On Recovery Path

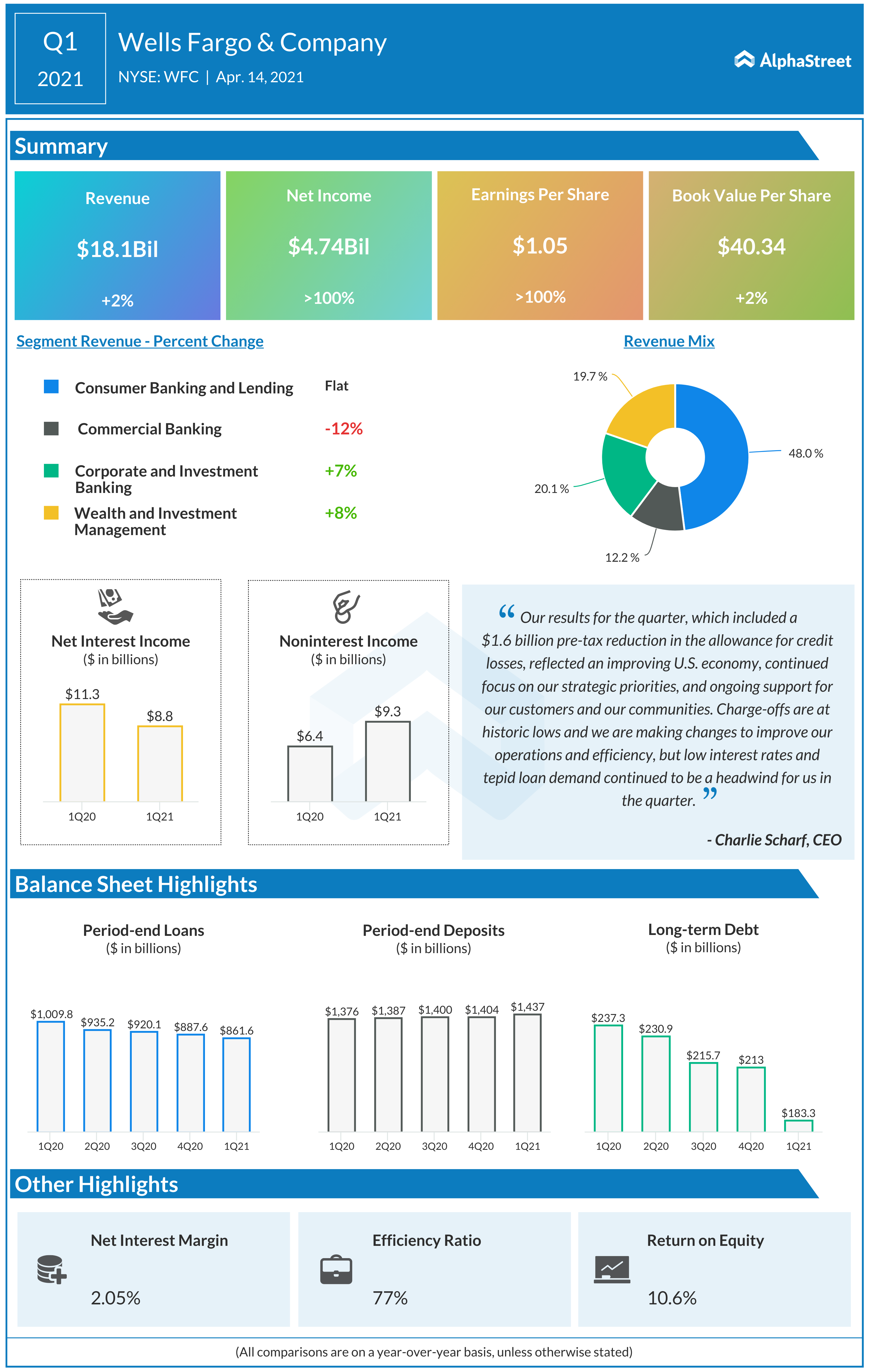

Like most of its peers, Wells Fargo released a part of loan-loss reserves accumulated during the crisis amid concerns of economic recession, taking a cue from the COVID vaccination drive and macroeconomic recovery. Commercial clients are coming out of virus-induced weakness and getting back on track, reviving loan demand. The company’s latest financial report indicates CEO Charles Scharf’s efforts to streamline the business, with focus on cost reduction, are bearing fruit. The tailwinds are expected to gather steam in the second half.

Credit quality continued to outperform our expectations with charge-offs at historical lows, with low interest rates and tepid loan demand remained headwinds for us during the quarter, and we continue to manage within the constraints of our asset cap, which require us to anticipate the inflows from government stimulus, effects of QE and additional fiscal actions which could impact our balance sheet. Overall economic trends improved during the quarter. And while there are risks, the likelihood of improvement continues to increase, and you certainly see this in the markets.

Charles Scharf, chief executive officer of Wells Fargo

Earnings Surge

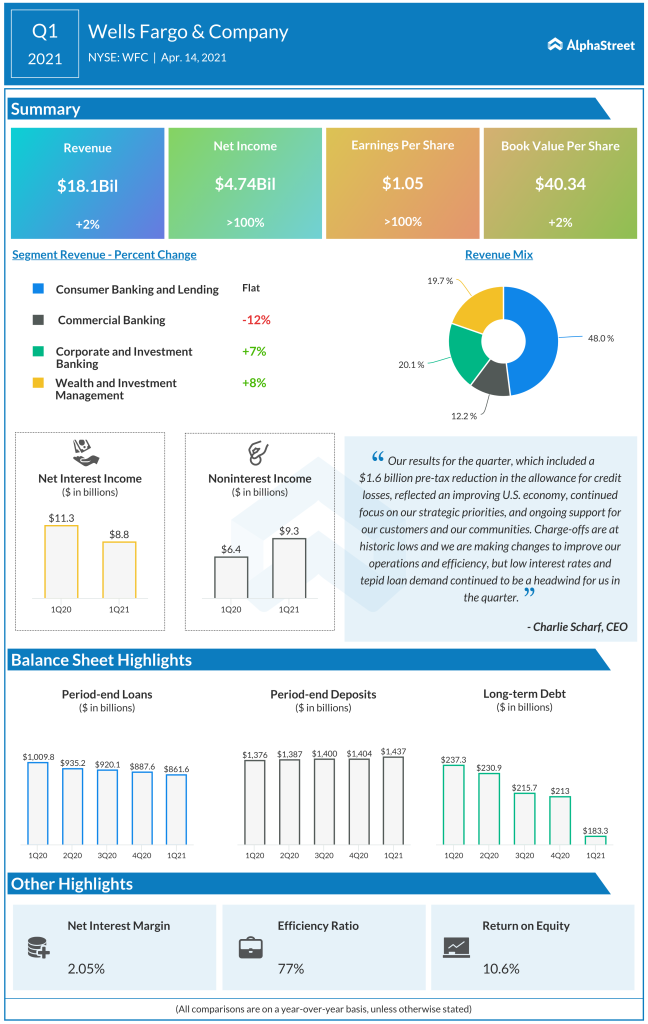

In the first quarter, earnings and revenues exceeded Wall Street’s estimates. A 22% fall in net interest income was more than offset by a 44% increase in non-interest income, driving revenues up 2% to $18 billion. At $1.05 per share, earnings were sharply higher compared to the year-ago period. The bottom line benefited from the release of credit loss allowance. The numbers also came in above the market’s projection, as they did in the trailing two quarters, in a sign that financial performance is returning to the pre-pandemic levels.

Read management/analysts’ comments on Wells Fargo’s Q1 earnings

Earlier, Wells Fargo’s bigger rival JPMorgan Chase (NYSE: JPM) reported double-digit revenue growth for the first quarter when its earnings more than doubled to $4.50 per share, aided by the release of loan loss provision. Among others, revenues of Citigroup (NYSE: C) declined in the most recent quarter hurt by faltering loan demand, while Bank of America (NYSE: BAC) posted flat revenues.

At the Bourses

The market responded positively to Wells Fargo’s impressive first-quarter outcome. The stock made strong gains early Wednesday following the announcement and maintained the uptrend since then. The shares had a positive start to 2021 and gained 39% since the beginning of the year.