Revenue and comps

Profits

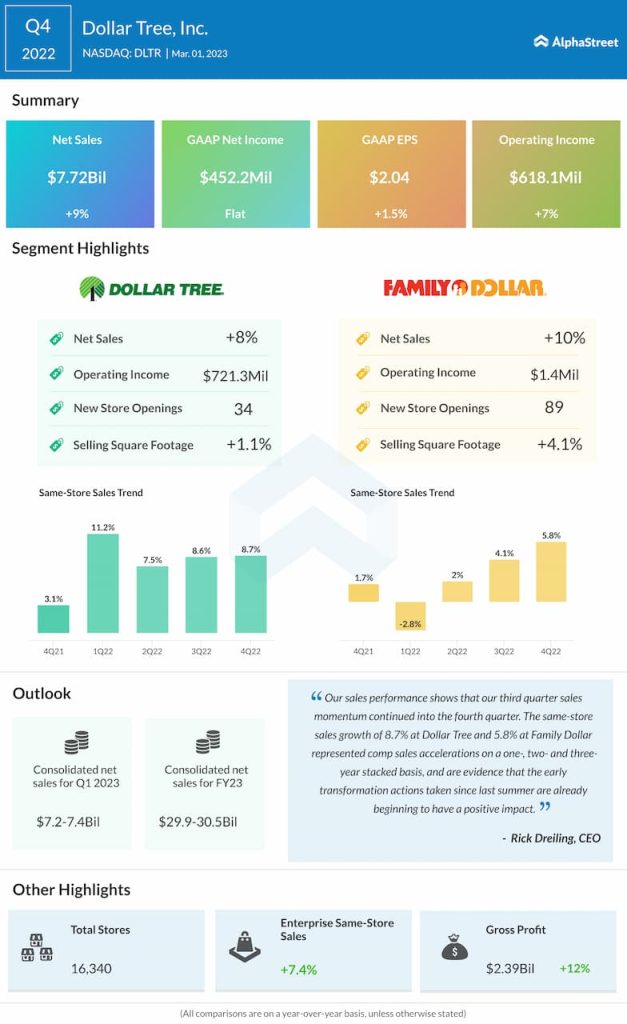

Dollar Tree reported net income of $452.2 million, or $2.04 per share, in Q4 2022 compared to $454.2 million, or $2.01 per share, in the same period last year. Dollar General’s net income increased 10.3% to $659.1 million while its EPS rose 15.2% to $2.96 in Q4 versus last year.

Category performance

In Q4, Dollar Tree reported an 8% growth in net sales for its namesake banner along with a 10% sales growth in its Family Dollar segment. Same-store sales for the Dollar Tree segment increased 8.7%, driven by a 10% increase in average ticket, partly offset by a 1% drop in traffic. Same-store sales for Family Dollar grew nearly 6%, helped by increases in average ticket and traffic.

Outlook

Dollar Tree expects consolidated net sales for the first quarter of 2023 to range between $7.2-7.4 billion. Same-store sales are expected to increase in the mid-single digits, with a low single digit comp increase at the Dollar Tree banner and a mid-single digit comp growth at the Family Dollar banner. EPS is expected to be $1.46-1.56 in Q1.

For FY2023, Dollar Tree’s consolidated net sales are expected to come between $29.9-30.5 billion. Comparable store sales are expected to increase in the low to mid-single digits, with a low single-digit increase in the Dollar Tree segment and a mid-single-digit increase in the Family Dollar segment. EPS is expected to range between $6.30-6.80 in FY2023.

Dollar General expects net sales growth of 5.5-6% and same-store sales growth of 3-3.5% in FY2023. EPS is estimated to grow around 4-6% for the full year.

Shares of Dollar Tree were up 2% on Monday while Dollar General’s stock was up less than 1%.

Click here to read the full transcript of Dollar Tree’s Q4 2022 earnings conference call