Upbeat Sentiment

Over the past several years, the company’s quarterly financial performance exceeded expectations consistently, underscoring its tested and proven business model. The upbeat sentiment has reflected in the stock’s performance also. The company’s growing clout in the cloud space and solid fundamentals make it an irresistible investment option.

Microsoft has always been a favorite among investors, though some prospective buyers would find it unaffordable. Currently, the stock looks fairly priced in relation to earnings, and estimates point to a further increase in valuation. Taking a cue from the positive outlook, experts overwhelmingly recommend buying MSFT.

Record Q2 Results

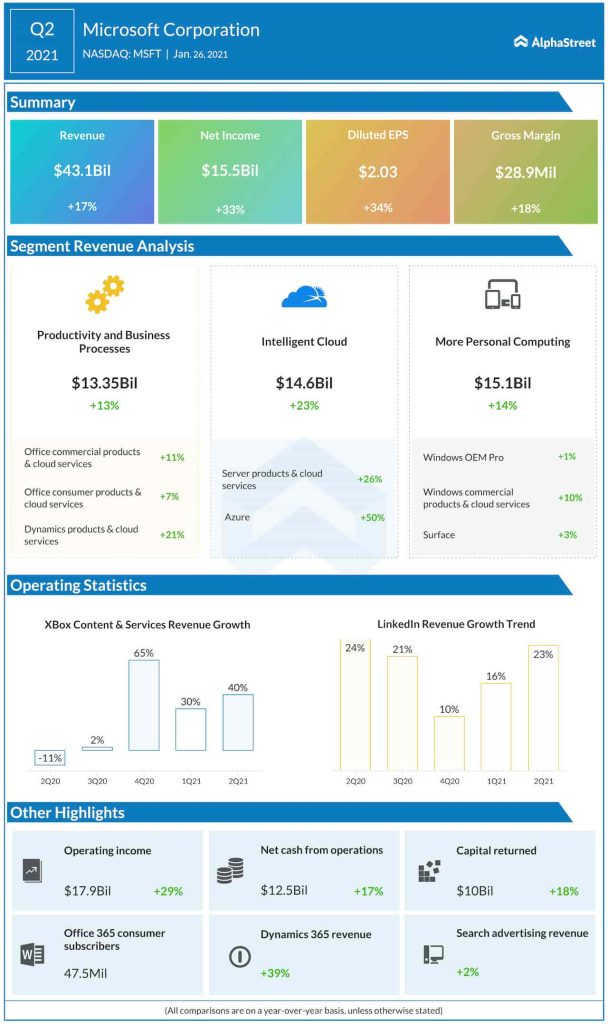

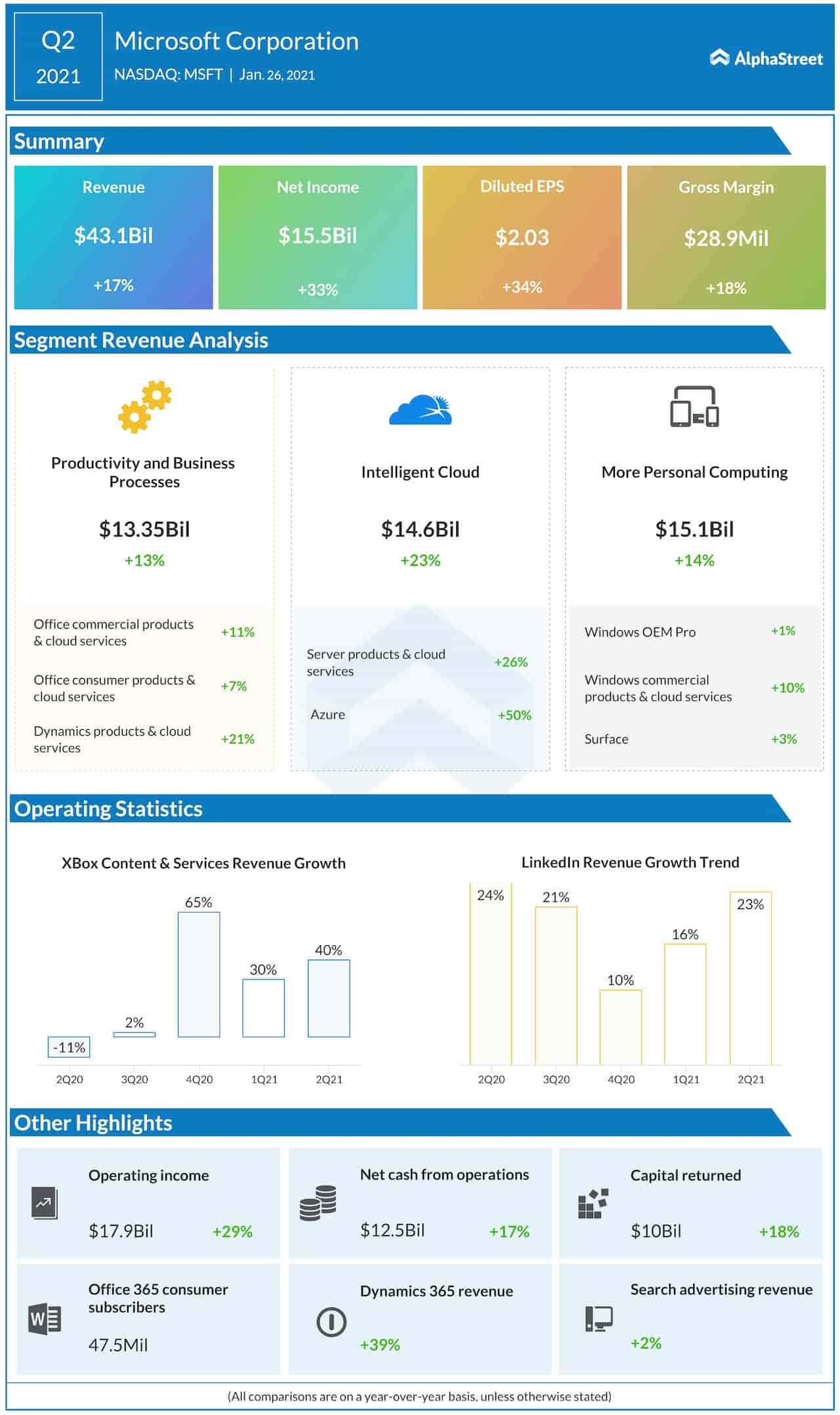

After a strong start to fiscal 2021, the company posted blockbuster results for the second quarter aided by solid holiday sales, with the key numbers hitting record highs. For the first time, revenues crossed the $40-billion mark, representing a 17% year-over-year increase. At $2.03 per share, earnings were up 34%. Interestingly, a major chunk of revenues came from the Intelligent Cloud segment, with the highlight being a 50% growth in the Azure business.

Besides Azure, the main cloud offerings include Dynamics enterprise software and the Office 365 suite. Meanwhile, Amazon (AMZN) Web Services, Microsoft’s main rival in the cloud space, registered a slower annual growth of 28% in its latest quarter. Among others, though Google (GOOG) Cloud’s fourth-quarter growth matched that of Azure, it has a meager market share.

Future Perfect

It is estimated that the business world will soon witness the second wave of digital transformation, with enterprises seeking to build new technology to gain a competitive advantage after migrating to the cloud. And, Microsoft looks well-positioned to tap this opportunity.

In a recent interaction with analysts, Microsoft’s CEO Satya Nadella said, “We’re building Azure as the world’s computer to support organizations’ growing cloud needs. We’re investing to bring our cloud services to more customers, announcing seven new datacenter regions in Asia, Europe, and Latin America, and adding support for Top Secret classified workloads in the United States. We have always led in hybrid computing, and we are accelerating our innovation to meet customers where they are.”

Media reports recently stated that Microsoft’s management is in talks to acquire Discord, Inc., a privately held video-game chat community, for about $10 billion. Earlier, the company’s bid to purchase China-based video-sharing app Tik Tok failed after the latter rejected the offer.

Stock Peaks

The impressive second-quarter outcome triggered a rally and Microsoft’s shares entered an upward spiral in January. They maintained the momentum and reached an all-time high last month. But the stock changed course since then and slipped to the pre-earnings levels in the following weeks. It traded slightly lower in early trading on Thursday, after closing the last session at $237.58.