Adding to the positive sentiment, weekly jobless claims dropped to about 712,000, beating the estimates of economists who have cautioned that the number might go up in the coming weeks as the COVID situation continues to be critical.

Enlivening the M&A space, Salesforce this week clinched a deal to acquire instant messaging app Slack Technologies Inc. for about $28 billion — the biggest buyout by the cloud service provider.

On Thursday, store operators Kroger Company and Dollar General released their latest quarterly numbers, indicating a slowdown in the comparable-store sales boom triggered by the shopping spree during the pandemic. Earlier, Hewlett Packard Enterprises released mixed results for the fourth quarter and provided full-year outlook.

Salesforce on Tuesday reported earnings that more than doubled year-over-year, aided by strong revenue growth. Zoom Video Communications, which has been thriving on the high demand for online meetings, registered record customer growth in the October-quarter.

After a modest start – with not many companies reporting in the initial days of next week, except Toll Brothers, AutoZone, and GameStop — the earnings scene is set to get busy on Thursday when Broadcom, Oracle, and Costco are expected to publish results. On Wednesday, design software firm Adobe is scheduled to report its fourth-quarter results.

Key Earnings to Watch

Monday: JinkoSolar, Lightinthebox, Coupa Software, Smartsheet, Sumo Logic, and Stitch Fix

Tuesday: Barnes & Noble, Casey’s General Stores, G-III Apparel Group, Autozone, Star Group, and Chewy

Wednesday: Roots Corporation, Campbell Soup Company, Designer Brands, Photronics, and Restoration Hardware Holdings

Thursday: CIENA Corp, Adobe Inc., Lululemon Athletica, Broadcom Inc., Dave & Buster’s Entertainment, and Oracle Corp

Friday: Construction Partners, Johnson Outdoors, and Quanex Building Products

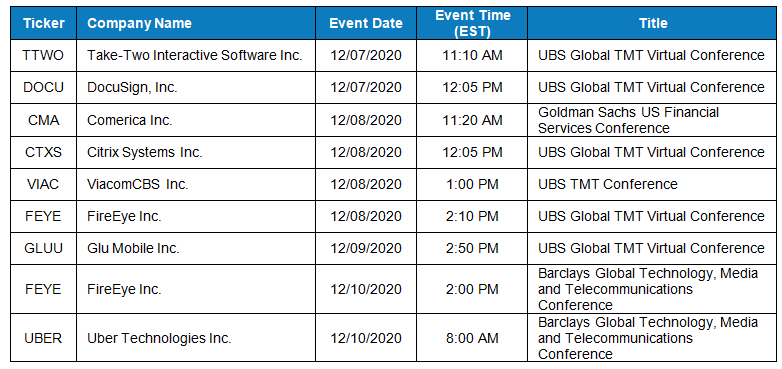

Key Corporate Conferences to Watch

Key Investor Days/AGMs to Watch

Key US Economic Events

Looking Back

The following are notable companies which have reported their earnings last week. In case if you have missed to catch up on their performance, click the respective links to skim through the transcripts to glean more insights.

Zoom Video Communications

Box Inc.

Salesforce.com

Hewlett Packard Enterprise Company

NetApp Inc.

Cloudera, Inc.

Dollar General Corporation

DocuSign, Inc.

Kroger Co.

Zscaler Inc.

If you want to listen to how management responds to analyst questions and the tone they use, you can head over to our YouTube channel to listen to conference calls on the go.