Sales growth

Ford’s total vehicle sales increased 27.3% in August 2022 compared to the same month a year ago. Retail sales for the month were up 29.7%. Retail sales for SUVs increased 51% while for trucks they were up 11%. Sales of hybrids rose 9% from the same month last year.

Electric vehicles

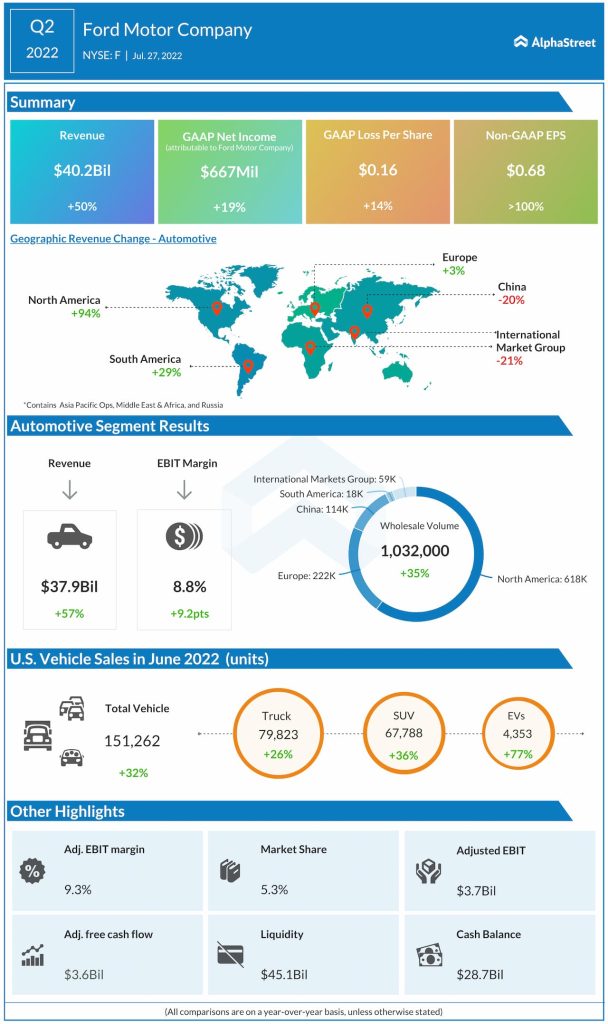

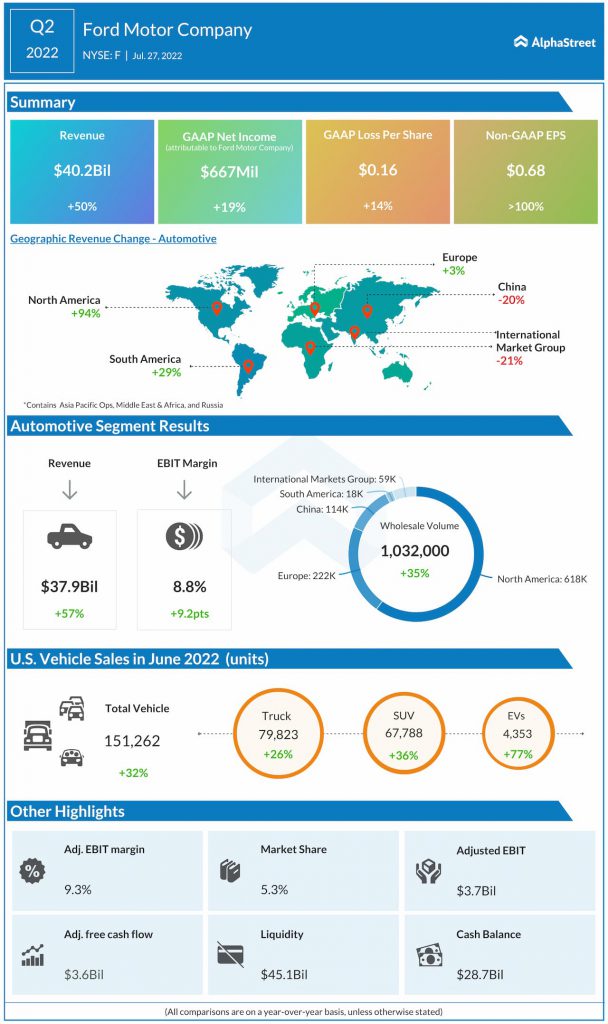

Ford has been making heavy investments in its EV business and it is seeing strong demand for its EV models. In its earnings report, the company said that according to Motor Intelligence, through the second quarter, Ford E-Transit accounted for 95% of full-size electric vans sold in the US.

In July 2022, Ford’s EV sales increased 168.7% compared to July 2021 with strong performances from Mustang Mach-E, F-150 Lightning and E-Transit. In August, sales of EVs jumped 307.3% with Mustang Mach-E sales up 115%.

Ford has strong multi-year order banks for these products and it believes they can help in expanding its share in the fast-growing EV market. The company is on track with its plan to reach a run rate of 60,000 EVs by the end of next year. The automaker aims to reach 2 million by late 2026.

Ford Pro

The Ford Pro business specifically targets commercial customers who currently have very fragmented solutions in the marketplace. Ford is working to bring vehicles, software, charging, service, and financing all together under the Ford Pro segment for its commercial customers. This is expected to pave the way to new addressable markets in higher-margin businesses.

In North America, Ford has 40% of the full-size truck and van business for commercial customers. It continues to grow its share in commercial vehicles in Europe as well. The company believes there is significant pent-up demand for commercial products.

Click here to read the full transcript of Ford’s Q2 2022 earnings conference call