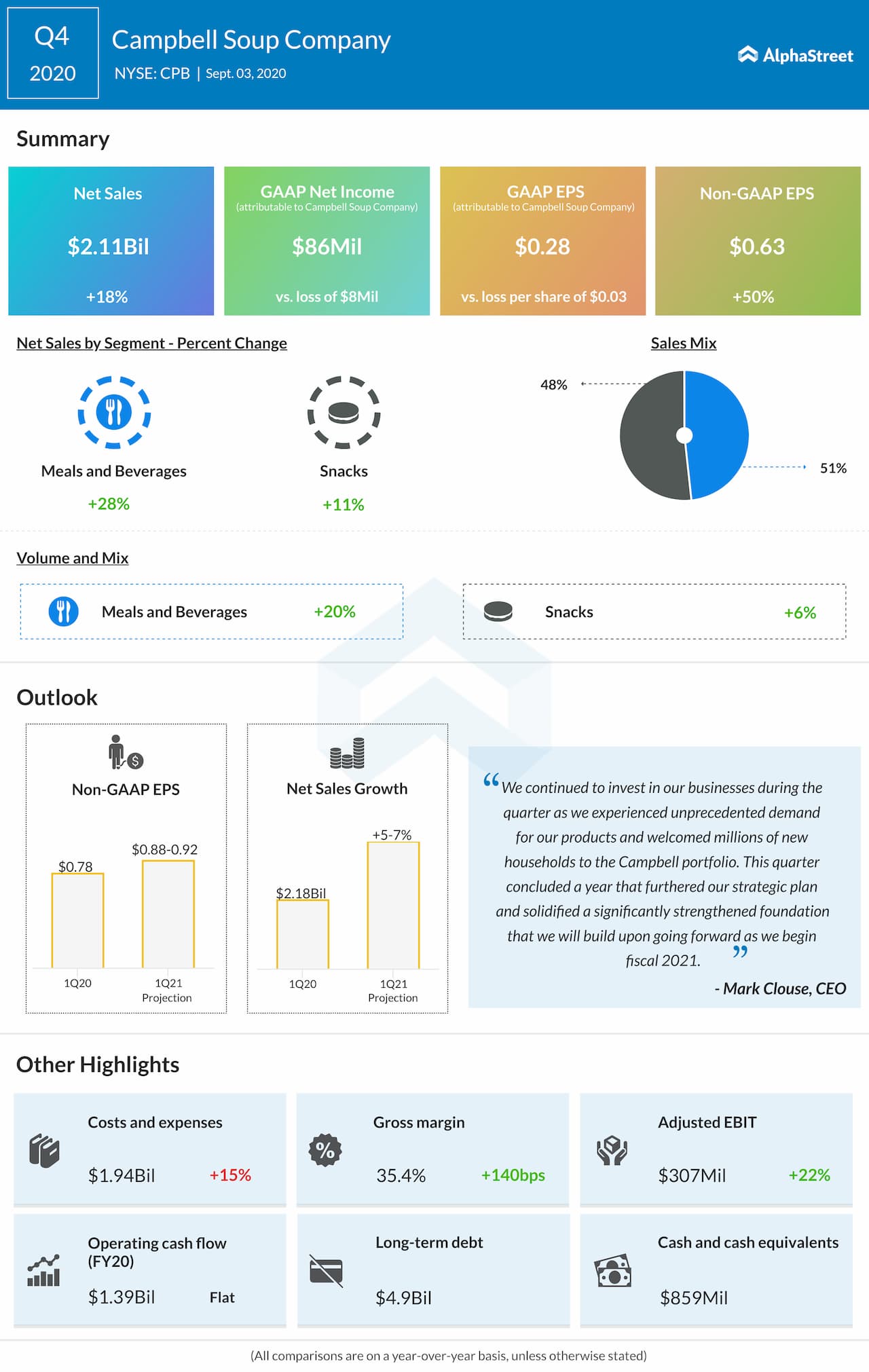

Campbell Soup Company (NYSE:CPB) ended fiscal year 2020 on a strong note with solid results in the fourth quarter. The company saw double digit growth in net sales, both on a reported and organic basis, for the quarter while adjusted EPS grew 50%.

The quarterly numbers benefited from the change in consumer behavior brought on by the COVID-19 pandemic, as shelter-in-place orders led to an increase in home cooking as well as more snacking, thereby driving higher demand for the company’s products.

The company’s in-market performance saw an uptick across both its Meals & Beverages and Snacks segments. In measured channels, total in-market consumption rose 22% with double-digit consumption increases across most of the portfolio.

Campbell also saw its household penetration increase across most of its key brands, driven by pandemic-induced shopping trends. Amid the health crisis, more people have resorted to quick-scratch cooking and making meals at home while also doing most of their shopping online and focusing on value due to the difficult economic environment.

Meals & Beverages

The Meals & Beverages division experienced high demand during the quarter driving net sales growth of 28%. The gains were broad-based across US soups, beverages, Prego Pasta and Canada. The soup category saw more growth than any of the other edible categories during fiscal year 2020, with Wet Soup’s growth doubling that of the total edibles group.

Sales in soup rose 52% in the quarter, driven mainly by a 30% increase in consumption, with gains across condensed, ready-to-serve and broth. Household penetration in soup increased more than 5% year-over-year, with particular strength in the condensed soup business, fueled by increased investments and the roll-out of new recipes.

In the sauce category, Campbell saw double-digit consumption gains from Prego and Pace despite supply challenges. The company also saw double-digit consumption growth in V8 juices and beverages, with gains in both single-serve and multi-serve products.

The foodservice business, however, was negatively impacted by the aforementioned changes in consumer behavior and saw sales decline during the quarter.

Snacks

Net sales in this division increased 11%, helped by 21% consumption growth in measured channels and growth across all power brands, especially Milano, Farmhouse and Late July. During the quarter, most of the company’s power brands either grew or retained their market share.

Despite the overall momentum, the snacks segment faced challenges during the quarter due to supply constraints and lower growth in the non-measured channels such as convenience store and vending.

Campbell significantly increased its marketing investment in snacks and its efforts paid off as household penetration increased significantly across the majority of its power brands. The company has also been seeing healthy performance for some of the new products that it launched such as Late July Organic Potato Chips and Farmhouse Breakfast Breads. Campbell remains optimistic about the growth potential of its portfolio within this business which represents about half of its annual sales.

Outlook

Looking ahead into fiscal year 2021, the operating environment remains volatile due to the COVID-19 pandemic but Campbell will continue to focus on investing in its brands, supply chain execution and cost savings. The company expects cost inflation within the supply chain to be largely offset by continued productivity savings across the network.

Based on the current environment, demand is expected to moderate versus the fourth quarter of 2020 but still remain high during the first half of 2021. The company also expects to continue to incur COVID-19 related costs but at a moderate level versus the fourth quarter.

Campbell expects to deliver an incremental $75-85 million in cost savings in fiscal year 2021, keeping it on track to deliver $850 million by fiscal year 2022. The company expects to incur capital expenditures of approx. $350 million as it continues to invest in its business.

Click here to read the full transcript of Campbell Soup Q4 2020 earnings call