“Pana cell lines at Giga are only at ~24GWh/yr & have been a constraint on Model 3 output since July,” Musk tweeted, adding that “Tesla won’t spend money on more capacity until existing lines get closer to 35GWh theoretical.”

This also added to Musk’s long list of spats on social media, from rivals to short-selling investors, and even the Securities & Exchange Commission (SEC).

However, this time, the implications are much higher. The fight, however, began with reports on both companies batting down expansion plans at the battery plant in Nevada. Musk took to Twitter saying that Panasonic was responsible for slowing the production of his company’s Model 3 sedan.

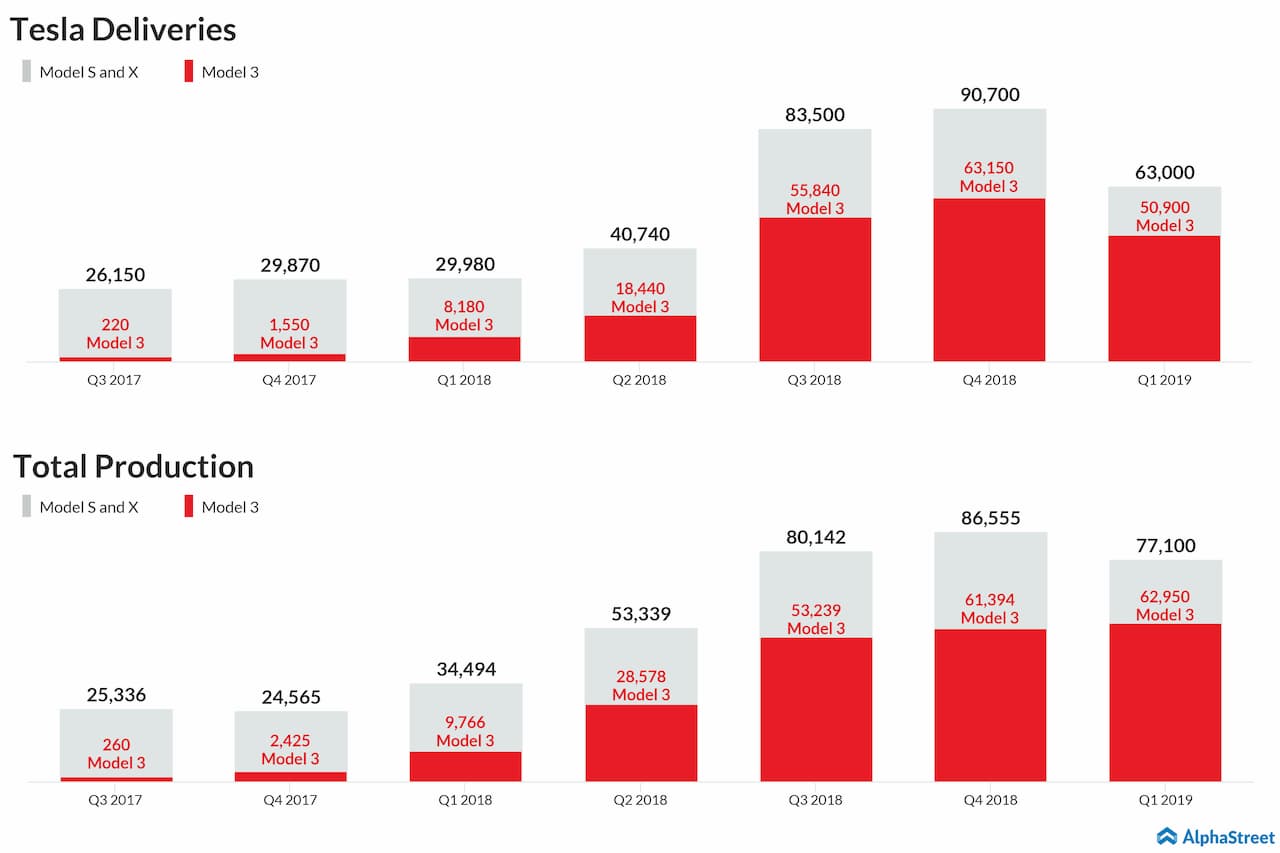

But Panasonic’s rollback could mean that it doubts Tesla’s capabilities. This puts Tesla in a very tricky position. Tesla delivered only 63,000 cars globally in its first quarter, vs. 91,000 in the preceding quarter.

There is 35 GWh/yr “theoretical capacity”, but actual max output is ~2/3. It was physically impossible to make more Model 3’s in Q1 due to cell constraints.

ADVERTISEMENT— Elon Musk (@elonmusk) April 14, 2019

Last week, on Thursday, Tesla shares (Nasdaq: TSLA) slipped 4% in early trade shortly after news of the electric car maker suspending the expansion initiatives at its Gigafactory in the US. Most reports suggested that Tesla was joined by business partner Panasonic in freezing investments in the production facility amid concerns of demand falling short of expectations.

However, these new tweets seem to have raised a few eyebrows on the topic.

Previously, both companies has opted to lift the capacity by 50% at its much-hyped manufacturing “super facility” in Nevada—which was set up spending about $4.5 billion.

With more reports pouring in that it was the financial uncertainties surrounding Tesla that prompted Panasonic to put its plan to invest in the carmaker’s production facility and battery plant in Shanghai, China, on hold, it was only natural for Musk to retaliate—at least with a few tweets.

A month ago, Alphastreet reported that Tesla stock was hammered after its long-awaited Model Y crossover SUV failed to impress the market. It’s lackluster response was linked to a possible order shortfall even as the first unit of Model Y is expected to hit the road only next year—or even later.

Tesla shares have at least 11% this year and shed 8% of its value in the past twelve months.