Shares of Carnival Corporation & plc (NYSE: CCL) were down on Monday. The stock has gained 69% year-to-date. The company delivered strong results for the third quarter of 2023 and although its full-year earnings guidance was better-than-expected, its fourth quarter outlook failed to impress. Nevertheless, there is a positive sentiment surrounding the stock. Here are four factors that bode well for the company:

Revenue growth

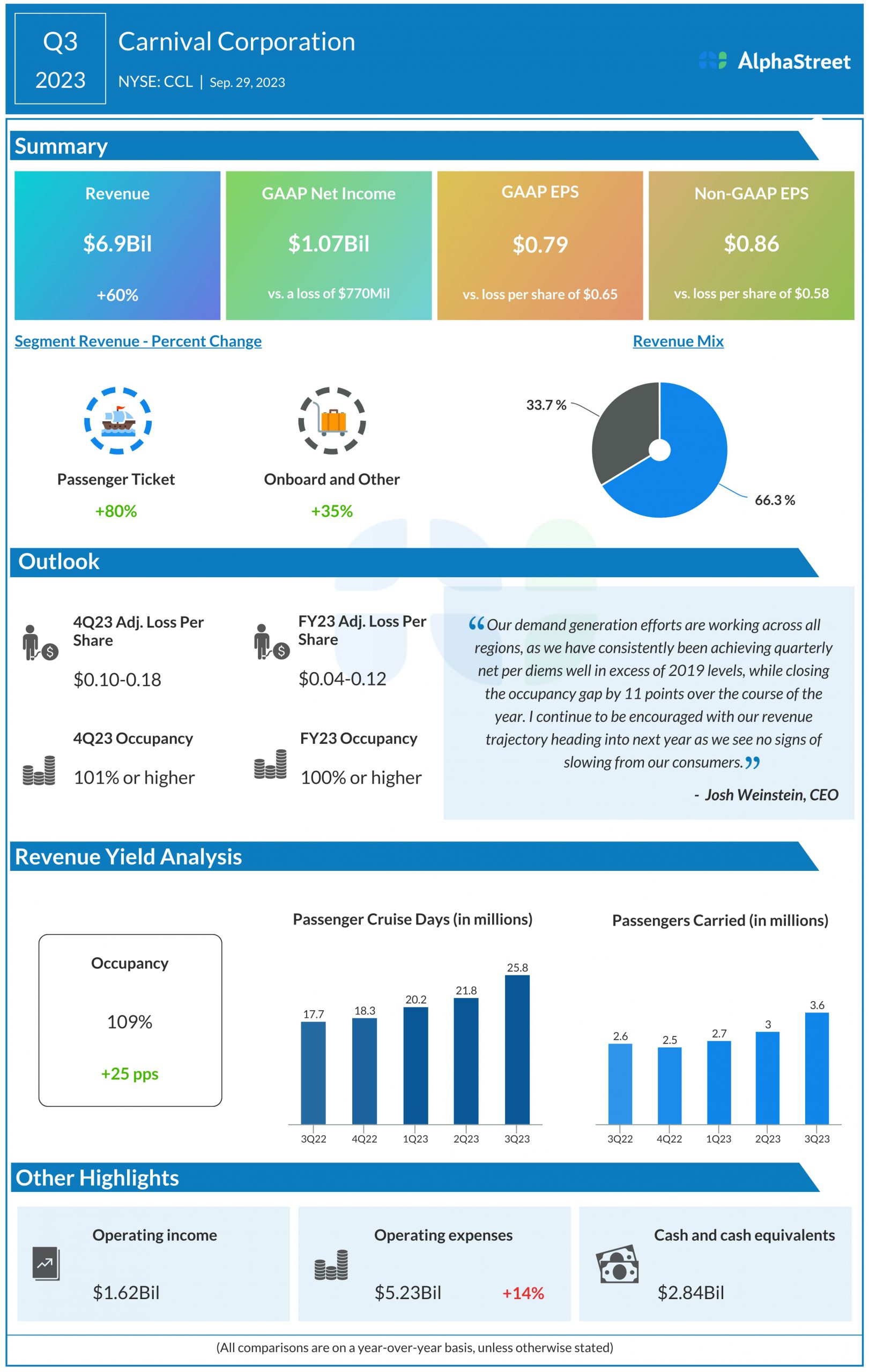

Carnival has seen its revenues continue to grow through this fiscal year. In the third quarter of 2023, revenues increased 60% year-over-year to $6.9 billion and surpassed expectations. The growth was driven by strong demand for travel and the outperformance of the company’s brands and segments.

Profitability

The cruise ship operator achieved profitability for the first time since resuming guest cruise operations. The company delivered GAAP net income of $1.07 billion, or $0.79 per share, for the third quarter of 2023. Adjusted EPS amounted to $0.86, which also exceeded analysts’ projections. This is a significant improvement from the adjusted net losses of $0.31 per share in Q2 and $0.55 per share in Q1.

Favorable trends

Carnival is seeing strong demand for travel as consumers choose to spend on experiences than material goods. Booking volumes in the third quarter remained high, running nearly 20% above 2019 levels. In addition, first-time cruisers reached 170% of prior-year levels in Q3.

Total customer deposits for the third quarter stood at $6.3 billion, surpassing the previous Q3 record of $4.9 billion by 28%. The company also saw strong performance from its segments with North America and Australia, and Europe both outperforming expectations.

Better-than-expected full-year outlook

Carnival has forecasted an adjusted net loss of $0.04-0.12 per share for the full year of 2023, which is better than analysts’ projections of a loss of $0.17 per share. On the other hand, for the fourth quarter of 2023, the company expects an adjusted loss of $0.10-0.18 per share, with analysts predicting a loss of $0.11 per share.