Of late, International Business Machines Corp. (NYSE: IBM) has been laser-focused on hybrid cloud and artificial intelligence, after transforming itself into a diversified technology firm through multiple corporate reorganizations, including the sale of its infrastructure services segment a few years ago.

After more than three decades of regular dividend hikes, IBM’s stock currently carries a forward yield of about 5.5%, which is sharply above the average for the sector. The impressive growth and high yield place IBM among Wall Street’s dividend aristocrats. The performance of IBM in recent years has been mixed, in terms of creating shareholder value, but the valuation looks reasonable. The stock, which is down 5% since the beginning of the year, closed Thursday’s session higher.

Q2 Report on Tap

The computing behemoth will be reporting second-quarter results after the close of markets on July 19. Analysts are a bit cautious in their earnings guidance for the June quarter, but the actual number is likely to exceed the consensus — quarterly profit beat estimates regularly in recent years. The market sees a 13% year-over-year dip in adjusted profit to $2.01 per share on flat revenues of about $15.6 billion.

The IBM leadership is looking to end the fiscal year with a healthy free cash flow of $10.5 billion, which is up by $1 billion compared to last year. It also predicts a 3-5% growth in full-year revenues. CFO James Kavanaugh said at the last earnings call, “Looking at the second quarter, we expect first to second-quarter revenue seasonality to be fairly consistent with last year. That’s up about $1.3 billion, though the underlying dynamics are different due primarily to Z Systems’ product cycle and currency. I’ll remind you, we had a successful launch of our z16 in the second quarter of last year, and that creates a year-to-year headwind to growth of about 3 points. In terms of profit, we now expect a little over one-third of our operating net income in the first half and just under two-thirds in the second half.”

Q1 Outcome

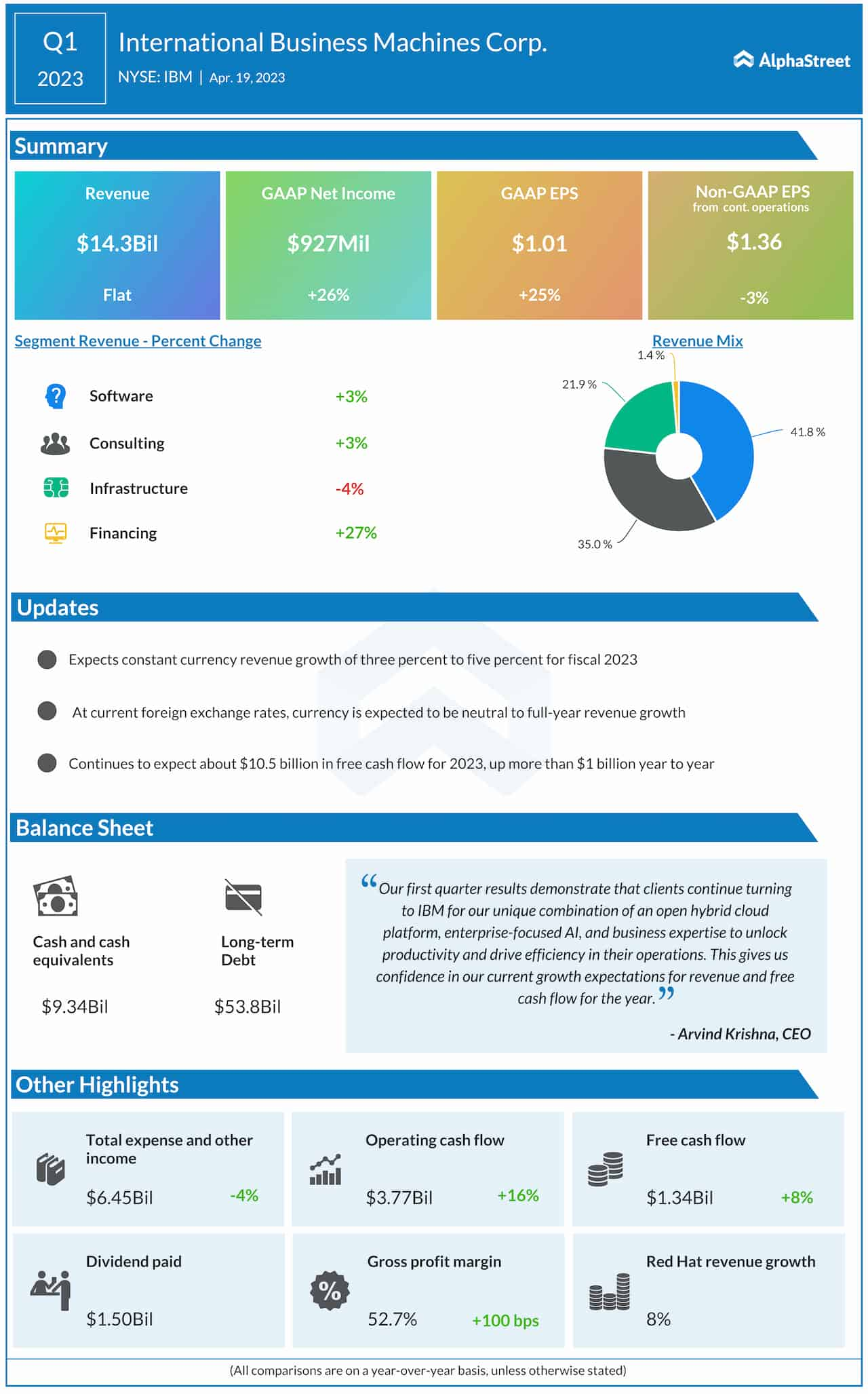

In mid-April, IBM reported first-quarter revenues of $14.3 billion, which is broadly in line with the market’s estimates. Earlier, revenues had topped expectations for five consecutive quarters. The latest number also remained unchanged from the prior-year period as a contraction in the Infrastructure business offset revenue growth in the other three operating segments. Meanwhile, earnings from continuing operations, excluding one-off items, declined 3% annually to $1.36 per share.

The company is banking on the unique combination of its open hybrid cloud platform, industry-leading expertise, and enterprise-focused AI to achieve long-term revenue and free cash flow goals.