Dividend Hike

Dick’s Sporting Goods Inc. Q4 2022 Earnings Call Transcript

While the company is not immune to the challenges facing the broad retail sector — ranging from the pandemic to economic slowdown and interest rate hikes to high inflation – it has done a good job of navigating through the headwinds. Encouragingly, the resilience will likely continue in the foreseeable future. That said, supply chain issues and inventory challenges would remain a concern in the near term.

Outlook

For fiscal 2023, the management expects earnings per share to be in the range of $12.9 to $13.8, and targets capital spending between $670 million to $720 million, on a gross basis. The CapEx will be focused on enhancing the store experience and extending special in-store elements like batting cages and golf simulators to more locations. The earnings forecast is above the consensus estimates.

From Dick’s Sporting Goods’ Q4 2022 earnings call:

“Along with enhanced service, we’ve leveraged distinct in-store elements powered by technology to provide an unparalleled athlete experience. Experiential in-store elements such as HitTrax batting cages, TrackMan’s golf simulators, and premium full-service footwear decks, inspire confidence in our athletes and reinforce the power of our expertise. These strategies, in combination with our personalized marketing engine and brand-building efforts, are working.”

The shift in customer behavior, marked by a return to discretionary spending after the pandemic-era spending cuts – with sports and fitness products being a priority for many – will continue to drive growth for Dick’s. The stable demand also gives the company the pricing power needed to lift margins.

Strong Q4

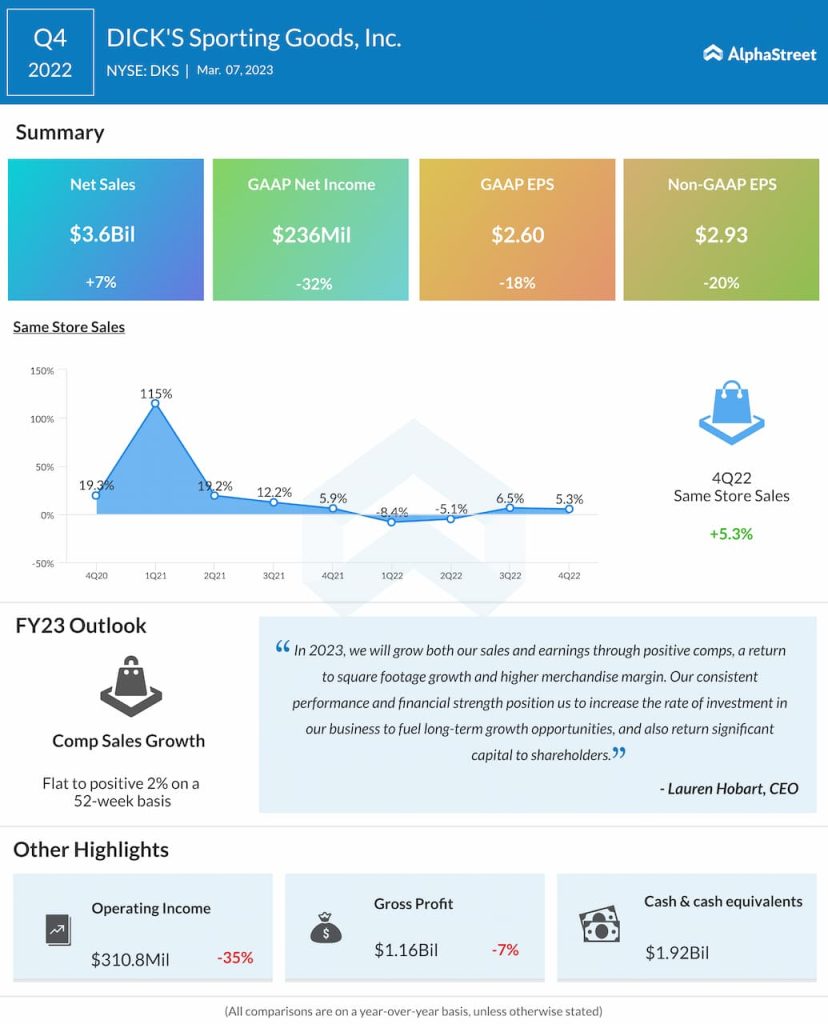

In the final three months of fiscal 2022, Dick’s comparable store sales increased by 5.3%, which translated into a 7% growth in net sales to $3.6 billion. However, adjusted profit decreased by about 20% to $2.93 per share in the holiday quarter. The company has a good track record of beating the market’s quarterly earnings estimates, and the trend continued in the latest quarter. Sales and comps also came in above estimates.

Nike beats inventory and inflation woes with discounts. What future holds?

The management expects its store expansion initiatives and traffic recovery to catalyze sales growth this year, and there would be a corresponding uptick in margins and net profit. It is looking for a continued modest increase in comparable sales during the year.

In a significant move that would accelerate market share growth, Dick’s recently entered into a partnership with the National Collegiate Athletic Association, pursuant to which the company would become the latter’s official sporting goods retail partner.

Shares of Dick’s have been on an upward spiral since mid-2022, and they outperformed the market quite often. The stock traded up 1% in the final hours of Wednesday’s session, hovering slightly below the $ 150 mark.