Shares of FedEx Corporation (NYSE: FDX) have dropped 14% year-to-date and 19% over the past 12 months. The company delivered mixed results for the third quarter of 2022 last week as revenue surpassed expectations but earnings missed the mark. Despite several near-term challenges, FedEx believes it will see growth over the coming quarters.

Quarterly performance

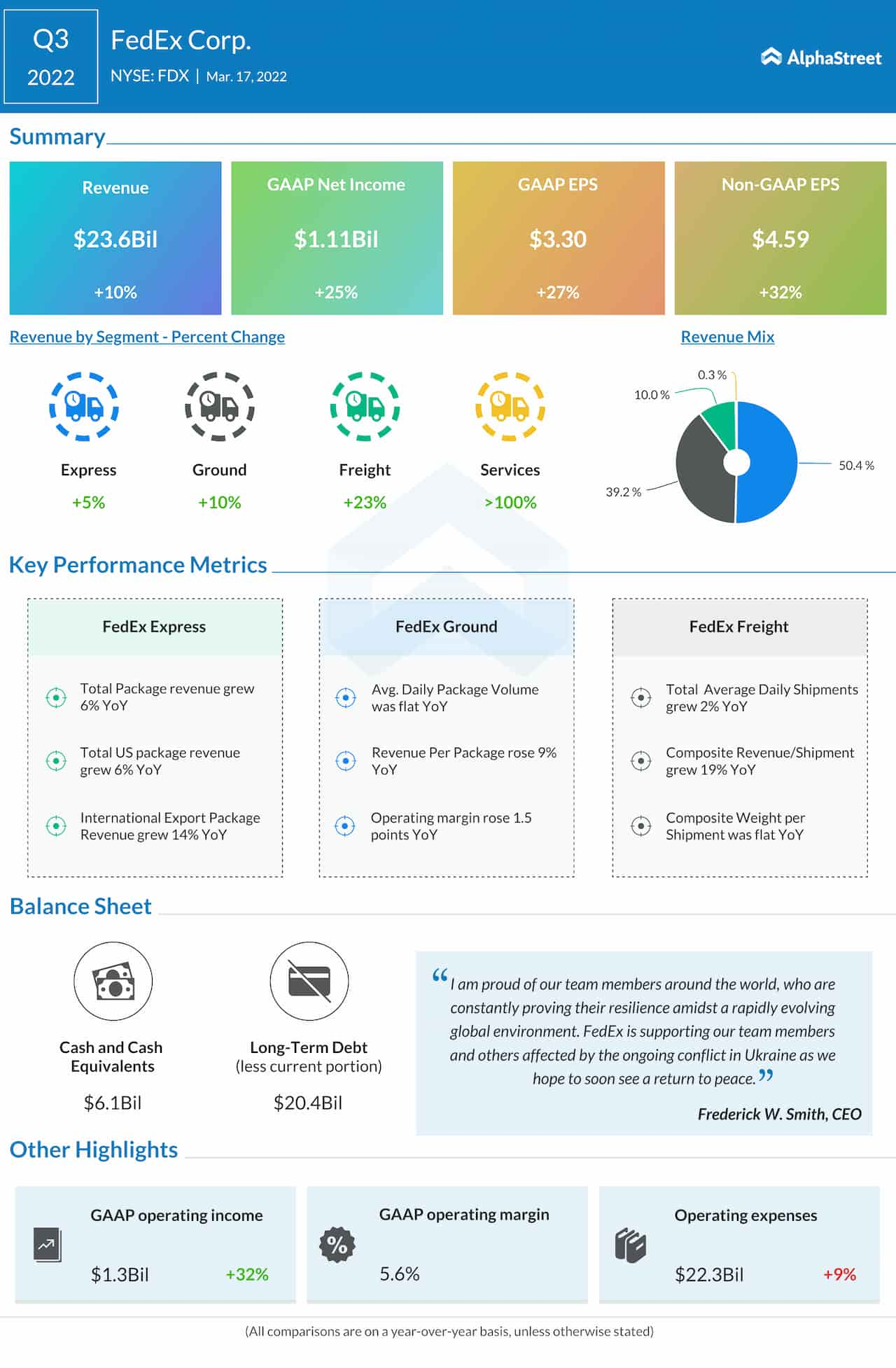

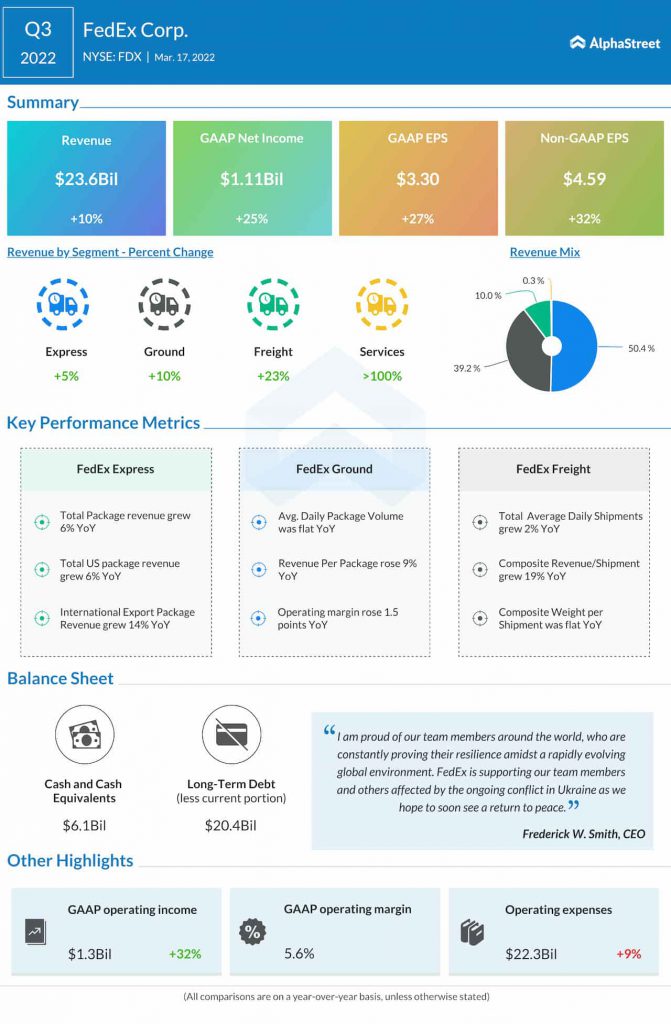

In the third quarter of 2022, revenue increased 10% year-over-year to $23.6 billion while adjusted EPS rose 32% to $4.59. FedEx witnessed a strong peak season with record performance during December.

Despite this, the company faced challenges brought on by the Omicron variant, such as staffing shortages, reduced demand for services and softness in volumes. The estimated impact from Omicron-driven volume softness on Q3 results was around $350 million. However, this effect was temporary and volumes are seeing a rebound.

Operating results in the Express segment benefited from higher yields, a net fuel benefit, and lower variable compensation expense. These were partly offset by headwinds to labor availability and shipping demand caused by Omicron.

Results at the Ground segment were negatively impacted by higher rates for purchased transportation and wages, network inefficiencies, and expansion-related costs. The Freight segment benefited from growth in average daily shipments and revenue per shipment.

Expectations

On its quarterly conference call, FedEx stated that several macroeconomic forces such as the conflict in Ukraine, uncertainty around the pandemic, a tight labor market, supply chain disruptions, high energy prices and inflationary pressures have dampened the current GDP outlook globally and for the US.

FedEx has also lowered its economic outlook. US GDP is now expected to increase 3.4% in calendar year 2022, revised down from 3.7% and the company’s outlook is 2.3% in calendar year 2023. Global GDP growth was previously estimated to be 4.1% in calendar year 2022 and this has now been revised to 3.5%. It is estimated to be 3.1% in calendar year 2023.

FedEx believes that ecommerce will continue to drive strong market growth. It estimates ecommerce growth rate in the US to be in the mid to high single digits for the next three to four years.

Capacity constraints are a key factor affecting FedEx’s international businesses. Lower capacity on transatlantic passenger airlines is currently expected to recover faster compared to transpacific. Passenger airline capacity is not anticipated to fully pick up to pre-pandemic levels until 2024 or even later across the company’s largest global trade lines. Scarce capacity on international lanes and strong demand out of Asia is driving a favorable pricing environment.

For FY2022, FedEx expects adjusted EPS to range between $20.50-21.50. EPS, before the year-end mark-to-market retirement plans accounting adjustment, is estimated to range between $18.60-19.60. Capex is estimated to be $7 billion for the year.

Click here to read the full transcript of FedEx’s Q3 2022 earnings conference call