Labor market conditions continued to improve, with the economy adding more jobs than expected and unemployment claims falling to a new pandemic low. Leading stock indexes bounced back from recent lows as the positive employment data offset the mid-week tech selloff.

The Dow Jones Industrial Average was up 128 points early Friday, while the S&P 500 index crossed the 4,200-mark once again and hovered near its peak.

In another technology deal involving private equity firms, Cloudera agreed to be acquired by an investor group for $5.3 billion early this week. Post-acquisition, which is expected to close in the second half, the data cloud company will become a private entity.

Game publisher Take-Two Interactive purchased privately-held mobile game developer Nordeus for $378 million. In a move aimed at boosting its IoT security portfolio, Microsoft bought firmware security startup ReFirm Labs.

Earlier, Accenture revealed plans to buy France-based EPM solutions firm Nell’Armonia for an undisclosed amount, which was followed by the acquisition of Entropia by its subsidiary Accenture Interactive.

Medical device maker Abiomed purchased preCARDIA, a provider of catheter-based cardiac care. In the tech space, PC maker HP closed its previously-announced acquisition of gaming gear maker HyperX for $425 million.

With the earnings season approaching its final phase, there were only a few major announcements in the holiday-shortened week. Canada-based marijuana producer Canopy Growth and technology titan Hewlett Packard Enterprise revealed details of their latest quarterly performance on Tuesday.

Advance Auto Parts, a provider of automotive aftermarket parts, was probably the only major company that reported on Wednesday. More financial data came from the tech world the next day when Broadcom and cloud technology firm CrowdStrike posted impressive results for their most recent quarter.

The market is headed into another week of muted activity, with very few events scheduled in the coming days. Spend management platform Coupa Software and caravan maker Thor Industries are expected to report earnings on June 7. Then, after a couple of lean days, the reports of pet-care retailer Chewy and Fuel Cell Energy are slated for June 10.

Key Earnings to Watch

Monday: Coupa Software, Marvell Technology Group, Stitch Fix, VA Tech Wabag, and Vail Resorts

Tuesday: American Software, Chico’s Fas, Momo, UiPath, and Yatra Online

Wednesday: Campbell Soup Company, GameStop Corp, Restoration Hardware Holdings, United Natural Foods, and Verint Systems

Thursday: Aurora Mobile Limited, CHEWY, Dave & Buster’s Entertainment, FuelCell Energy, Signet Jewelers, and Zedge

Friday: BCL Industries, Bowman Consulting Group, and Navigator Holdings

Key Corporate Conferences to Watch

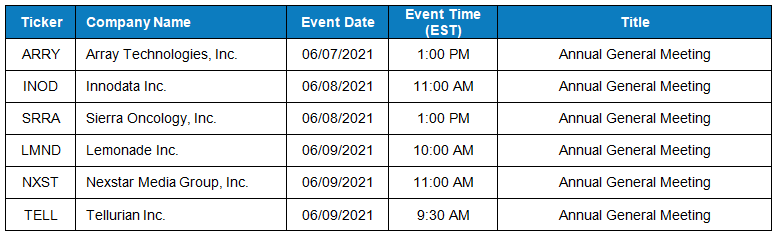

Key Investor Days/AGMs to Watch

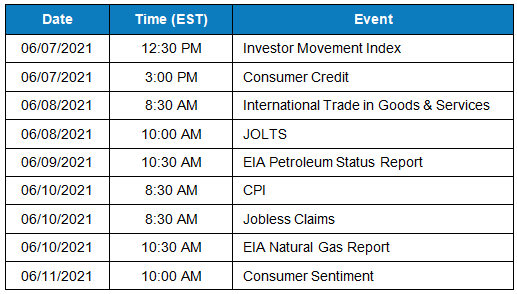

Key US Economic Events

Notable Transcripts

The following are notable companies which have reported their earnings last week. In case if you have missed catching up on their performance, click the respective links to skim through the transcripts to glean more insights.

Canopy Growth Q4 2021 Earnings Transcript

Hewlett Packard Enterprise Q2 2021 Earnings Transcript

Zoom Video Q1 2022 Earnings Transcript

NetApp Q4 2021 Earnings Transcript

Broadcom Q2 2021 Earnings Transcript

If you want to listen to how management responds to analyst questions and the tone they use, you can head over to our YouTube channel to listen to conference calls on the go.