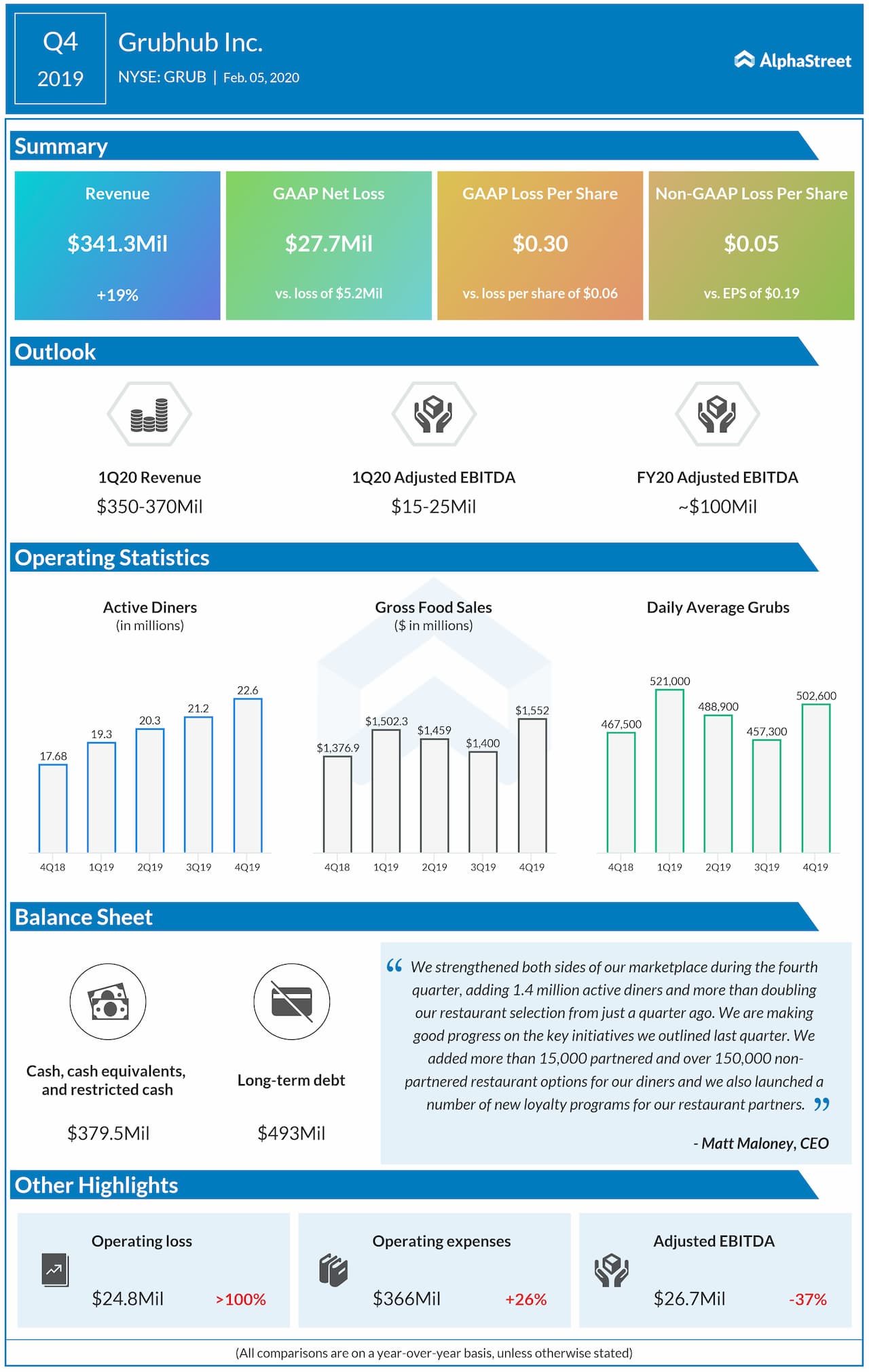

GAAP net loss was $27.7

million, or $0.30 per share compared to $5.2 million, or $0.06 per share, in

the prior-year period. Adjusted loss was $4.2 million, or $0.05 per share.

Analysts had projected a loss of $0.04 per share.

Adam DeWitt, President and CFO, said, “We continue to

innovate the online takeout industry with our recent launch of Grubhub

Ultimate, a revolutionary, first-of-its-kind proprietary hardware and software

solution that integrates all restaurant ordering channels into one system.

Grubhub Ultimate is an important step in helping unlock the pickup market,

which accounts for the majority of the more than $250 billion takeout industry.

We remain confident our overall strategy will deliver sustainable value for all

of our stakeholders and the team is determined to continue to execute and build

on the early wins.”

During the quarter, the number of active diners increased

28% year-over-year to 22.6 million. Daily Average Grubs rose 8% to 502,600.

Gross food sales grew 13% to $1.6 billion.

For the first quarter of 2020, Grubhub expects revenue to be $350-370 million. For the full year of 2020, revenue is expected to be $1.4-1.5 billion.

Get access to timely and accurate verbatim transcripts that are published within hours of the event.