Shares of Dick’s Sporting Goods Inc. (NYSE: DKS) soared 13% on Wednesday after the company reported solid results for the second quarter of 2021 and raised its outlook for the full year. The stock has jumped 132% since the beginning of this year.

Quarterly numbers

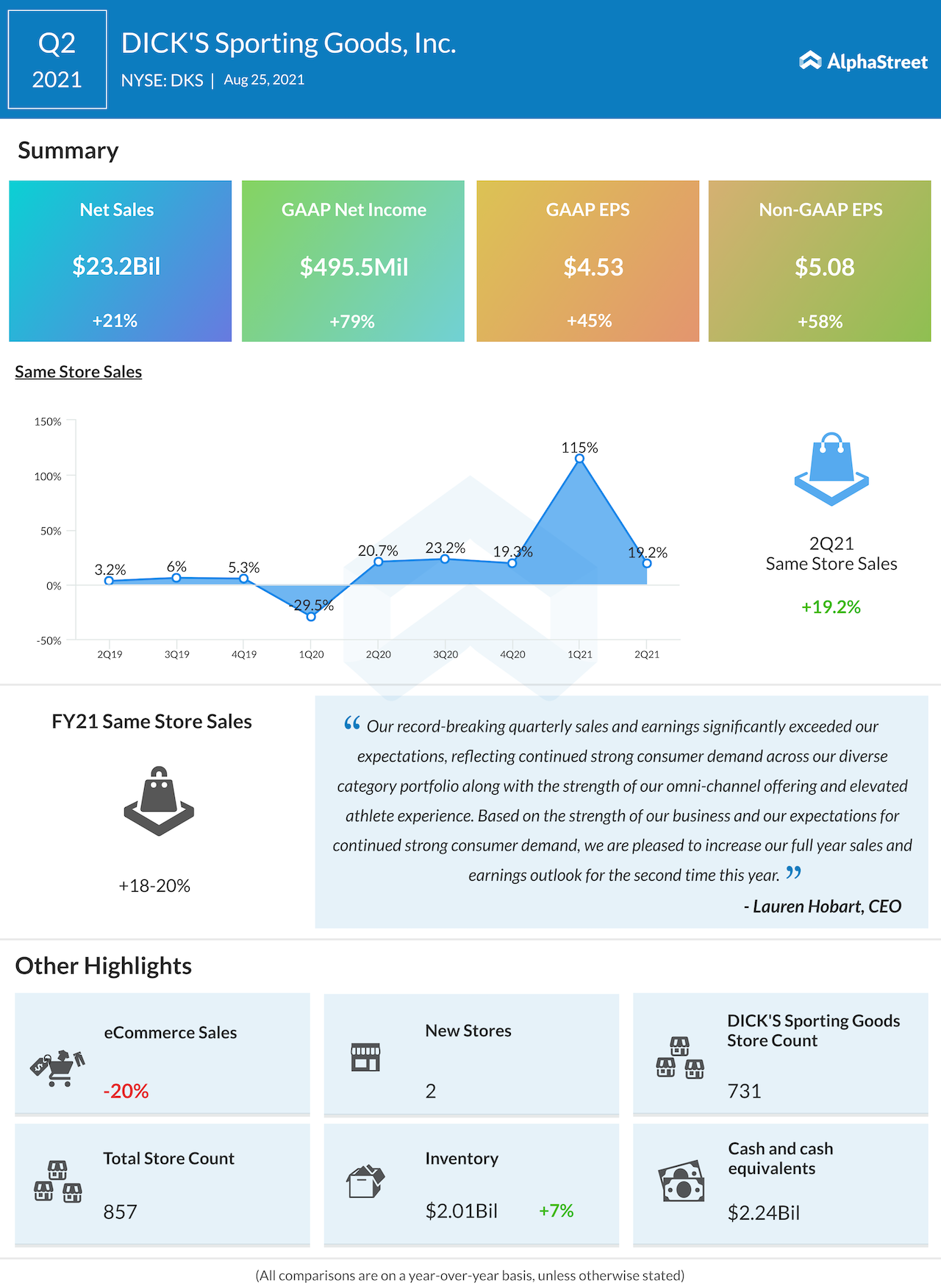

Net sales increased around 21% year-over-year to $3.27 billion in the second quarter of 2021 and was up 45% from the same period in 2019. Consolidated same store sales rose 19.2%. Adjusted EPS rose 58% to $5.08 in Q2. Both the top and bottom line numbers surpassed market expectations.

E-commerce sales were down 28% compared to Q2 2020 during which time many of the company’s stores remained closed and there was a surge in online sales. E-commerce sales jumped 111% from Q2 2019. E-commerce penetration stood at 18% of net sales in Q2 2021, up from 12% in Q2 2019 but down from around 30% in Q2 2020.

Trends

Dick’s Sporting Goods has benefited from changes in consumer behavior wherein people are focusing more on health and fitness and their participation in outdoor activities has increased. This has driven demand for athletic apparel and lifestyle products. In Q2, the company saw double-digit sales growth in the hardlines, apparel and footwear categories.

The retailer believes these trends will continue over the near term, driving growth in categories like golf, team sports, apparel and footwear while offsetting risks in smaller categories like home fitness and outdoor equipment.

In its Q2 presentation, DKS stated that, according to research reports, 75% of industry experts believe the growth in the athleisure market will continue. The data indicates that the total addressable market in sporting goods stands at $120 billion.

DKS holds a 7% market share in sporting goods, which is the highest among its peers and the company believes it is well-positioned to continue growing this share as the sporting goods market undergoes a shift.

Shareholder returns

The company’s board declared a special dividend of $5.50 per share on its common stock which will be funded from its cash on hand. This dividend will return over $475 million to shareholders. The company also increased its quarterly dividend by 21% to $0.4375 per share, which amounts to $1.75 per share on an annualized basis. In addition, DKS plans to repurchase $400 million of its common stock in 2021, up $200 million from its previous guidance.

Outlook

For the full year of 2021, Dick’s Sporting Goods expects net sales to range between $11.5-11.7 billion. Consolidated same store sales are expected to increase 18-20% for the year. GAAP EPS is expected to be $11.00-11.45 while adjusted EPS is estimated to be $12.45-12.95.

Click here to read the full transcript of Dick’s Sporting Goods’ Q2 2021 earnings conference call