, recovering from the beating it took following the disappointing first quarter 2022 earnings report it delivered earlier this week. The stock has dropped 53% year-to-date and 71% over the past 12 months. There is a bearish sentiment surrounding the stock and here are a few reasons why:

Revenue

Beyond Meat’s revenue missed expectations and its sales growth rate has been slowing down over the past couple of quarters, raising concerns among investors.

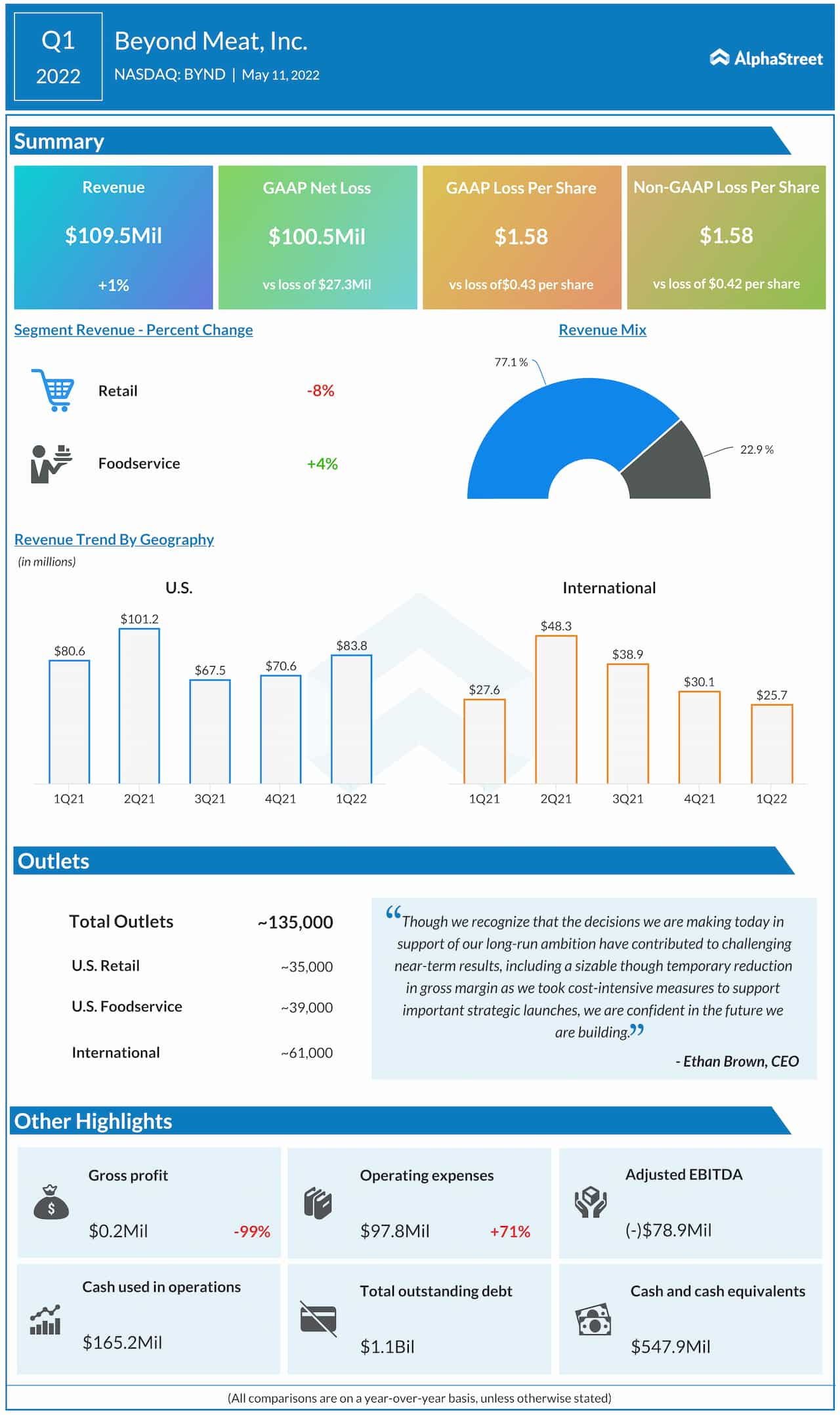

In the first quarter of 2022, Beyond Meat’s revenues inched up 1.2% year-over-year to $109.5 million but fell short of market estimates. Volume growth of 12.4% was largely offset by a 10% decrease in net revenue per pound, mainly attributable to increased trade discounts, list price reductions in the EU, changes in sales mix and negative Forex impacts.

Sales also declined across all segments, barring US Retail which saw a growth of 6.9%, which in turn helped drive a 4% increase in total US net revenues. The US retail channel revenue growth was driven mainly by the launch of a new product, Beyond Meat Jerky, while all the other products in the category witnessed declines. The 7.5% decline in US foodservice was caused by the discontinuation of distribution at a certain customer and higher trade discounts.

Revenues declined across the international segment in both retail and foodservice due to list price reductions in the EU, increased trade discounts, changes in sales mix and negative Forex impacts. Beyond Meat’s sales growth has decelerated over the past few quarters coming down to 1% in Q1 2022 from 11% in the year-ago period. For the full year of 2022, Beyond Meat expects net revenues to increase 21-33% YoY to $560-620 million.

Profitability

The plant-based foods company has been delivering heavy losses and its margins have also taken a hit, raising concerns over its growth trajectory. Adjusted net loss in Q1 widened to $100.5 million, or $1.58 per share, from $26.2 million, or $0.42 per share, in the year-ago period. The bottom line also missed analysts’ projections for the quarter. The higher losses were caused by increased investments in marketing, a rise in non-production headcount levels, and higher SG&A expenses.

Gross margin dropped to 0.2% in Q1 from 30.2% in the prior-year quarter, mainly due to the launch of Beyond Meat Jerky which involves high manufacturing costs. Beyond Meat expects these costs to significantly moderate in the latter half of the year. Margins were also impacted by reduced net revenue per pound due to higher trade discounts, changes in price and sales mix, and higher logistics costs. The company did not provide an earnings guidance and this did not go down well with investors.

Costs

In Q1, Beyond Meat’s operating expenses increased to $97.8 million from $57.4 million in the year-ago period. Cost of goods sold increased $1.15 per pound year-over-year, with Beyond Meat Jerky accounting for approx. $0.68. Manufacturing costs, including depreciation, were up $0.90 per pound with Jerky accounting for approx. $0.36 per pound. Logistics costs increased $0.32 per pound during the quarter versus last year. These cost increases have been taking a toll on margins and profitability.

The lagging sales, widening losses, declining margins and rising costs have all put Beyond Meat in a tough spot. The company faces immense pressure to rectify these issues and come up with a strategy to deliver sustained revenue and earnings growth as soon as possible.

It also faces tough competition in the plant-based foods industry from both its peers as well as several leading processed foods companies that are venturing into this space with product offerings of their own. Despite the current headwinds, the company believes its long-term investments will pave the way for strong growth in the future. The Street, however, prefers to wait and watch.

Click here to read the full transcript of Beyond Meat’s Q1 2022 earnings conference call