“During the quarter, we saw customers take on projects throughout their homes. From deck building to painting projects, landscape work, and home repairs due to increased wear and tear. Clearly, our customers engaged with home improvement in a meaningful way,” said CEO Craig Menear.

Shares of the Atlanta, Georgia-based home improvement retailer hit yet another record this week as investors rushed to tap the opportunity they offer. Experts, on average, predict an 11% growth in Home Depot’s market value in the near term, which justifies the consensus buy rating on the stock. It grew by 14% in the past six months alone.

Bullish View

Though the markets are gradually opening up and people are venturing out, the demand for home improvement products might remain elevated. Home Depot’s recent initiatives to enhance customer experience by opening new fulfillment centers and the improved physical and digital infrastructure keep the company well-positioned to meet the demand. However, it will depend on the rate of customer re-engagement and the company’s ability to maintain sufficient inventory while easing the strain on the supply chain.

Read: Walmart bets big on grocery

Meanwhile, there are concerns that the deepening uncertainty, both social and financial, would dissuade people from spending high on discretionary items. Another factor that can affect sales growth is the cancellation of promotional events that were planned for the year, including Memorial Day, due to the COVID-related risks.

Cautious Stance

Home Depot has withheld its full-year outlook citing lack of clarity on the future of the economy and cautioned that some of the infrastructure projects, originally earmarked for the current fiscal year, have been delayed and will be completed only in fiscal 2021. Due to investment deferrals of about $500 million, capital expenditure in 2021 will be close to this year’s levels of $2.8 billion, which is considered relatively high. The management had suspended its share buyback program in the first quarter itself, for preserving liquidity.

Comps Surge

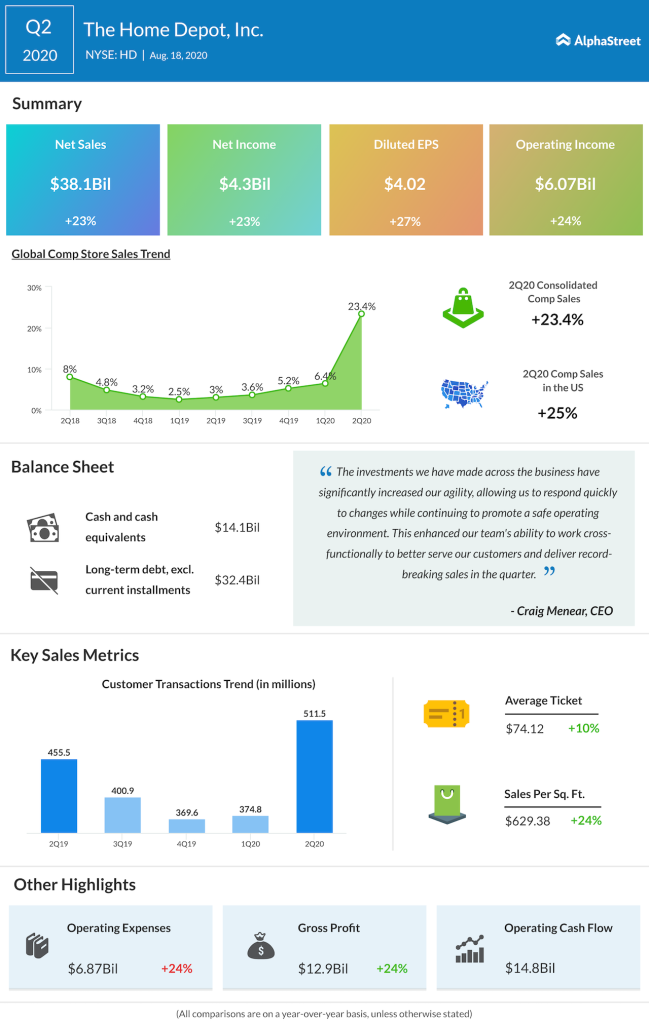

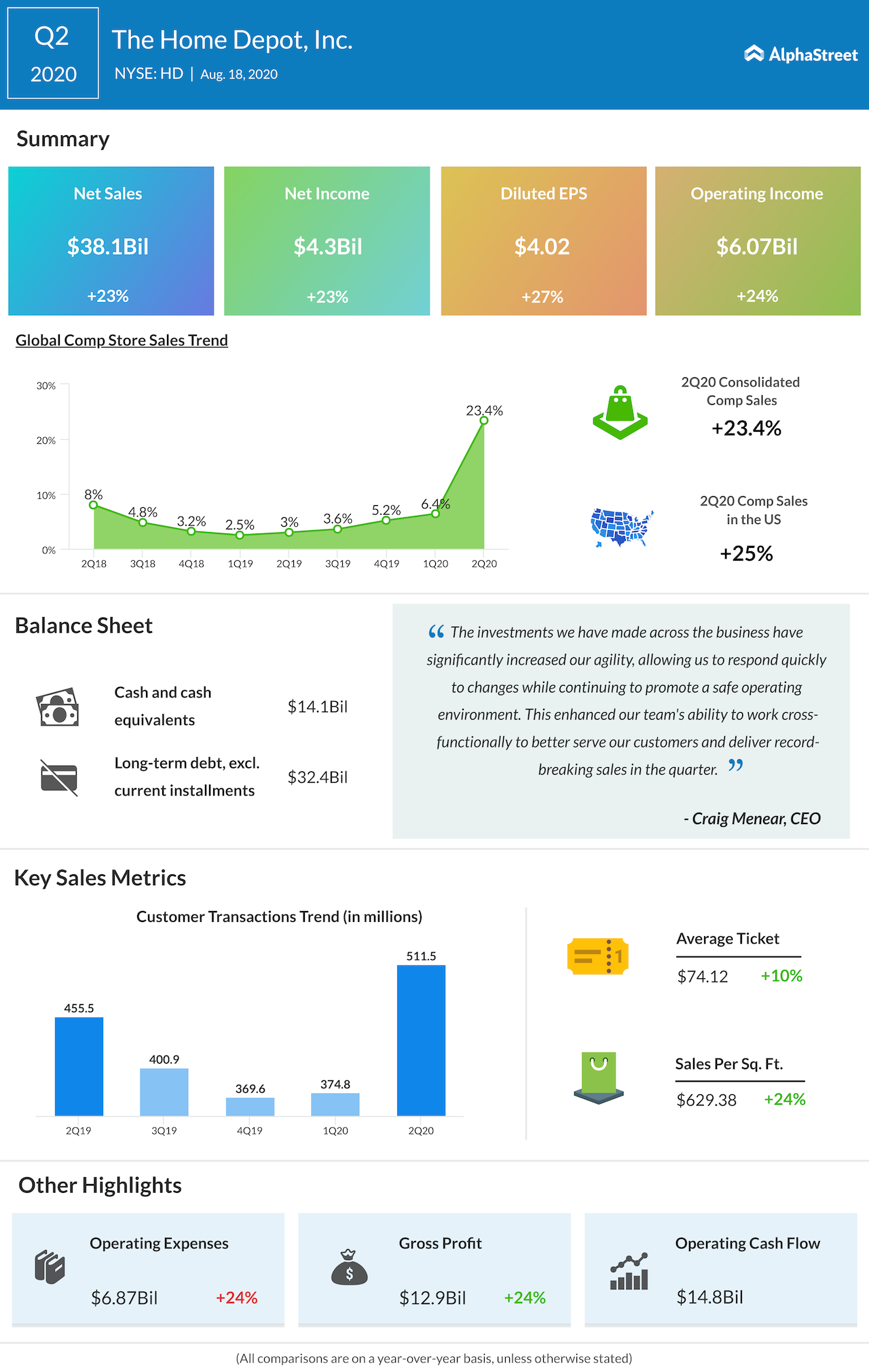

The highlight of Home Depot’s second-quarter report is a 23% spike in comparable-store sales, which shows that a lot of people spent money on modifying their homes during the lockdown period, making the best use of spare time. As a result, sales surged 23% to $38 billion and earnings grew in double digits to $4.02 per share, flying past the market’s projection.

Read management/analysts’ comments on Home Depot’s Q2 2020 earnings report

The breakup of the sales numbers shows there was a marked increase in the demand for plumbing and electrical items during the quarter, which translated into profit helped by favorable pricing and an extension of operating hours at stores.

“Both ticket and transactions were up double-digit in the quarter and we saw healthy growth from both our Pro and DIY customers. During the quarter, we saw customers take on projects throughout their homes. From deck building to painting projects, landscape work and home repairs due to increased wear and tear. Clearly, our customers engaged with home improvement in a meaningful way.”

Craig Menear, chief executive officer of Home Depot

Peer Performance

Among peers, a similar pattern was visible in the performance of Lowe’s Companies (LOW), which unveiled its second-quarter results this week. All merchandising divisions recorded comparable sales growth of more than 20%, resulting in strong top-line and earnings growth. Interestingly, the momentum is being carried forward to the current quarter.