Flux Power Holdings, Inc. (NASDAQ: FLUX) is a leading provider of lithium-ion energy storage electrification solutions for industrial and commercial sectors. Its battery packs are less expensive and are a more environmentally-friendly alternative to traditional lead acid and propane-based power solutions.

In an email interview with AlphaStreet, Flux Power’s chief executive officer Ron Dutt spoke about the company’s products and growth strategy.

What differentiates Flux Power’s products and solutions from others in the market?

Differentiation of Flux Power’s products and solutions include (a) UL Certification, for safety and durability; (b) telemetry “SkyBMS” that provides real-time reports via the cloud transmitted from our packs that provide data along with summary reports of pack health, performance, and remaining life; and (c) nation-wide service capability, with over 17,000 lithium battery packs for material handling sold/in the field.

By when do you expect to achieve consistent profitability, and what is your strategy for it?

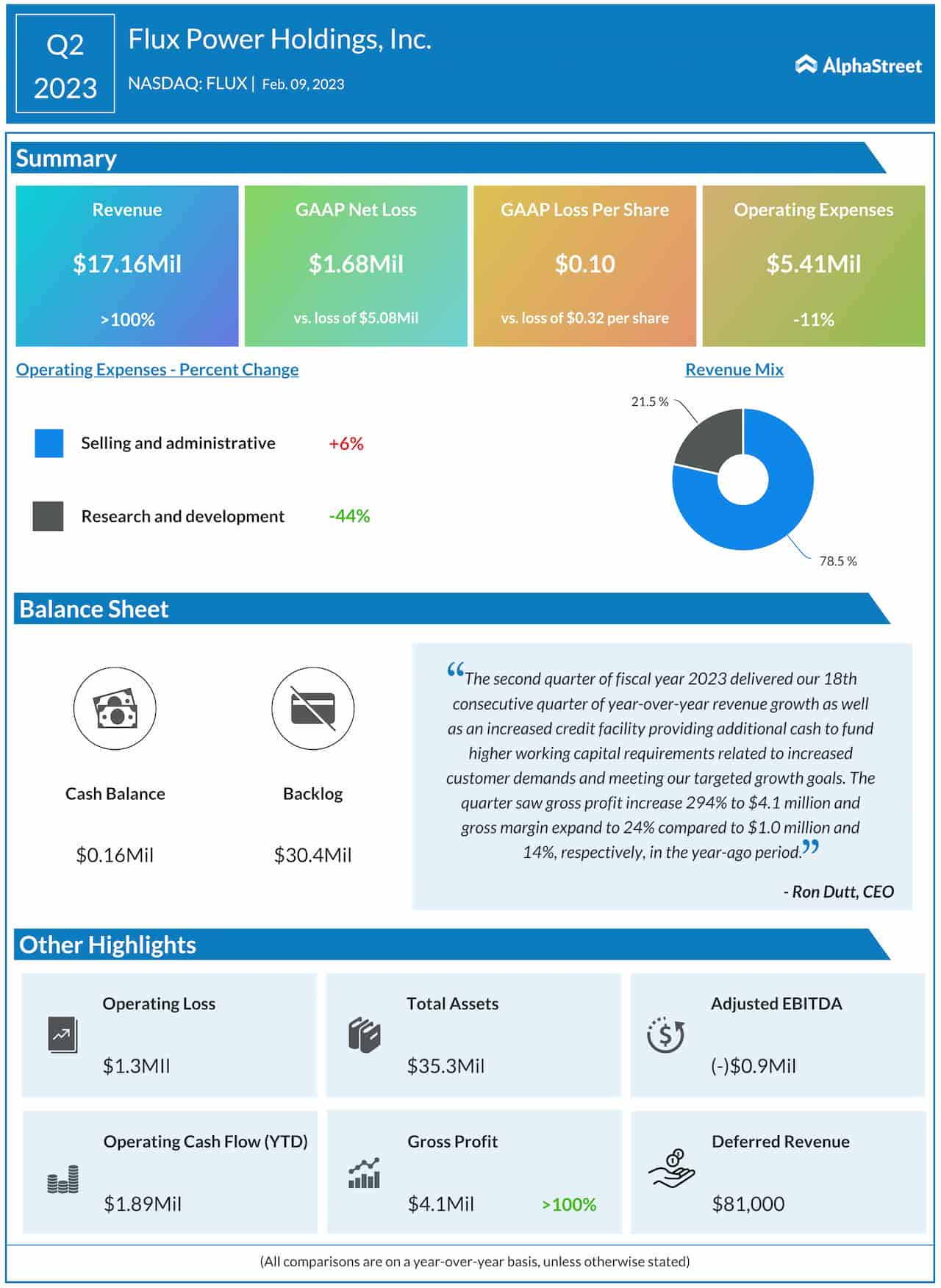

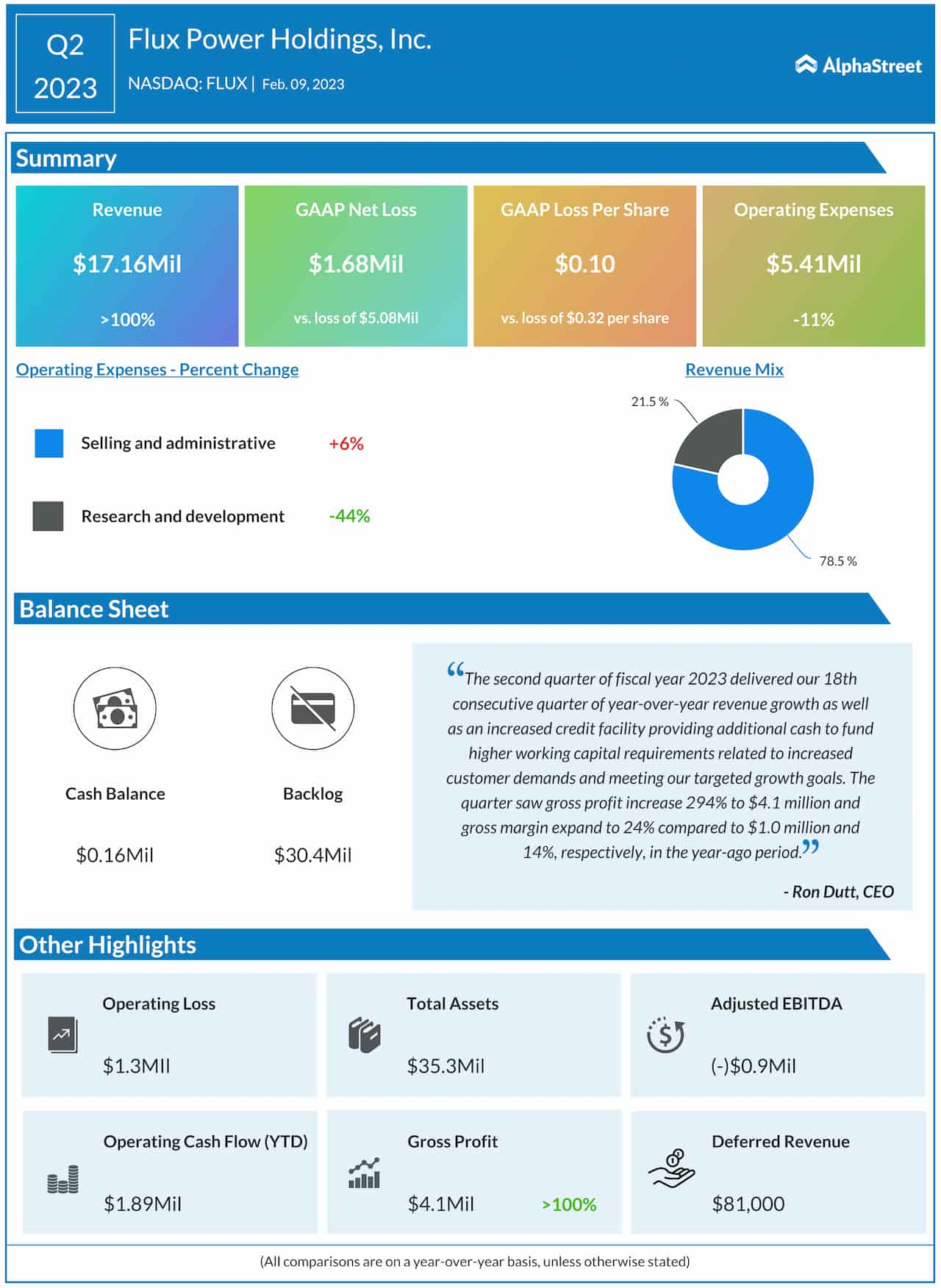

Our current initiatives on gross margin improvement (cost and pricing) and revenue trajectory should enable us to reach profitability this year. Please note that we do not give guidance beyond our directional comments.

Can you shed some light on your plans for 2023, in terms of growing the business?

Our sales strategy is focused on large fleets, typically of Fortune 500 companies who find the value proposition of better performance at a lower lifetime cost to be attractive. We continue to add new customers on a quarterly basis that realize that value. New customers require our building and vetting of a relationship that supports a lower lifetime cost, and then we become their supplier for ongoing business. Our customer support and service maintain that relationship, which leads to additional growth.

What are the emerging trends in energy storage, and what is your take on the future of the industry?

Emerging trends in energy storage generally reflect increasing confidence in the value proposition of lithium-ion solutions for a wide spectrum of automotive and industrial equipment, along with energy storage backup such as solar backup. In addition to forklift and airport ground support equipment, we are watching applications that are growing rapidly, such as warehouse robotics and large forklifts currently using diesel or propane. Advances in lithium-ion chemistries are being made globally with both private and government funding. Fast charging, along with more charging alternatives, is another area with dynamic growth.

Modulex Modular Buildings plans 20 factories in 15 countries: CEO Suchit Punnose

Considering your impressive track record, do you see any significant opportunity for the company in the electric vehicle market?

Yes – but we want to limit that to the core areas that include opportunities in industrial equipment/trucks that fit into our assembly process and our expertise. We know who we are and we will go after the right opportunity that makes sense.