In Growth Mode

Salesforce has a well-balanced mix, with each of the five operating segments – Sales, Service, Data, Platform, and Marketing and commerce – contributing meaningfully to the top line. Outperforming most of the top players in the tech space, the company has remained largely unaffected by economic uncertainties and cautious enterprise spending. After a series of M&A deals, now the cloud firm is focused on ramping up AI investments to better serve customers and cash in on the automation opportunities.

From Salesforce’s Q2 2024 earnings call:

“The reality is every company will undergo an AI transformation with the customer at the center because every AI transformation begins and ends with the customer, and that’s why Salesforce is really well positioned with the future. And with this incredible technology, Einstein that we’ve invested so much and grown and integrated into our core technology base. We’re democratizing generative AI, making it very easy for our customers to implement every job, every business in every industry.“

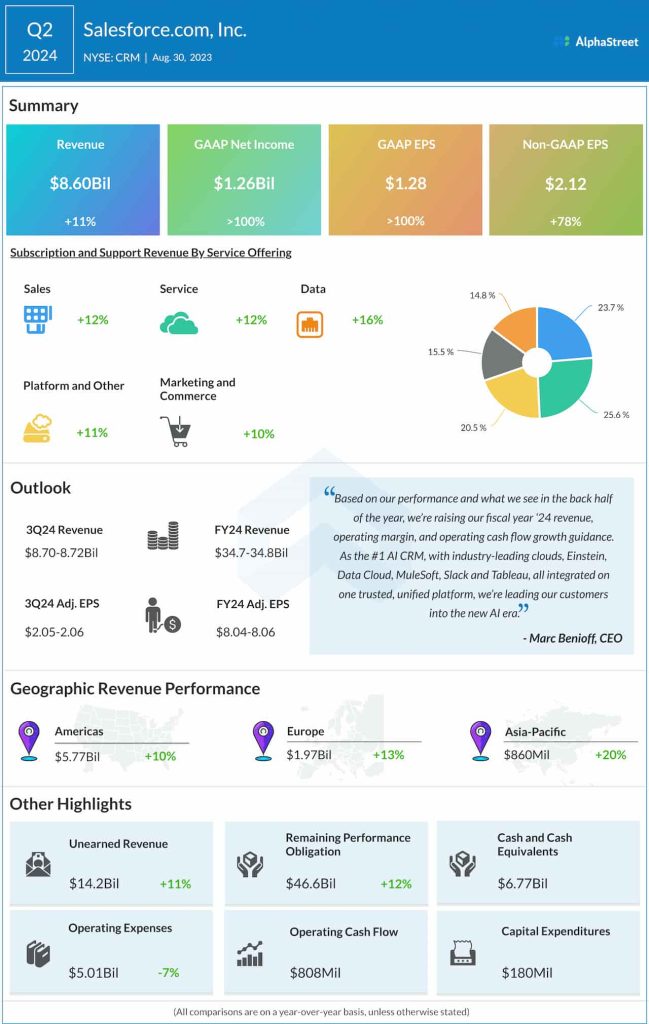

July-quarter profit, adjusted for special items, increased to $2.12 per share from $1.19 per share in the same quarter last year. On a reported basis, the company posted earnings of $1.27 billion or $1.28 per share for Q2, compared to $68 million or $0.07 per share in the corresponding period of 2023. Revenues grew 11% year-over-year to $8.60 billion in the three-month period, with all key operating segments registering growth. The results also beat estimates, as they have done in almost every quarter in recent years.

Guidance Raised

Meanwhile, the Salesforce leadership raised its full-year guidance for revenue, earnings, and cash flow. Currently, revenues are expected to come in between $34.7 billion and $34.8 billion in fiscal 2024, and adjusted earnings in the range of $8.04 per share to $8.06 per share. The revised forecast for operating cash flow growth is 22-23%. Operating margins, on an adjusted basis, are expected to be around 30%.

The stock traded up 3% on Thursday afternoon, extending the post-earnings momentum. The current price is well above the 52-week average.