After the Coronavirus pandemic, which is believed to be originated from a live-animal market in Wuhan, China, the number of people who have started to eat vegan food has been increasing. And this has created an opportunity for plant-based meat producers to develop their business all over the world. Alternative meat producers believe that their products address concerns related to human health, climate change, resource conservation and animal welfare.

Beyond Meat earnings

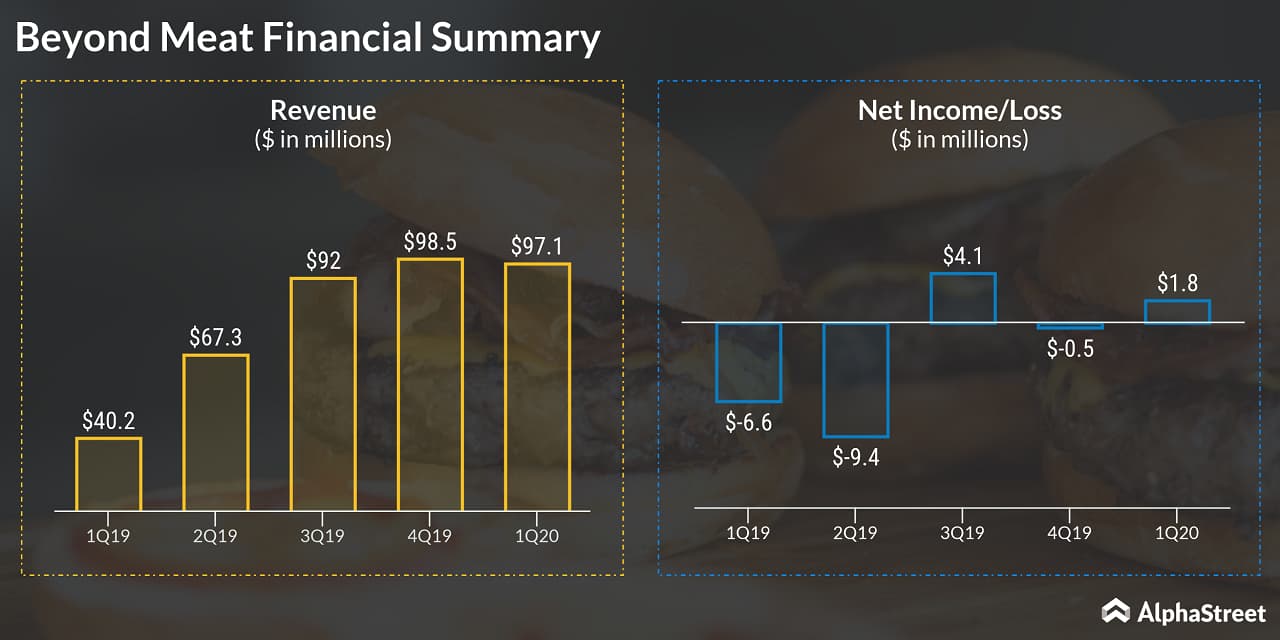

Vegan company Beyond Meat (NASDAQ: BYND), which went public in May 2019, reported its first quarter 2020 results on Tuesday that outpaced the market’s targets. Surprisingly, the company swung to a profit in the quarter with a 141% jump in revenue. Even though the company expects to benefit from its retail channel, the uncertainty related to the global health crisis is expected to affect the foodservice channel and negatively impact the company in the short term. As a result, Beyond Meat joined the other companies in the food and beverage industry who withdrew their previously provided FY20 outlook in their earnings announcements.

[irp posts=”50741″]

Despite achieving the strong margin in Q1, Beyond Meat expects gross margin to be sequentially down in Q2 as the near-term headwinds associated with volume deleveraging and repackaging costs to affect Q2. When an analyst asked about the potential impact on the revenue from Q1 to Q2, CFO Mark Nelson said, “We’ll probably stay away from giving guidance.” The company expects the foodservice channel to be impacted more in Q2 compared with Q1.

China

Beyond Meat, which partnered with Starbucks in China, plans to establish its production footprint in Asia before the end of 2020. During the Q1 earnings call, CEO Ethan Brown said Beyond Meat’s partner Starbucks had done a good job in China. He added, “We aren’t taking it lightly. We’re going to be investing a lot over there.” In China, Beyond Meat didn’t experience much disruption because of the pandemic, but the start was delayed a bit.

Marketing

Beyond Meat has curtailed its spending on content creation and marketing spend due to the current global health crisis. Once the recovery is in full swing, the company plans to spend more on content creation and marketing to reach out to more people. Ethan Brown pointed out in the call that Beyond Meat will try all the possible ways to sell its products to customers and online will play a big role in that.

Market opportunity

In its annual filing Beyond Meat stated that according to data from Fitch Solutions Macro Research, the meat industry is the largest category in food and in 2017 generated estimated sales across retail and foodservice channels of approximately $270 billion in the United States and approximately $1.4 trillion globally.

[irp posts=”50620″]

According to Zion Market Research, the global plant-based meat market is expected to grow to $21 billion in 2025 with a compound annual growth rate of 8.6%. The study says that the Asia Pacific region is expected to hold a lion’s share of the global plant-based meat market in the future, as more people in China and India have stared preferring plant-based meat substitutes.

Despite the headwinds created by COVID-19 pandemic, it is estimated that the plant-based protein market will evolve continuously and the issues related to the environment, health and animal welfare are expected to benefit Beyond Meat, the only pure-play public company in this space, in the near-term.

Most Popular

CL Earnings: Key quarterly highlights from Colgate-Palmolive’s Q2 2024 financial results

Colgate-Palmolive Company (NYSE: CL) reported its second quarter 2024 earnings results today. Net sales increased 4.9% year-over-year to $5 billion. Organic sales increased 9%. Net income attributable to Colgate-Palmolive Company was $731

Key takeaways from Visa’s Q3 2024 earnings report

Credit card behemoth Visa, Inc. (NYSE: V) this week reported mixed results for the June quarter, with earnings matching expectations and sales slightly missing the view. Both numbers grew in

Southwest Airlines (LUV): A look at the airline’s performance in Q2 2024

Shares of Southwest Airlines Co. (NYSE: LUV) were up over 6% on Thursday after the company beat earnings estimates for the second quarter of 2024. The stock has gained 4%