Sustained memberships and high renewal rate

Costco’s total revenue is growing at a rate of 8-9% per year from 2015, with recent annual growth of 7.7% in FY 2019. Gross margin has been consistent at around 11% for the last five years, which is quite impressive for a business that is dominated by discounts. The SG&A expenses as a percentage of net sales have been kept consistent near 10% for the last three financial years, which shows disciplined cost control.

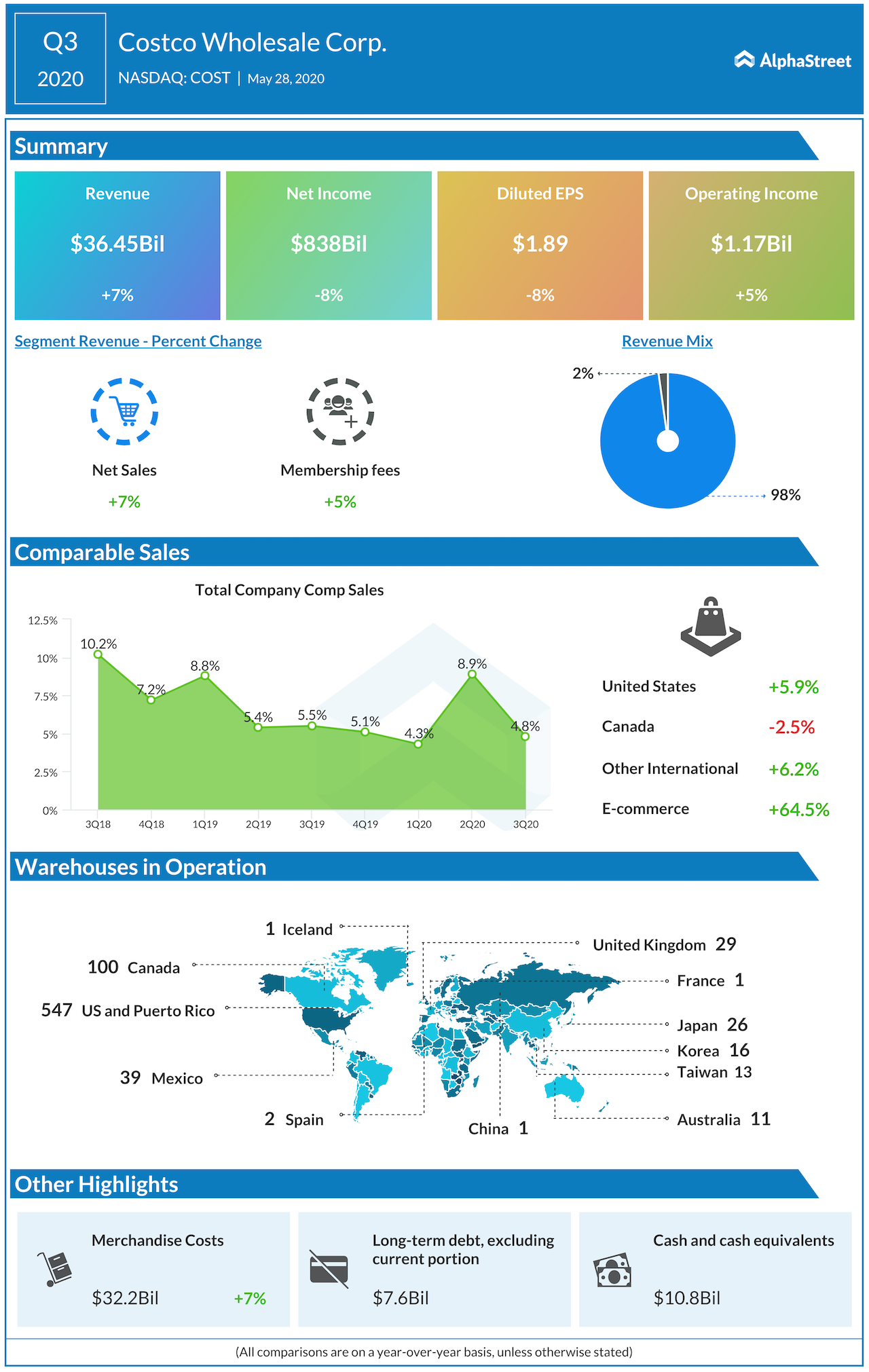

Down the line, net income is increasing at an average rate of 16% per year. However, in the latest reported quarter, net income declined by 7.6% year-over-year, which was largely due to higher provision of income tax and lower profitability in the pandemic phase. Net profit margin has been hovering around 2% consistently for the last three financial years – the low margin keeps hardly any space left for higher promotions, increase in costs, etc. for the company.

Costco management has put a huge emphasis on comparable sales and subsequent growth. This comparable sale is the sum of sales from warehouses opened with over a year of operation, including remodel / relocation / expansion, and sales through e-commerce websites that are operating for over a year. Comparable sales growth for the US, Costco’s major market, has been 8% & 9% respectively in the last two financial years. The company has been opening an average of 20 warehouses per year with slow expansion beyond US-Canada.

Improving leverage ratios

Total assets for the company increased by 11% year-on-year, while the total liabilities increased at a slower pace of 7%, signaling financial strength. Along with that, Costco has reduced the leverage ratio (debt/equity ratio) considerably from 0.51 in FY 2018 to 0.33 in FY2019, in an effort to reduce the debt level. The subsequent interest burden reduced marginally from $159 million to $150 million in 2019, and more benefits are likely to be visible in fiscal 2020.

[irp posts=”63039″]

The cash conversion cycle for Costco has been fluctuating a lot over the quarters, ending with 3.86 at the end of May 2020 quarter, down from 6.47 a quarter ago. These values are fairly low as compared to the industry standards, implying that Costco is in a better position in terms of converting initial investment in inventory into cash.

This, in turn, leaves some headroom in terms of relaxing credit norms, delaying payments, and storing higher inventory, which is of foremost importance during post COVID times.

Poor liquidity ratios

Liquidity ratios are, meanwhile, a concern for Costco Wholesale Corporation. With the current ratio barely touching one and quick ratio at half-mark, Costco might find it difficult to meet the current liabilities. The company has been trying to change this by increasing the cash positions. Cash & cash equivalents along with short-term investments have been valued at $9.44 billion and $7.26 billion at the end of 2019 and 2018 respectively, which also resulted in higher interest income ($178 million & $121 million respectively).

Although keeping excess cash could mean missed investment opportunities, it helps during turbulent times as seen during the Covid-19 pandemic by providing enough cushion to operate under reduced sales.

[irp posts=”64346″]

E-commerce strategy – a potential avenue for sales

In the third quarter of fiscal 2020, the e-commerce section saw a whopping growth of 64.5% due to preventive measures of social distancing, lockdown, etc. There is an enormous growth opportunity in this mode of delivery waiting for Costco. It may be noted that the retailer had recently acquired Innovel, a leading provider of third-party end-to-end logistics solutions operating a fleet of 1000+ trucks,11 distribution centers, and 100+ final-mile cross-dock facilities.

However, Costco sees this acquisition mainly as part of vertical integration that would leverage it to deliver high volume/ weight products. CFO Richard A. Galanti had earlier stated that the primary focus of Costco would be their warehouses as it would enable higher ticket/basket size.

Meanwhile. the company has decided to cut the speed of the establishment of a new warehouse in the remaining part of FY 2020 and the first half of 2021 to cut costs. So, investors will be eager to see how things play out post-pandemic and whether there is any change in lifestyle or purchasing style among the customers.

Takeaway

On an aggregate basis, the stock of Costco Wholesale Corporation has rallied around 20% with respect to a year ago. Amidst the pandemic, the company is better placed because of its wide portfolio of essential products including food items (processed and raw), health items including medicines, etc.

It can be said that Costco is well poised to ride the shock that the US is currently undergoing. This is because of the nature of the industry, along with extensive distribution and sales network, loyal customer base and efforts for vertical integration. At the same time, the company will need to focus on strengthening the liquidity ratios along with efforts to increase margin in the coming quarters.

Costco Wholesale Corporation is the third-largest global retailer with $135 billion in market capitalization. It operates wholesale membership warehouses in multiple countries with prime focus in the USA (around 70% of 786 warehouses) and Canada (around 13%). The Company sells all kinds of food, automotive supplies, apparel, toys, jewelry hardware, sporting goods, electronics, apparel, health, and beauty aids.

_____

[irp posts=”64296″]