Buy COST?

Read management/analysts’ comments on Costco’s Q4 earnings

Analysts’ consensus target price points to continued growth during the remainder of 2021 and beyond. Costco’s ability to navigate the pandemic effortlessly is a testament to its underlying strength, which makes the stock one of the safest investment options. Also, regular dividend hikes are attracting income investors to the company. The majority of market watchers recommend buying the stock.

Future Perfect

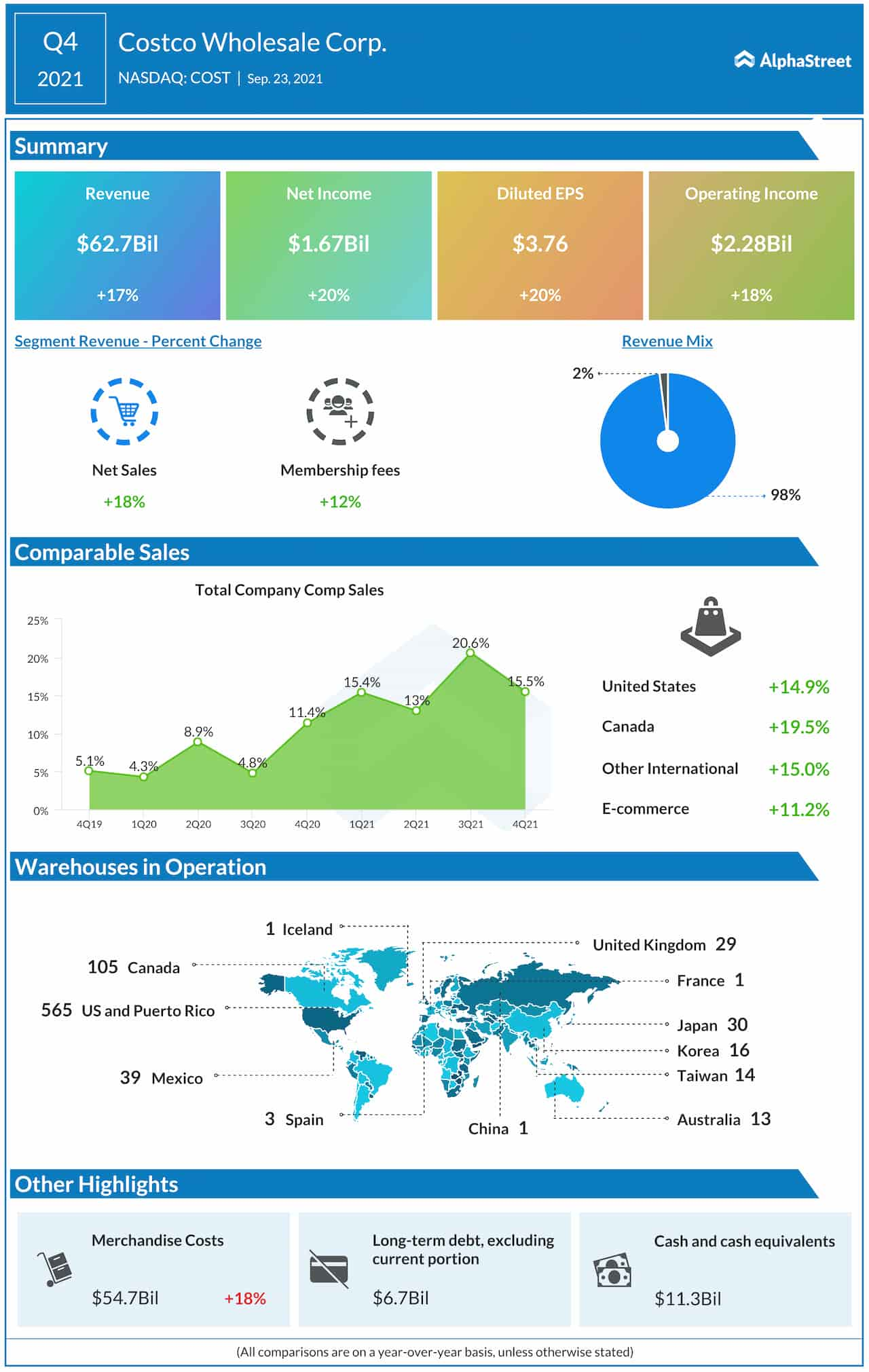

The Washington-based firm is busy expanding its store network, at a time when department stores are grappling with dwindling customer traffic. It is expected that the relaxation of movement restrictions and market reopening would drive sales growth going forward. Moreover, the rebound in economic activity would encourage people to start spending on non-essential items once again. Some of Costco’s virus-affected segments like Optical and Travel are already back on track.

While the company continues to keep its prices low, rising inflation might eat into margins in the coming quarters. New store openings and the expansion of e-commerce capabilities – to expedite the transformation from a brick-and-mortar player into a multichannel retailer — would demand high investment, which can also put pressure on the bottom-line. At the same time, the decline in online sales in recent quarters, even as the COVID concerns eased, suggests that Costco’s customers prefer the traditional mode to digital shopping.

From Costco’s Q4 2021 earnings conference call:

“In terms of transportation costs, they’re increasing — we’re reading about it every day. Containers, trucks, and drivers all are impacting the timing of deliveries and higher freight costs. Despite all these issues, we continue to work to mitigate cost increases in a variety of different ways and hold down and/or mitigate our price increases passed onto the members. We’ve also chartered three ocean vessels for the next year to transport containers between Asia and the US and Canada and we’ve leased several thousand containers for use on these ships.”

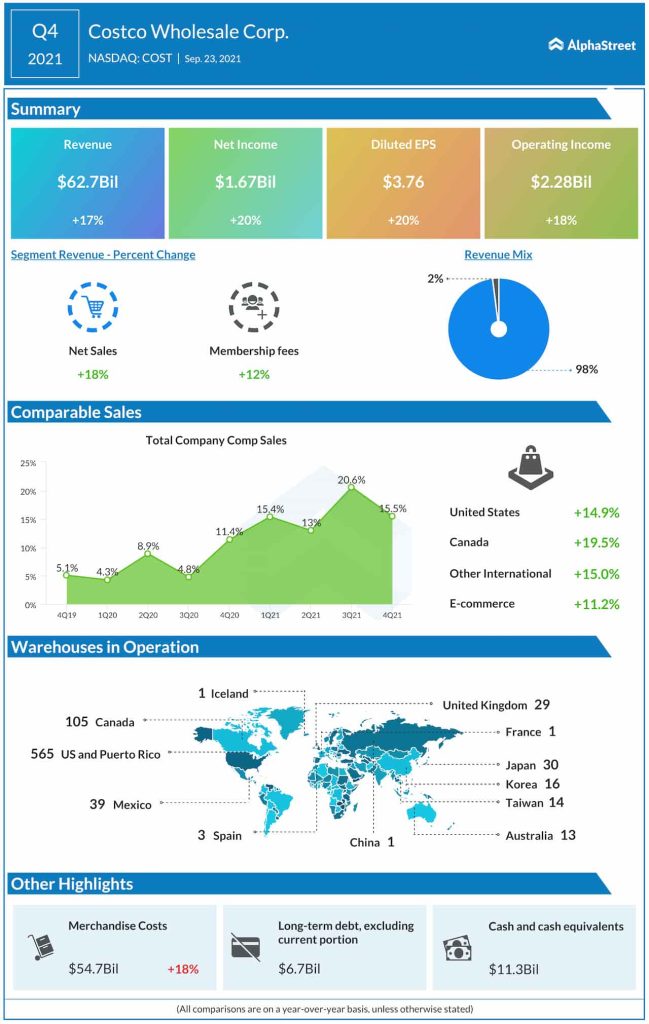

Double-digit Growth

Quarterly sales and net profit increased sharply in the whole of 2021 and earnings topped expectations for two consecutive quarters. In the final three months of the fiscal year, the top line rose in double digits to $63 billion amid strong comparable sales growth, resulting in a 20% increase in earnings to $3.76 per share.

Can grocery push guard Walmart against short-term challenges?

Though the stock experienced weakness ahead of the earnings, after hitting an all-time high early this month, it bounced back soon after the announcement on Thursday and maintained the uptrend since then. The shares have gained about 23% so far in 2021, often outperforming the industry.