As the market’s recovery from the pandemic gains steam, GM’s stock will likely move up further. Despite the recent gains, the shares look priced rightly, relative to earnings. Investors wouldn’t want to miss the buying opportunity, which is endorsed by the majority of the analysts following the company. According to them, the stock is on track to gain 18% in the next twelve months.

Large Vehicles Lead

The company looks to ride on the high demand for its SUVs and full-size pickups, especially in the U.S and China where the market is rapidly returning to normal. Interestingly, cost-savings and other benefits from the global restructuring the company implemented prior to the pandemic came in handy during the crisis period.

Encouraged by the pick up in sales, the management is planning to invest heavily in capacity expansion and has earmarked about C$1 billion to boost its Canadian operations. Those efforts are being complemented by the expansion of the electric vehicle segment. While the fourth quarter is typically a soft period for GM in terms of sales, the management does not see the final outcome of the presidential election affecting performance.

This year and this quarter, in particular, you can clearly see how we are rapidly transforming our company to lead in EVs by leveraging our iconic brands, technological innovation, manufacturing capability, and scale in a way that will change the way customers and our investors view our company. The foundation is our flexible and highly scalable Ultium architecture, battery and propulsion system, which have empowered our designers and given them free rein to reimagine our approach to interior and exterior design.

Mary Barra, chief executive officer of GM

Strong Liquidity

Having streamlined operations through a comprehensive restructuring, GM has a comfortable cash balance now, despite the COVID-related uncertainties. The strong liquidity has helped the company repay a significant portion of its revolving credit facility in recent months.

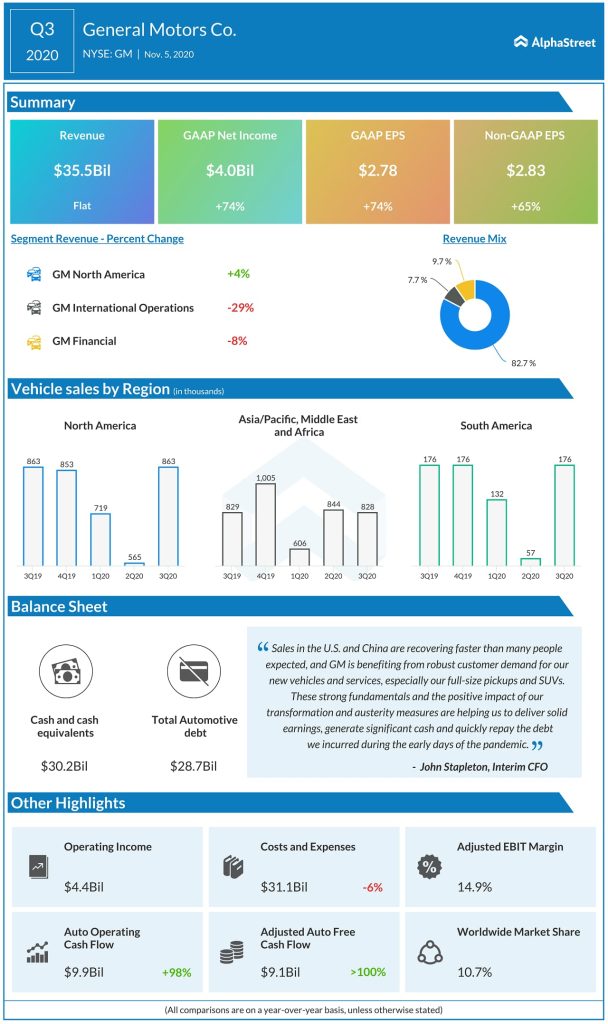

North America, the biggest market for GM vehicles, witnessed stable demand in the early part of the second half, which was offset by weakness in the other regions. Consequently, revenues remained unchanged year-over-year at $36 billion in the third quarter. Improved margin performance lifted earnings to $2.83 per share, up 65% from last year. The momentum is expected to stay in the final months of the year, supported by the strong cash position and market recovery.

Inventory Woes

While the rebound is pretty quick, automakers might face difficulties in deliveries as the current inventory levels are far below normal. Since manufacturing is yet to return to the normal levels, meeting the shipment targets would remain a challenge.

Also read: Electric vehicles form key part of Ford Motor Company

The recovery of GM’s shares from the March-mayhem has been impressive, and they are currently trading close to the peak. The stock has gained 70% in the past six months, all along outperforming the market. Though the stronger-than-expected third-quarter results drove up the shares initially, they pared a part of the gains later.