Check out JPMorgan’s Q1 2020 earnings infograph

Outlook

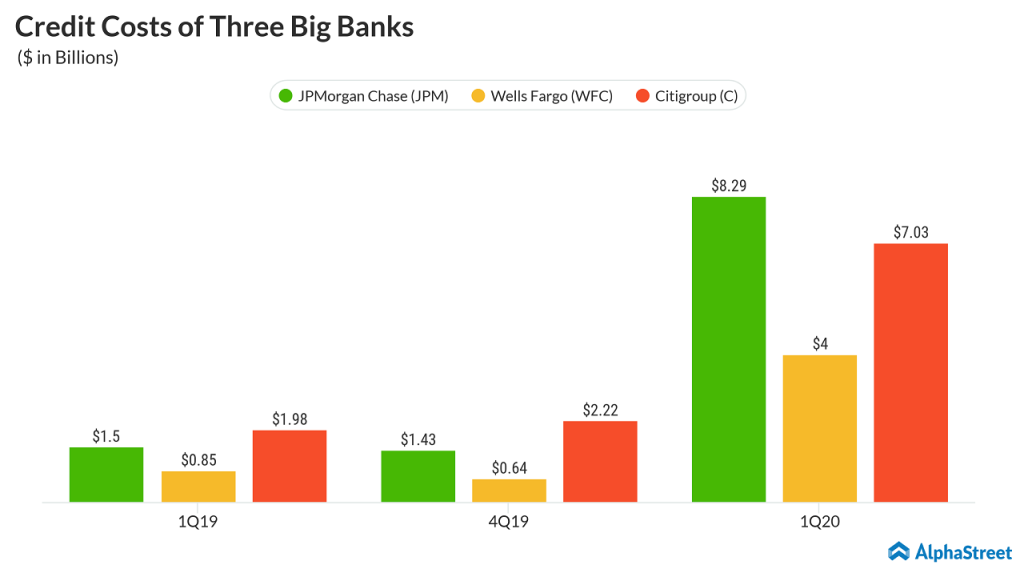

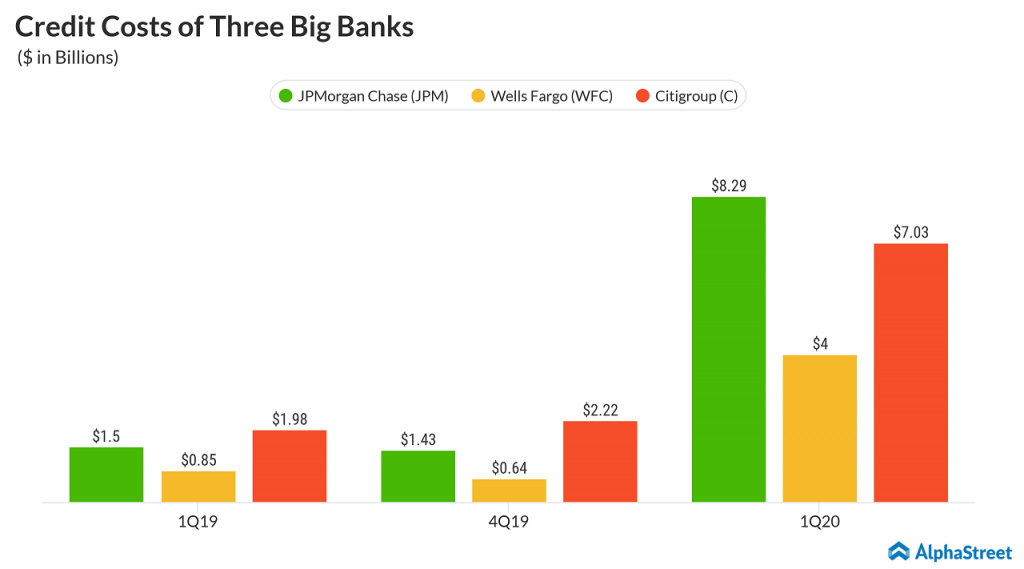

On commenting about the outlook for the US economy, JP Morgan said it expects a more significant deterioration in the US GDP and unemployment rate. If this nightmare scenario continues, JPM would be building its reserves in the second quarter and this build could be meaningfully higher in the next several quarters compared to the first quarter. JPM expects 2020 adjusted expenses to be about $65 billion, which shot up from the outlook it provided at the Investor Day.

Given the deteriorated macroeconomic outlook, we would expect to build reserves in the second quarter. But again, a lot will depend on the ultimate effect of these extraordinary programs and how effective they can be in bridging people back to employment. And we’re going to still have a number of unknowns, I would say, at the end of the second quarter, but we’re going to learn a lot through these next few months that will inform our judgment for second quarter reserves – Jennifer Piepszak, CFO

ADVERTISEMENT

Net interest income for 2020 was then projected to be slightly down from 2019 as lower rates will be offset by balance sheet growth and CIB Markets NII. With further pressure expected from the rates, now NII is projected to be about $55.5 billion compared to $57.8 billion in 2019.

Markets segment revenue was up 32% annually in the first quarter of 2020 as the growing COVID-19 concerns triggered a major correction in the equity markets which led to a spike in volatility and resulted in increased client activity and record trading volume. However, JPMorgan expects low rates and decreased economic activity to be the headwinds for Markets segment.

Capital return

In mid-March, the New York-based firm halted its share buybacks. For the first quarter, JP Morgan distributed $8.8 billion of capital to shareholders, which includes $6 billion in net share repurchases up to March 15. The company, which had planned to continue to pay $0.90 dividend, had stated that the Board might suspend the dividend, as there will be continued uncertainty over the next few years.

CEO’s letter

In early April, CEO James Dimon said, “our earnings will be down meaningfully in 2020.” In his letter to the company shareholders, he added, that the future holds for a bad recession combined with some kind of financial stress similar to the global financial crisis of 2008 and JPMorgan cannot be immune to the effects of this kind of stress.

The country was not adequately prepared for this pandemic – however, we can and should be more prepared for what comes next. Done right, a disciplined transition would maximize the health of Americans and minimize the time, extent and suffering caused by the economic downturn – From CEO’s shareholder letter

JPMorgan, after dealing with the legal issues from the 2008 crisis-era purchases, had performed well under the leadership of Dimon. Market watchers predict that when the economy starts to recover in the back half of 2020 or later in 2021, JPMorgan will also recover given its ability to bounce back. JPM stock, which plunged about 11% since its first quarter earnings announcement, had lost 37% of its value since the beginning of 2020.

Read the full transcript of JPMorgan Chase 1Q 2020 earnings call