The Market

Being a first-mover in the e-signature space, DocuSign enjoys a clear edge over competitors. Considering the continued strong adoption of e-agreements, the company sees significant opportunities with both existing and new clients. The international business, which is an important part of its addressable market, is expanding faster than the domestic segment.

Over the years, the DocuSign Agreement Cloud platform has expanded steadily and now features multiple applications for managing different stages of the contract lifecycle. However, it is yet to contribute meaningfully to the top line, and the company continues to depend on the e-signature business for revenue. Diversification of the business across all major industries enables the company to effectively deal with competition and lessen the impact of economic slowdown and softness in enterprise spending. However, macro uncertainties will likely remain a concern for the leadership in the near future.

Key Numbers

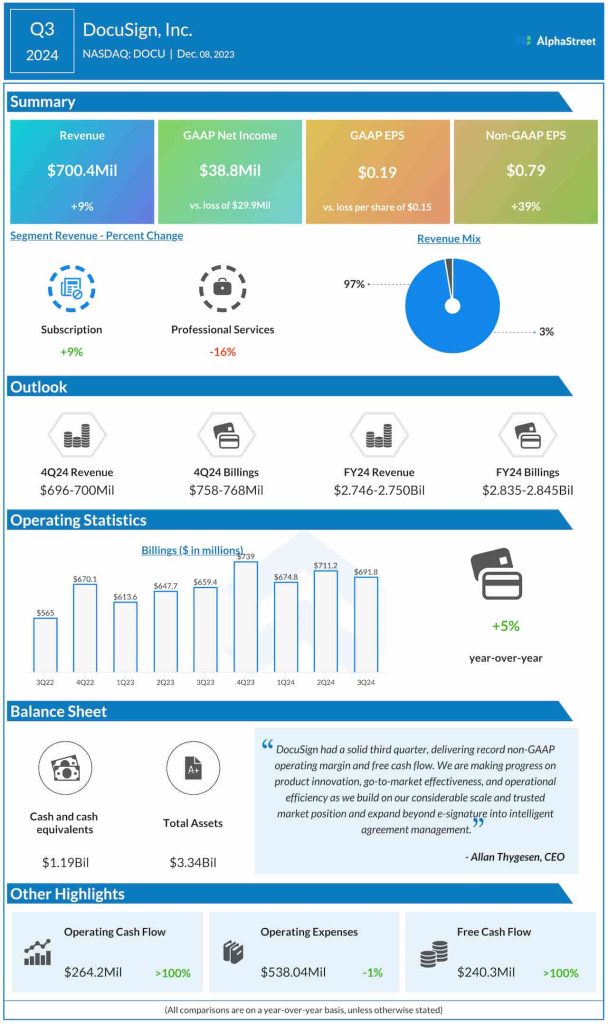

In the past two years, DocuSign has beaten quarterly earnings estimates consistently. In the October quarter, adjusted net income surged 39% to $0.79 per share. That reflects a 9% growth in the core subscription business. Total revenue rose to about $700 billion and topped expectations. At $692 million, Q3 billings were up 5%. Free cash flow reached a record high of $240 billion, representing a margin of 34%. Adjusted operating margin rose to an all-time high of 27%.

From DocuSign’s Q3 2024 earnings call:

“As we look ahead, we envision serving similar customer needs not addressed by CLM via a broader agreement management platform designed for all of our customers in all segments. We are previewing with select customers now, and we’ll have much more to share on our product roadmap and strategic vision at our Momentum user conference in April 2024. Across both our eSignature core and future agreement management products, we believe our investment will lead to even further differentiation in a competitive market.”

Outlook

Anticipating demand conditions to remain strong in the final months of the fiscal year, the company forecasts Q4 revenues in the range of $696 million to $700 million, and total billings between $758 million and $768 million. Full-year revenue is expected to be around $2.75 billion, and billings above $2.83 billion.

DocuSign’s stock gained an impressive 6% on Monday afternoon, extending the post-earnings upswing. With only a few weeks left before year-end, DOCU has grown about 27% so far in 2023.